Bed Bath & Beyond (BBBY), the embattled homewares retailer, has filed for bankruptcy after months of sounding the alarm and taking increasingly desperate measures to find enough money just to stay afloat.

Key Points to Remember

- Bed Bath & Beyond filed for Chapter 11 bankruptcy on Sunday, ending its months-long effort to remain liquid.

- The company has entered into a liquidation sale but will use bankruptcy proceedings to explore the sale of its assets.

- >Attempts to raise capital through convertible stock sales, stock offerings and reverse stock splits have failed.

The company has filed for Chapter 11 bankruptcy in New Jersey on Sunday, beginning the process of winding down its business. The company secured $240 million in debtor-in-possession financing with which it plans to fund the operations of its nearly 500 stores during bankruptcy proceedings.

"We deeply appreciate our associates, customers, partners and communities we serve, and we remain firmly committed to serving them throughout this process,” CEO Sue Gove said in a filing announcement. "We will continue to work diligently to maximize value for the benefit of all stakeholders."

Bed Bath & Beyond, once a thriving home goods retailer, has struggled to adapt to a changing retail landscape dominated by e-commerce and anything selling like Amazon (AMZN). The company's woes were exacerbated by the pandemic when brick-and-mortar stores became money pits and supply chain grunts wreaked havoc on inventory management.

Company sends flares from months. The company first warned of bankruptcy in January, when it said rising quarterly losses and negative cash flow called into question its “ability to continue in business.” .

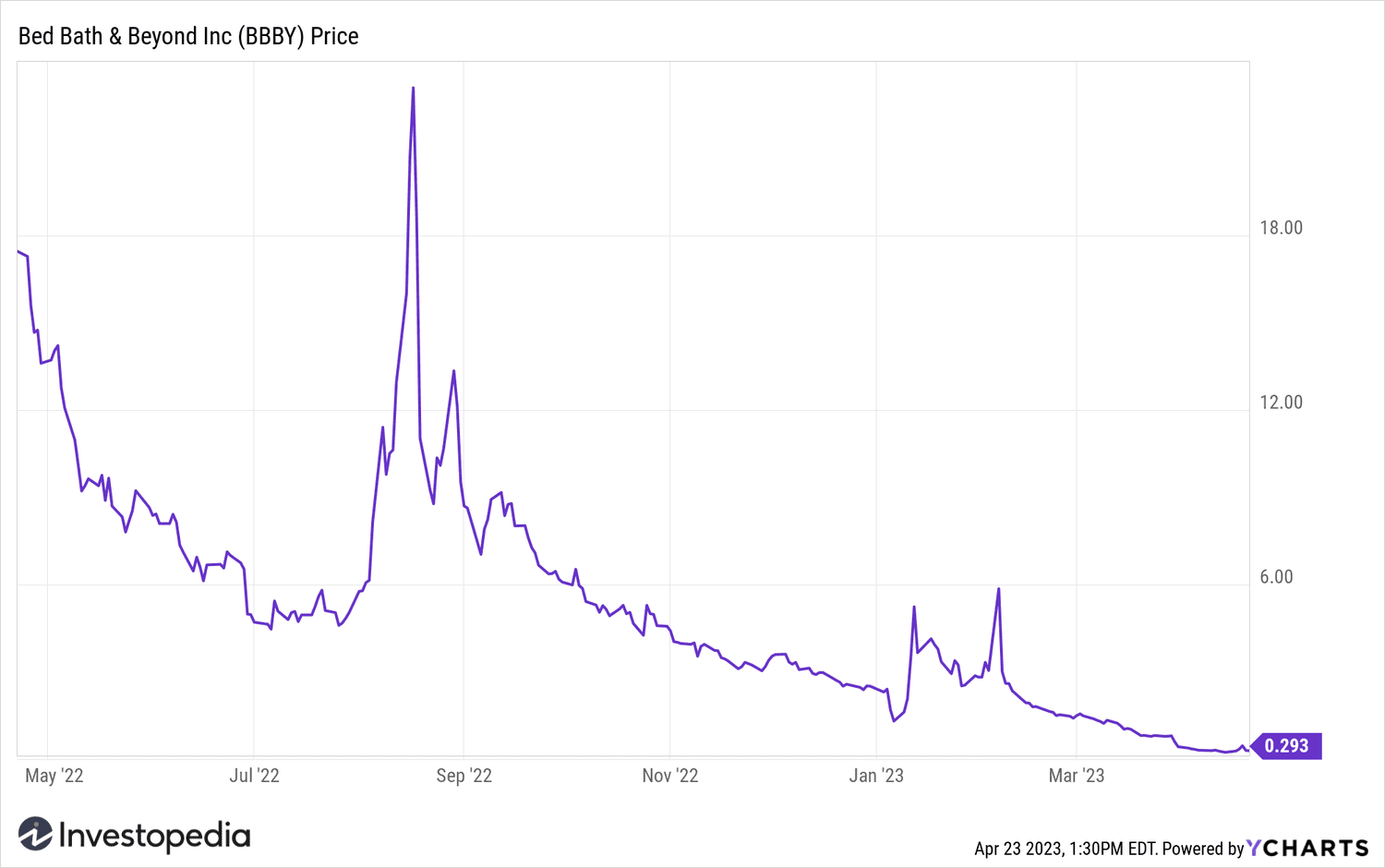

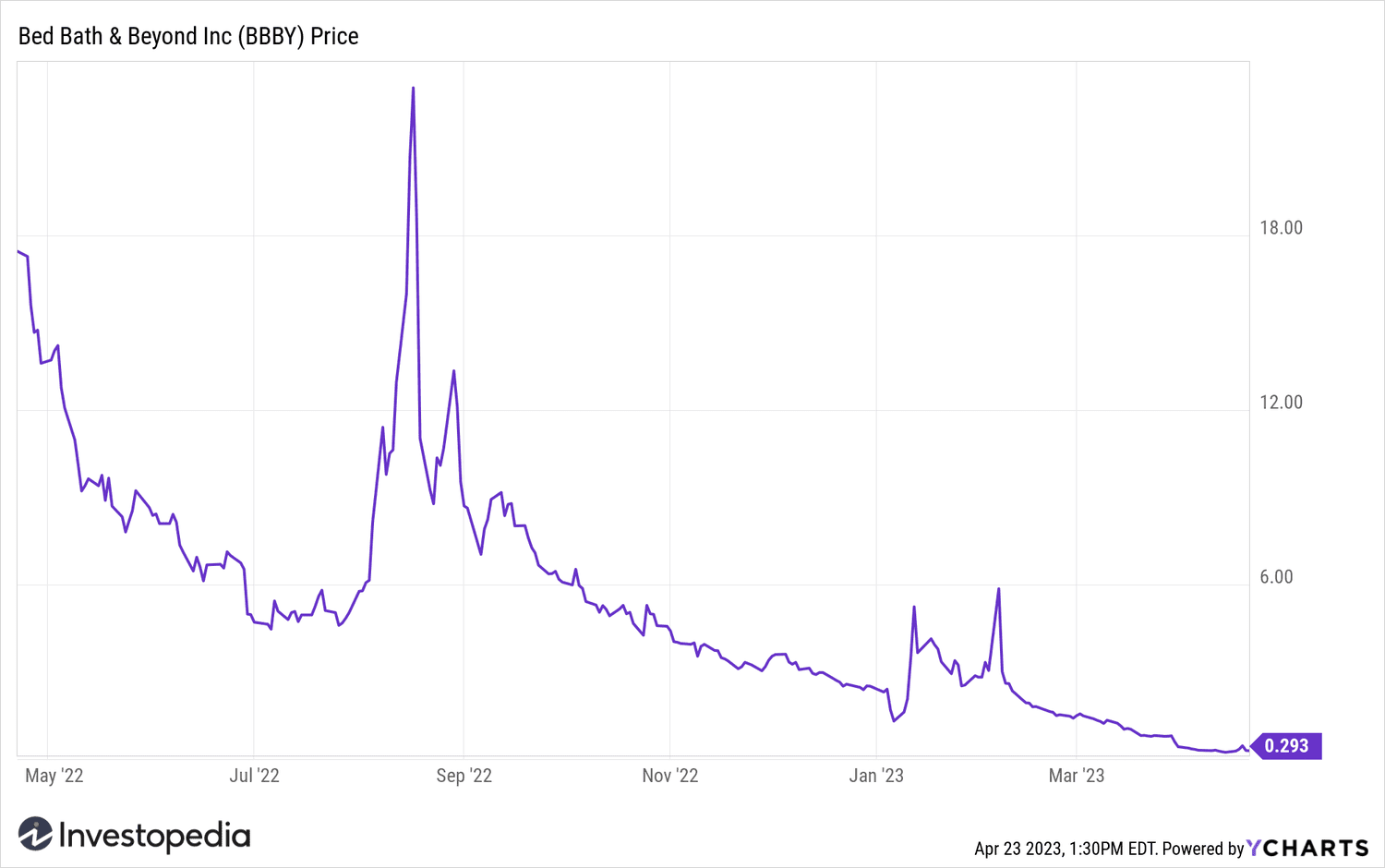

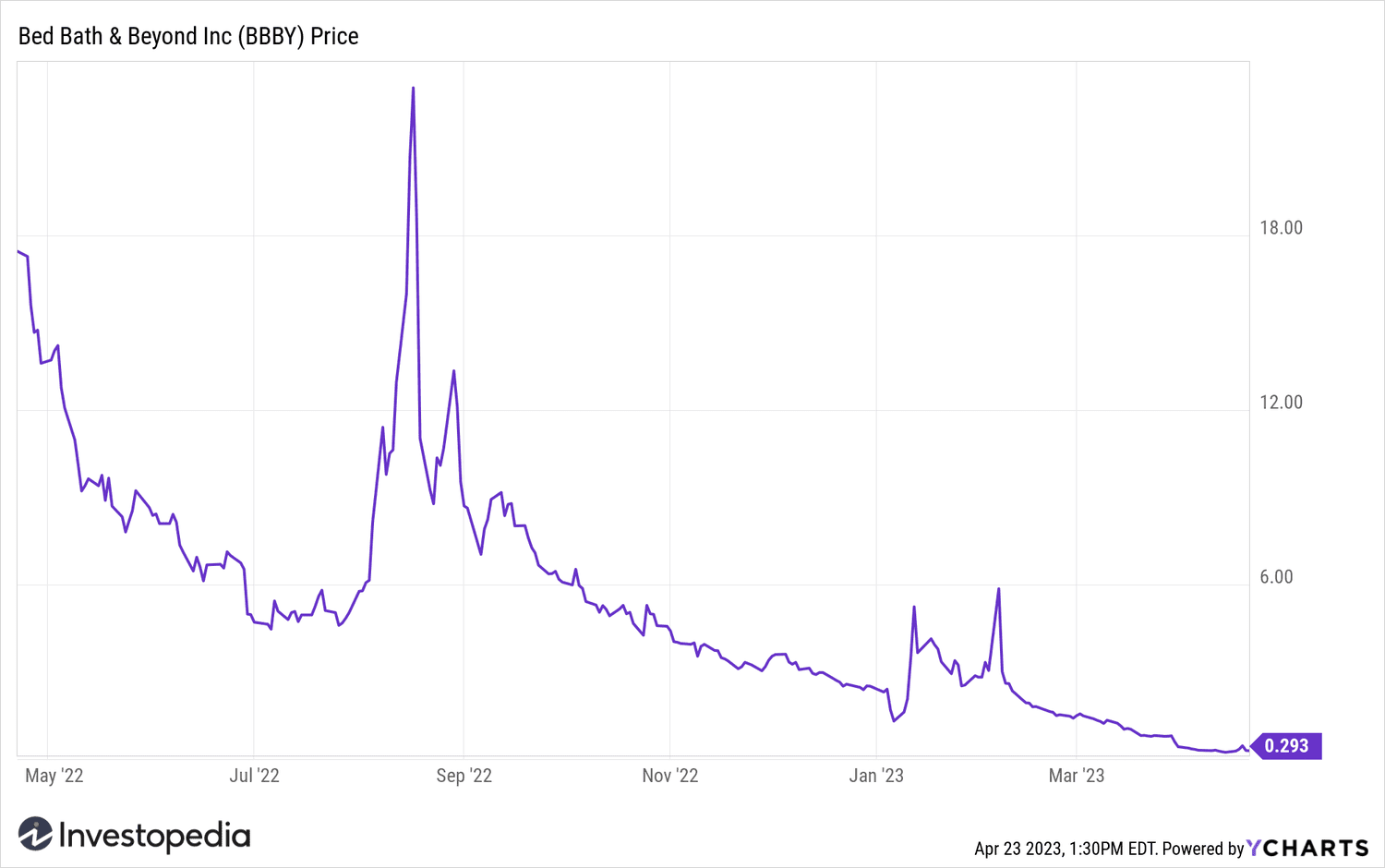

Bed Bath & Beyond missed a $25 million interest payment in February, sending its stock plummeting nearly 50%. The company was able to pay within the one-month grace period, avoiding being forced to immediately pay all of its $1 billion debt.

That same month, the company attempted to sell up to $1 billion worth of convertible stock and warrants in a last-ditch effort to shore up its finances. But the sale was called off late last month after bringing in only a fraction of the target.

Instead, Bed Bath & Beyond has launched an “on the market” offering of up to $300 million in shares. But by mid-March, the company's stock price had fallen below $1 for the first time since 1992, the year it went public.

” /> id=”mntl-sc-block_1-0-19″ class=”comp mntl-sc-block finance-sc-block-html mntl-sc-block-html”> The company was to hold a special meeting of shareholders en May approve a reverse stock split.

” /> id=”mntl-sc-block_1-0-19″ class=”comp mntl-sc-block finance-sc-block-html mntl-sc-block-html”> The company was to hold a special meeting of shareholders en May approve a reverse stock split.

Source: investopedia.com