Takeaways

- Bank of the United States earnings and revenues beat forecasts, boosted by higher interest income due to higher borrowing costs.

- The bank said higher credit card balances increased average loan and rental balances.

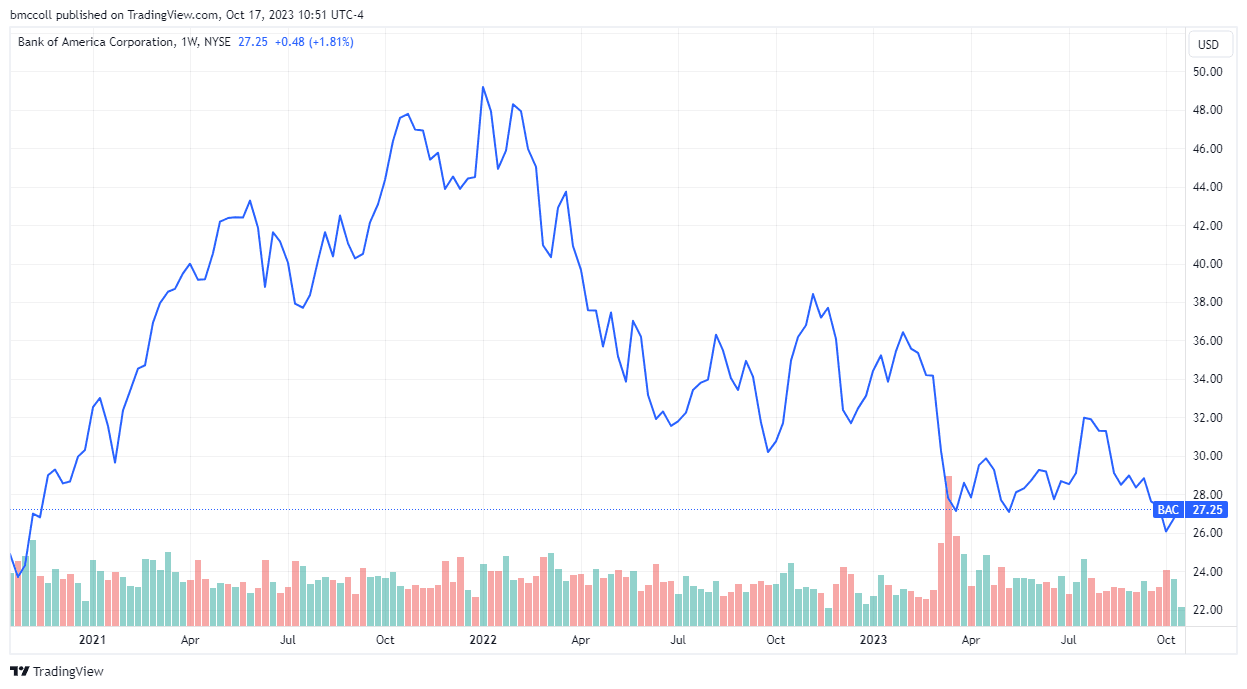

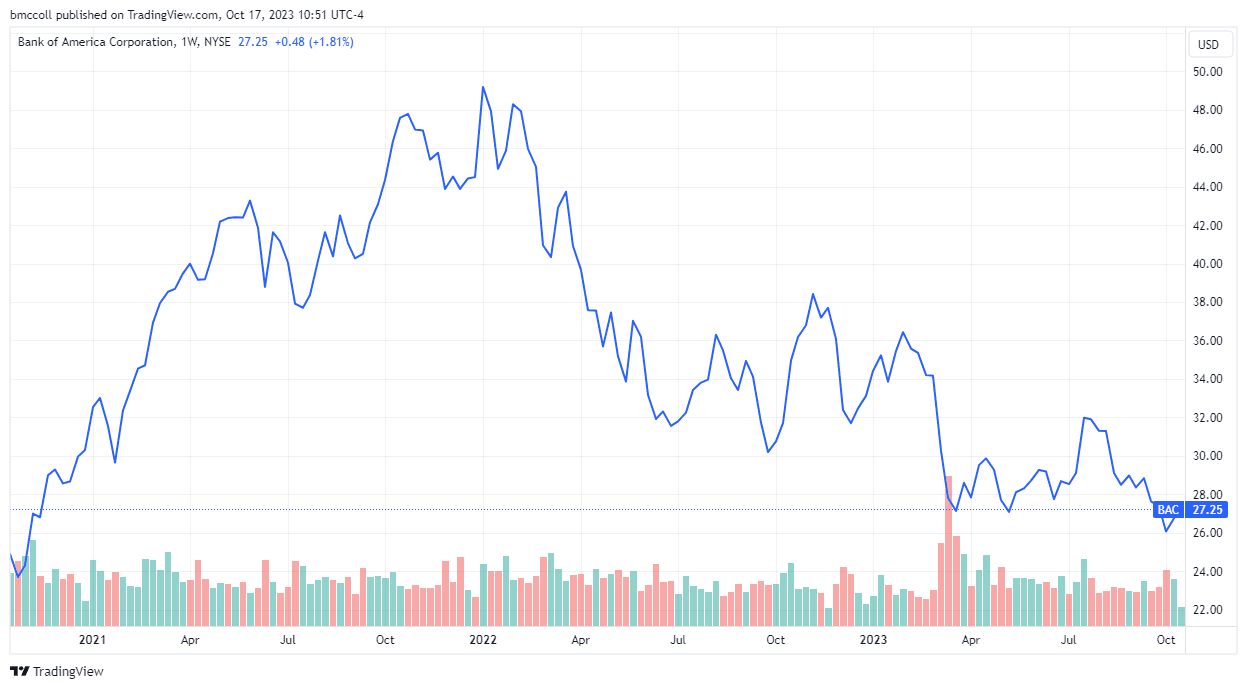

- Bank of America shares fell from nearly three-year lows earlier this month, but remained in negative territory for 2023.

Interest rate increases decided by the Federal Reserve to reduce inflation helped Bank of America (BAC) post better-than-expected results, and shares rose more than 1% in early trading Tuesday.

Bank of America released its third quarter earnings of fiscal 2023 jumped 10% to $7.8 billion, or $0.90 per share. Revenue, net of interest expense, rose 2.3% to $25.2 billion. Both were above expectations.

Interest income rose 4.5% to $14.4 billion, which the bank said was driven by rising interest rates and loan growth. Non-interest income rose 0.05% to $10.8 billion, with higher sales and trading revenues and asset management fees offsetting lower revenues elsewhere. .

The bank said average loan and rental balances stood at $1 trillion, a gain of 1 percent, driven by rising credit card balances. Average deposit balances were $1.9 trillion, a gain of $1 billion from the second quarter but down $87 billion from last year.

CEO Brian Moynihan said Bank of America has added customers across all its businesses, even with a slowing economy and a decline in consumer spending. Chief financial officer Alastair Borthwick added that the company “remained disciplined and reduced spending for the second consecutive quarter while continuing to invest in our franchise.”

Earlier this month , Bank of America shares hit their lowest level in nearly three years, and although it has made some gains since then, it is still down for the year.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com