Key Takeaways

- Analysts estimate adjusted EPS of $0.26 per share, compared to $0.74 in Q2 2019.

- The net interest margin is expected to fall year-on-year.

- Revenue seen falling due to sharp economic slowdown stimulated by COVID-19.

Bank of America Corp (BAC), one of the largest AMERICAN banks, has seen its market value plunge from its recent high that the coronavirus pandemic has sent shock waves through the stock market and the economy. This turbulence has placed downward pressure on the giant consumer banking business, which is related to the finance and health of millions of American borrowers and consumers.

Investors will focus on the measurement of the economic impact of Bank of America’s bottom line when the company publishes its results on 16 July for the 2nd quarter of the FISCAL year 2020. For the quarter, analysts expect earnings and revenue to fall compared to the same quarter a year ago. These numbers reflect the continued impact of the COVID-19 crisis, which has forced decision-makers to limit the movement and activity of companies across the country in an effort to slow the spread of the virus.

A particular concern for many investors will be a key parameter, the Bank of America’s net interest margin, which is expected to see a sharp decline. This measure is an indicator of the ability of the bank to lend money at an interest rate higher than what it pays on deposits such as savings accounts and other money. As the central banks like the Federal Reserve continue to cut rates throughout the world, Bank of America has faced a downward pressure on its net interest margins.

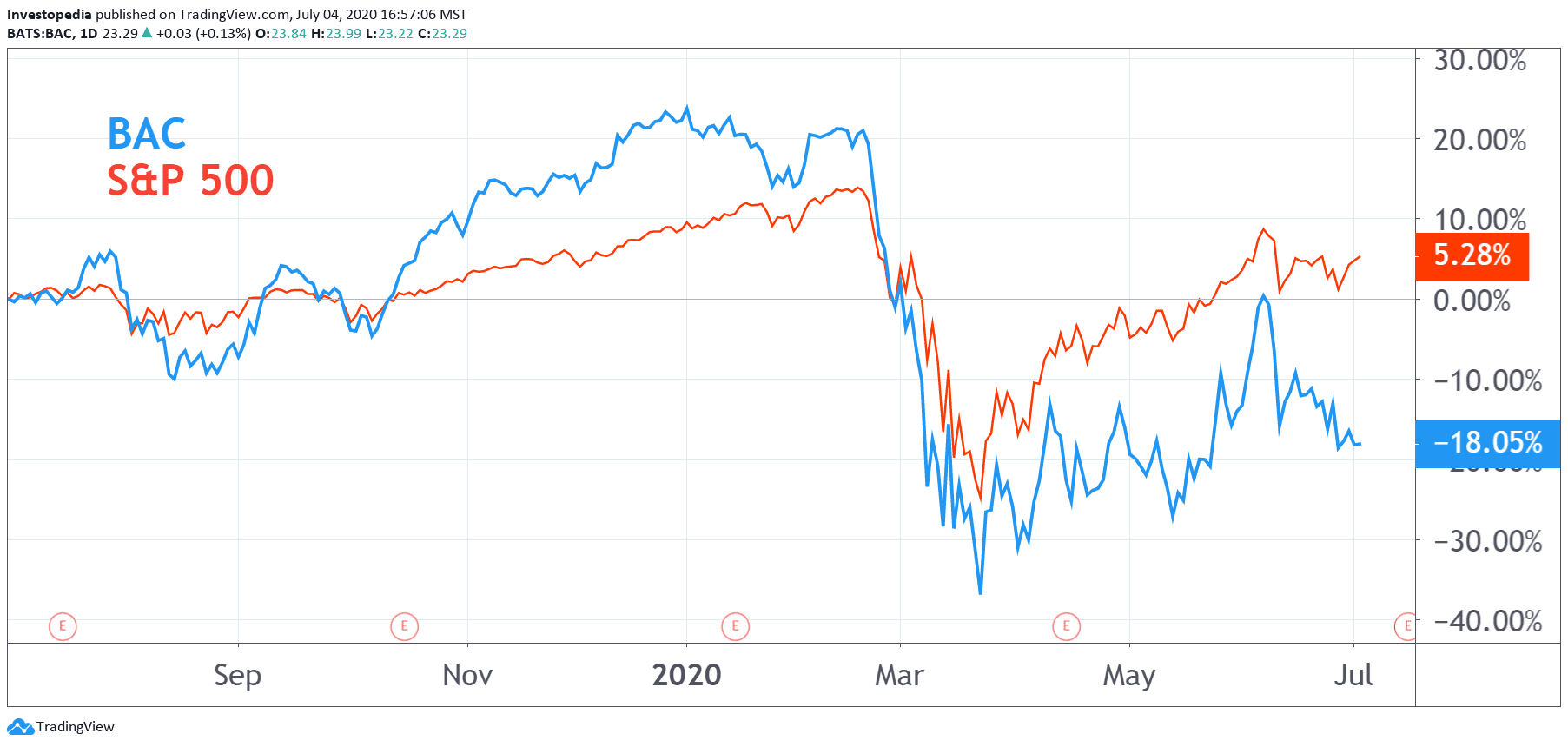

These trends were seriously injured, the Bank of America stock. Their actions have begun to exceed the overall market in the second half of 2019, but now they are now significantly under-performing. At the beginning of July, the company’s shares posted a total return of -18.1% over the past 12 months, compared to 5.3% for the S&P 500.

Source: TradingView.

On 15 April, the Bank of America reported its results for the 1st quarter of FISCAL year 2020. At this time, the adjusted earnings per share (EPS) missed the estimates of$ 0.06, the fall of 43% to $0.40 compared with the same quarter a year earlier. Q1 the YEAR 2020 marked the second time in three quarters of the Bank of America’s adjusted earnings per share has fallen, has also decreased by 14.5% in the 3rd quarter of the FISCAL year 2020. Despite this, the stock has increased in the months following the Q1 of FISCAL 2020 earnings report, supported in part by a favorable jobs report and signs of a reopening of the economy. In June, however, the shares paid a large portion of its recent gains, at a time when many states have begun to delay or cancel their opening plans due to the increase of the COVID number of cases.

Looking forward to the bank to come Q2 of FISCAL 2020 earnings, analysts are expecting adjusted EPS and revenue 64.5% and 7.4%, respectively, compared to Q2 of FISCAL year 2019. Analysts currently estimate adjusted EPS will plunge to 50.3% for FISCAL year 2020. Because of the very uncertain and volatile economic environment we are currently experiencing, the forecasts will be subject to a considerable margin of error.

Bank of America: Key indicators

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

The Adjusted Earnings Per Share

$0.26

$0.74

$0.63

Turnover (in billions of dollars)

$21.4

$23.1

$22.5

The Net Interest Margin

2.06%

2.45%

2.41%

Source: Visible Alpha

As mentioned, a metric that will be of particular importance is the Bank of America’s net interest margin. The banks often earn a profit by charging interest rates on loans to customers that are higher than the interest rate they pay for deposits. The higher the net interest margin can help to feed a bank of profits. In normal times, moderate changes in interest rates have little impact on a bank’s net interest margin. However, the Fed’s move to reduce quickly the rate has pressed the banks because they decrease the rate of charge to borrowers. A major risk is unemployment high and rising medical costs for some Americans could lead to peaks of delays and defects of the Bank of America’s vast portfolio of consumer loans.

To analysts of Bank of America’s net interest margin on a decline of close to 0.4% in the Q2 of 2020, compared to Q2 2019. This would be the lowest net interest margin of the bank has it posted in at least 14 quarters. Bank of America’s net interest margin increased to 2.23% in Q3 of FISCAL 2016 at its highest level in recent quarters to 2.55% in the 4th quarter of FISCAL year 2018. Since then, the bank, the net interest margin decreased sequentially for 5 consecutive quarters, from 1st quarter of FISCAL year 2019 in Q1FY 2020. Low rates may further tighten the Bank of America’s net interest margin if the current economic downturn steepens.

Source: investopedia.com