Atlas Corp (ATCO) shares extended their rally of over 5% during trading on Tuesday after BMO Capital upgraded the stock to Outperform with a $9.00 price target. Analyst Fadi Chamoun called Atlas “undiscovered stock in an underflowed industry” that offers a 7.9% dividend yield and significant capital appreciation potential. While it has cyclical end markets, the company’s products is mainly contracted with counterparties with a high credit rating.

The move came after the stock rally following its mixed financial results for the first quarter. Turnover rose 8.1% to $308.4 million, beating consensus estimates by $4.59 million, but net earnings came in at 15 cents per share, missing consensus estimates of 10 cents per share.

Atlas generates most of its EBITDA from the ocean container shipping (87%), which makes it vulnerable to the global economic crisis from COVID-19. However, it maintains an attractive dividend yield, it recently left in place, and the production of electricity accounts for the remainder of the EBITDA.

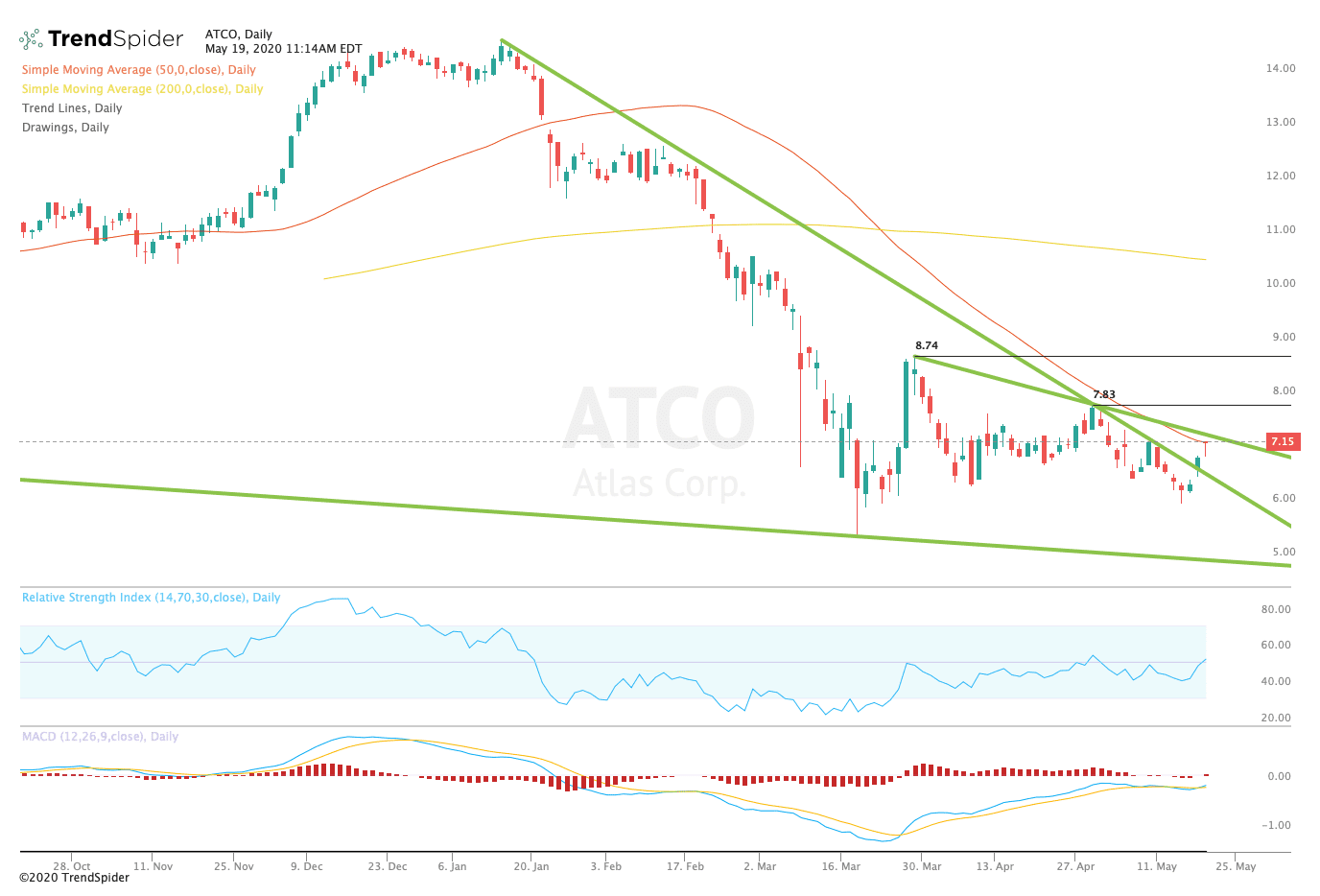

TrendSpider

From a technical point of view, Atlas stock extended its rally out of the 50-day moving average of $7.07 during the session on Tuesday. The relative strength index (RSI) remains at neutral levels with a reading of 52.26, while the moving average convergence divergence (MACD) in histogram MACD continues to trend to stagnate. These indicators provide some advice on the future direction of the price but suggest the possibility of a movement to the upside or to the downside.

Traders should watch for a close above the 50-day moving average and a tendency to the reaction of the vertices of $7.83, or $8.74 in the coming sessions. If the stock breaks down, traders can see the stock hit trendline support at about $6.50 and support near reaction low of close to $6.00. The overall bias appears to be optimistic, however, given the favourable situation on the financial results and analyst commentary on the latest sessions.

The author holds no position in the stocks mentioned, except through the passive management of index funds.

Source: investopedia.com