Key Takeaways

- Analysts estimate GAAP EPS of $22,419.70 vs $8,607.54 in Q2 2019.

- The operating income is expected to show slight decrease.

- Revenues are expected to decrease strongly in the middle of COVID-19 health crisis.

Berkshire Hathaway Inc.’s (BRK.(A) GAAP are as volatile as the stock market, in particular in the event of a pandemic. This is because Berkshire is the owner of a massive portfolio of shares worth hundreds of billions of dollars, along with the diversity of its holdings of operating companies. The COVID-19 induced by the collapse of the market of success that the investment portfolio hard in the first quarter.

Investors will be looking to see how Berkshire Hathaway’s portfolio and operating companies affected the company’s results when it publishes its results for the 2nd quarter of the FISCAL year 2020. The company has not yet announced when it released its report for Q2, but analysts estimate that it could be as early as August 1, 2020. Analysts expect GAAP earnings to rise strongly, while the income decreases (yoy).

Investors will also be interested in another key metric in the report for Q2: the operating profit, that give a better idea of how Berkshire Hathaway wide range of activities carried out to the exclusion of the impact of its investment portfolio. Analysts estimate that the operating profit will be posting a small decline for the quarter.

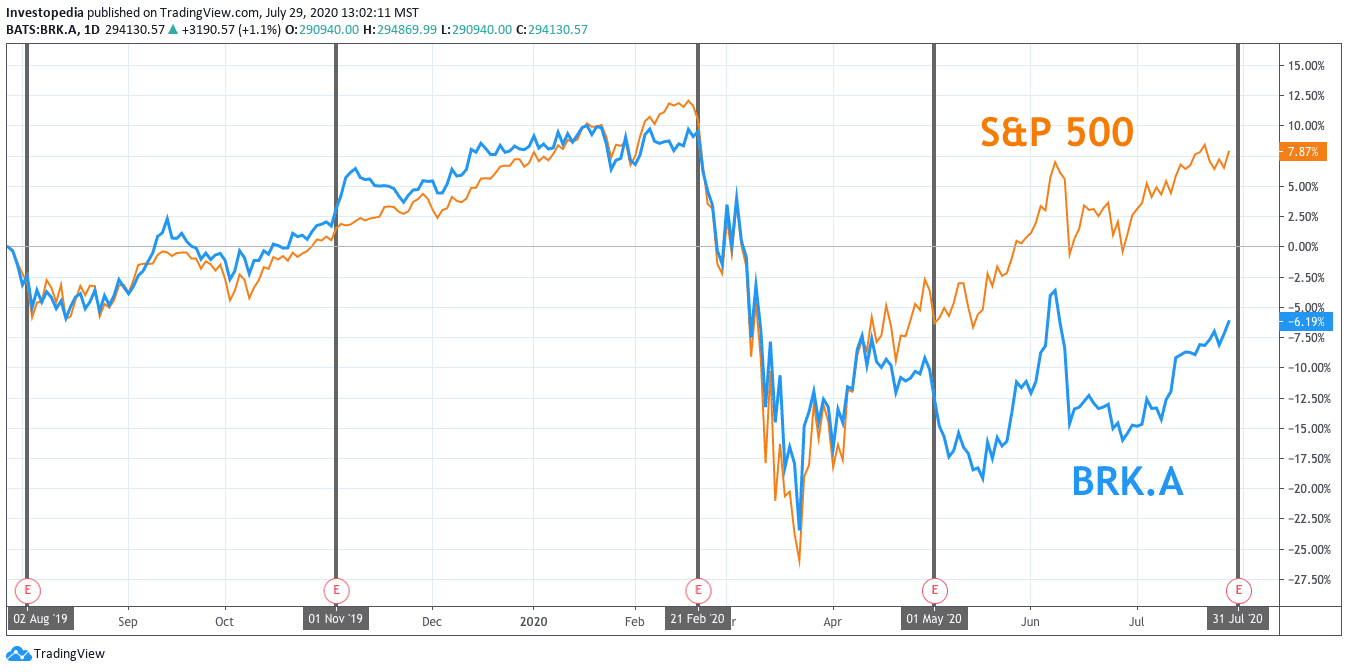

Berkshire Hathaway stock produced in tandem with the broader market for most of the past year, including during the market collapse that began at the end of February and during the initial phase of the stock market’s rebound until April. But since, the whole of the market has raced ahead of Berkshire Hathaway, and its shares, has significantly underperformed. As a result, Berkshire has posted a total return of -6.2% compared to the S&P 500 index total return of 7.9% over the last 12 months.

Source: TradingView.

Berkshire Hathaway, the stock performance has started to deviate from the rest of the market when it reported a net loss per class-A share for the 1st quarter of FISCAL year 2020 on 27 April. The company reported an EPS of$30,653.00 compared to $13,209.37 a year earlier. The revenues from the operations of the company, the companies increased 1.0% to $ 61.3 billion, but total revenue was negatively impacted by a $70.3 billion of losses on the company’s portfolio of investments and derivative contracts.

The large loss on investments and derivative contracts reflects the market collapse that began at the end of February. Before the accident, Berkshire Hathaway reported GAAP earnings per share (EPS) growth of 216.0%, to a total of 17,909.42 the 4th quarter of FISCAL year 2019. The Total revenue has increased 242.7%. But these results were not enough to keep the company’s shares to dive with the rest of the stock market.

Analysts predict a return to profitability in Q2 of FISCAL year 2020, the rebound in the stock market lifts the company’s investment portfolio. GAAP EPS is expected to increase 160.5% yoy for the 2nd quarter of the FISCAL year 2020. However, total revenue is expected to fall 27.2%.

Berkshire Hathaway Key Measures

Estimate of the Q2 2020 (AF)

Q2 2019 (AF)

Q2 2018 (AF)

Earnings Per Share ($) (class A shares)

$22,419.70

$8,607.54

$7,301.00

Total Revenue ($B)

$53.6

$73.7

$68.6

The Operating Income ($B)

$5.9

$ 6.1 million

$6.9

Source: Visible Alpha, YCharts.

As mentioned above, the investors will be also focused on the company’s operating income. Berkshire Hathaway is a large diversified holding company whose subsidiaries engage in the insurance, freight rail transportation, energy, production and distribution, manufacturing, and retail. Operating earnings provide a more accurate measure of how the companies performed by the exclusion of the impact of the company’s investment portfolio and derivative contracts. For example, the value of its investments in equity securities decreased by 27.1% year-on-year to $180.8 billion as at March 31, 2020.

Berkshire Hathaway has reported a 5.7% increase in operating income for the 1st quarter of FISCAL year 2020. It was a definite improvement from the 11.6% decline posted in the 4th quarter of FISCAL year 2019, but a slowdown of 14.2% increase for the Q3 of FISCAL 2019. Analysts expect an operating profit decline of 3.4% for the YEAR Q2 2020, in the middle of the course of the pandemic. The estimate of this reduction is modest compared to the drastic drops in operating income experienced by many companies in Q2. But much of Berkshire Hathaway’s operating companies are closely linked to the economy, and earnings could worsen if the US economy is again contracting.

Source: investopedia.com