- Berkshire sells stake in Phillips 66 and the Travellers

- Reduced his holdings of Goldman Sachs

- Moves follow the recent sale of all of the companies holdings

At the recent annual meeting of Berkshire Hathaway Inc. (BRK.A, BRK.(B) held on May 2, 2020, Chairman and chief executive Warren Buffett has revealed that, in April, the company has unloaded its entire interests in four major airlines AMERICAN, American Airlines Group Inc. (AAL), Delta Air Lines, Inc. (DAL), Southwest Airlines Co. (LUV), and United Airlines Holdings Inc. (UAL).

Based on Berkshire’s quarterly filing to the SEC Form 13F May 15, the company says it has also sold all its shares in the energy company Phillips 66 (PSX) and financial services firm Travelers Companies Inc. (TRV), while the output of the most of its position in the financial services firm Goldman Sachs Group Inc. (GS).

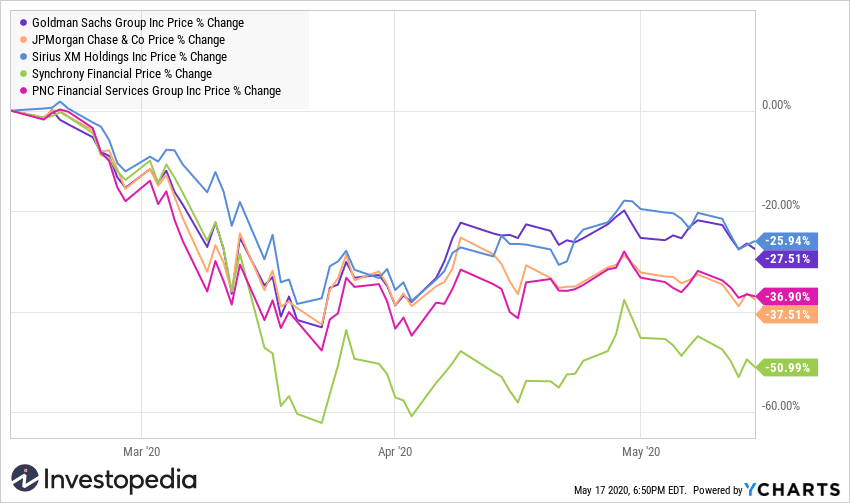

Berkshire has also revised its positions in the shares of banking giant JPMorgan Chase & Co. (JPM), the satellite radio service Sirius XM Holdings Inc. (SIRI), and the credit card issuer Synchrony Financial Corp (THE), each of about 3%. During this time, Berkshire has increased its ownership interest in the shares of the banking company of PNC Financial Services Group Inc. (PNC) of approximately 6%.

Key Takeaways

- Berkshire Hathaway has filed its most recent 13F May 15, 2020.

- The company has already announced the release of the airline’s shares.

- It also reduced its stake in the financial giant Goldman Sachs.

- He has increased his bet a regional bank PNC Financial.

Details about Berkshire’s Recent Big Moves

That of its previous Form 13F filing dated February. 14, 2020, Berkshire’s holdings in the capital of the companies referred to above have been, with their market values at the date of the:

- American Airlines, 42.5 million shares, 1.2 billion dollars

- Delta Airlines, to 70.9 million shares, for $ 4.1 billion

- Southwest Airlines, of 53.6 million shares, or $ 2.9 billion

- United Airlines, 21.9 million shares, the sum of $ 1.9 billion

- Travellers, 312 thousand shares, of $ 42.8 million

- Goldman Sachs, of 12.0 million shares, the sum of $ 2.8 billion

- Phillips 66, 227 thousand shares, of $ 25.3 million

- JPMorgan Chase, 59.5 million shares, $ 8.3 billion

- Sirius XM, 136.3 million shares, $974.4 million

- Synchrony Financial, to 20.8 million shares, $749.1 million

- PNC Financial, 8.7 million shares for $ 1.4 billion

According to its most recent Form 13F filed on May 15, Berkshire’s holdings in the stocks listed above, which has preserved, are now in these amounts:

- Goldman Sachs, 1.9 million shares, $296.8 million

- JPMorgan Chase, 57.7 million shares, $ 5.2 billion

- Sirius XM, 132.4 million shares, $654.1 million

- Synchrony Financial, 20.1 million shares, $323.9 million

- PNC Financial, $ 9.2 million of shares, $880.4 million

With the market being battered by the COVID-19 coronavirus crisis, the share prices of the select the stocks mentioned above that Berkshire has retained the services have declined significantly from Feb. 14 May 15:

YCharts.

Source: investopedia.com