Key Points

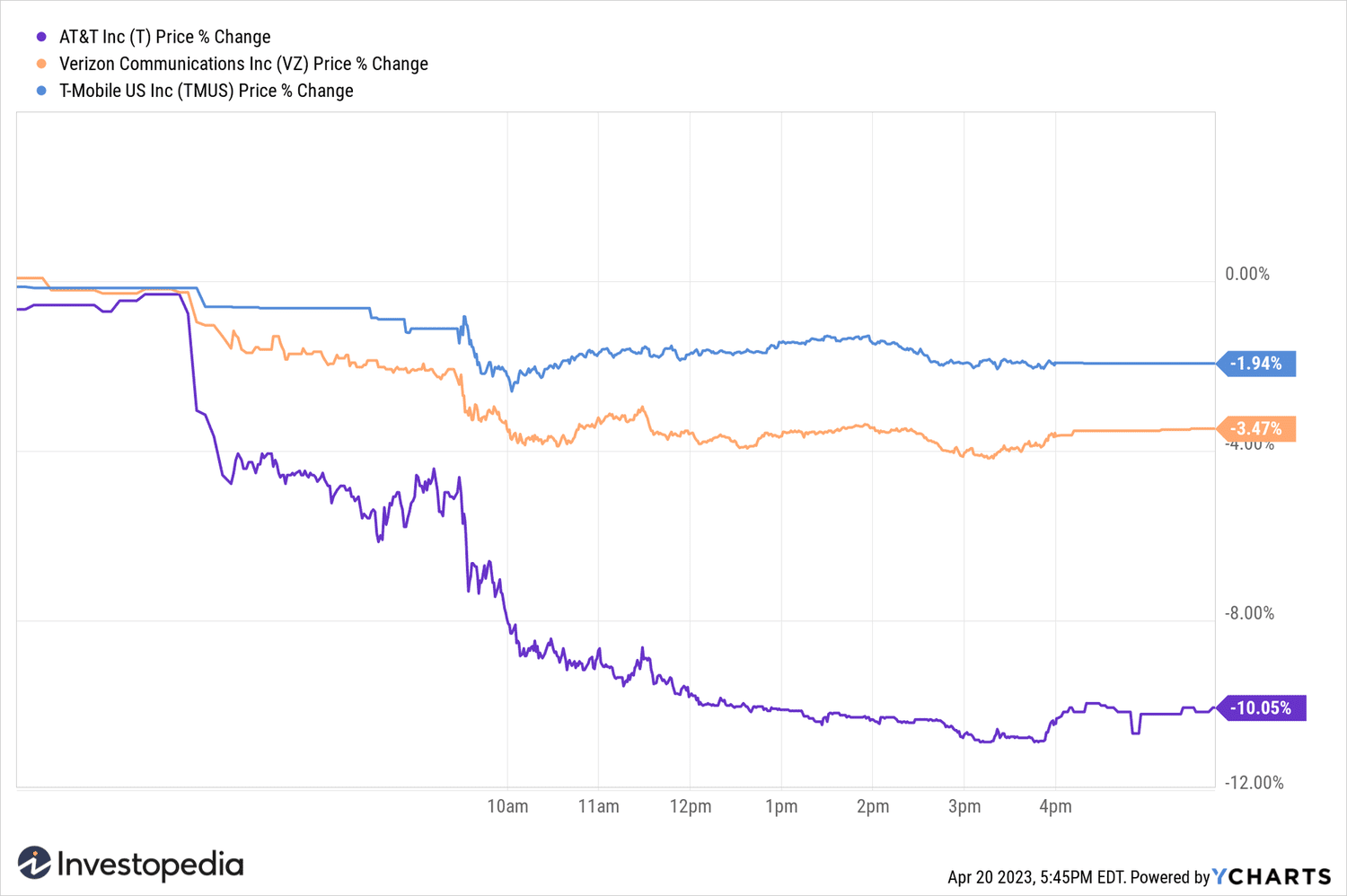

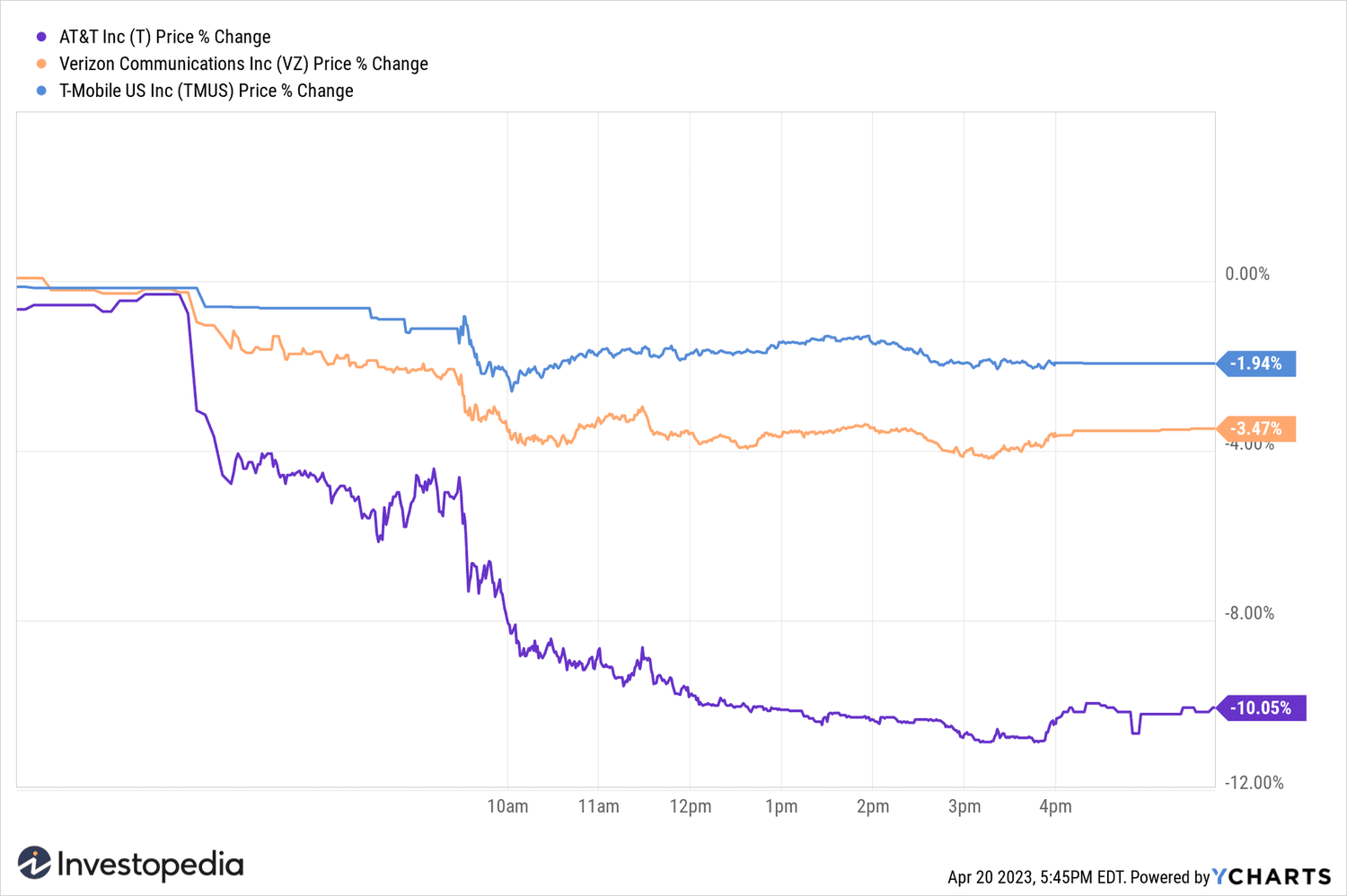

- Shares from AT&T (T) fell more than 10% on April 20, 2023, after the company reported disappointing subscriber numbers and revenue.

- The company s& #39;is focused on mobile subscriber growth since the sale of DirecTV in 2021.

- Shares of competitors Verizon (VZ) and T-Mobile (TMUS) have also dropped.

AT&T (T) shares fell 10.41%, the biggest one-day drop since July 2002, after the telecoms giant reported weak subscriber growth and revenue slumped. missed their targets.

In its Q1 2023 earnings report, the company said it added 424,000 postpaid phone plans, representing the number of consumers who pay their bills at the end of each month. While that's better than analysts' projections, it was down from the 691,000 postpaid phone subscribers reported in the first quarter a year ago.

Subscriber Growth Mobile telephony has been a priority for the Dallas-based telecommunications company since it sold DirectTV in 2021.

AT&T reported net profit of 4 .18 billion in the first quarter, to 57 cents per share, against revenue of $4.76 billion, or 65 cents per share, a year earlier. The company reported revenue of $30.14 billion, up from $29.71 billion a year ago. The results came in below analysts' forecasts, as AT&T was expected to report net income of $4.3 billion on operating revenue of $30.3 billion.

AT&T competitor shares Verizon (VZ) and T-Mobile (TMUS) also lost ground. Both companies are expected to release their results next week.

Source: investopedia.com