Barnes & Noble Education, Inc. (NDEB) shares rose more than 15 per cent during Friday’s session as traders focused on the digital side of its business. With the COVID-19 pandemic, causing more and more schools transition to online, investors were looking for opportunities to invest in digital education companies that could benefit from the transition over the next few quarters.

Needham reiterated its Buy rating and $4.00 price target on Barnes & Noble Education shares earlier this week, saying that about 80% of the company’s university partners expect to conduct classes on campus through a hybrid model. The analyst also cited the strategy of the company in connection with the universities and its suite of digital assets, which could pave the way to more stable than expected revenue.

Last quarter, the company reported revenues which decreased from 23.2% to $256.89 million, beating consensus estimates by $36.35 million, but GAAP net loss of 84 cents per share, missed the consensus estimates of 36 cents. Management has stated that it adapts quickly to its assets and its offerings to respond to the extraordinary challenges faced by the market.

TrendSpider

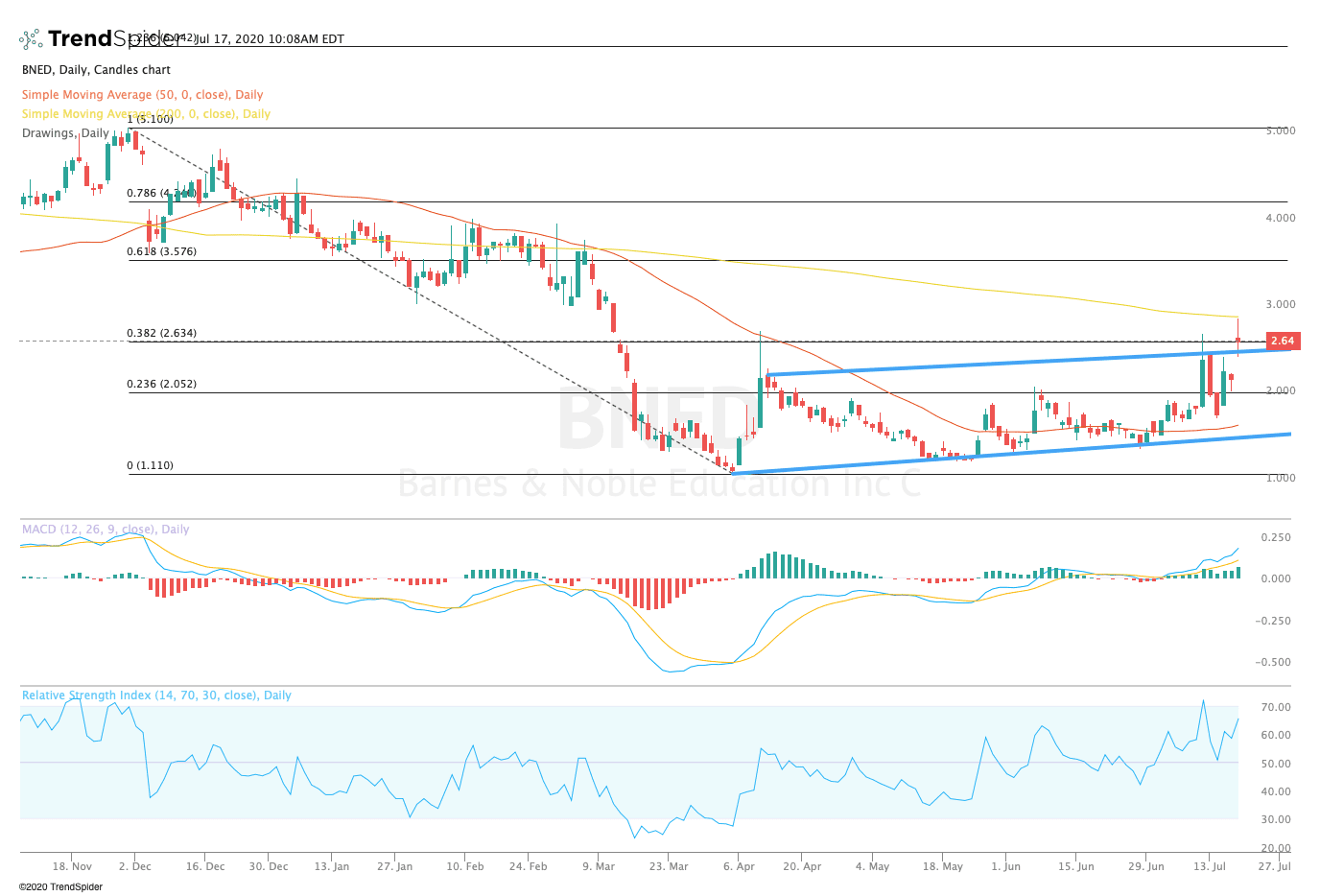

From a technical point of view, the stock broke out from the reaction of the vertices toward its 200-day moving average at $2.92 per share. The relative strength index (RSI) moved into overbought levels with a reading of 65.28, but the moving average convergence divergence (MCAD) remains in a bullish trend. These indicators suggest that the stock could see more upside ahead.

Traders should watch for a period of consolidation in the coming sessions before a potential break of the 200-day moving average at $2.92 to the front of the peaks of near $4.00. If the stock fails to break out, traders could see a period of consolidation between the 200-day moving average, and the 50-day moving average and a trendline of support near $1.67 in the short term.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com