Key Takeaways

- Berkshire Hathaway has added 34 million shares of BAC this week

- The alcohol content (BAC) Berkshire the second-largest equity position

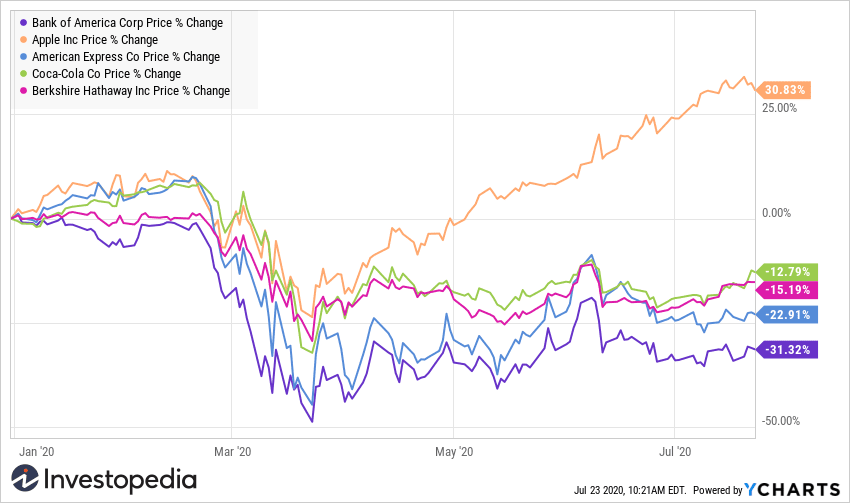

- BAC shares are down 32% YTD

Warren buffet, Berkshire Hathaway has bought more than $800 million dollars from the Bank of America’s stock this week, increasing its stake in the giant of more than 11%, according to documents filed with the SEC. Berkshire Hathaway has bought nearly 34 million shares at an average price of approximately $24 between Monday and Wednesday, which values the stake at $ 813 million. Berkshire’s total stake in the Bank of a value of about $23.9 billion, according to the Bank of America stock at a price of $24.31 as of Wednesday’s close.

Bank of America has been Berkshire the second-largest participation of the value of the dollar at the end of March, after Apple. The bank’s shares have dropped 32% this year, which means Berkshire’s stake would have been worth approximately $35 billion at the start of January. Outside of Apple, Berkshire’s largest equity holding, most of its key positions in shares, have had a rough 2020.

YCharts.

Buffett, always ready for a bargain, has done business in 2020, but Berkshire Hathaway still has more than $ 137 billion in cash, ready to deploy. The company has spent $ 10 billion to acquire the majority of the Domination of the Energy of the natural gas assets at the beginning of this month, and seems to have bought between $ 5 billion and $ 6 billion of its shares between the end of April and beginning of July.

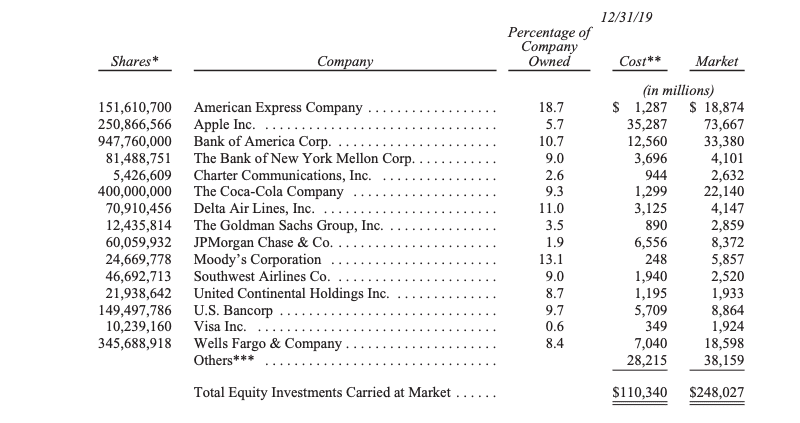

The table below shows Berkshire Hathaway’s top stock positions at the beginning of 2020. Since then, the company has sold most of his companies stocks and added to its positions in Apple and Bank of America.

Berkshire Hathaway Annual Report.

Source: investopedia.com