Key Takeaways

- Bloomberg reports of the possible merger between AstraZeneca and Gilead

- It would be the biggest pharma deal of all time

- The two drugmakers working on COVID-19-treatment

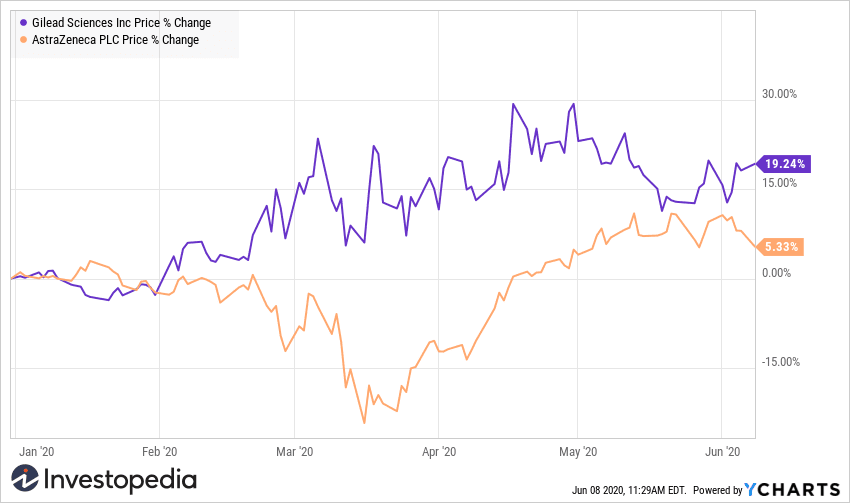

British pharma giant AstraZeneca has made a preliminary approach to the rival drugmaker Gilead Sciences, about a possible merger, Bloomberg reported at the weekend. Anonymous sources said Gilead has been informally contacted about a possible tie-up and the conditions are not specified. Based in California, the firm has discussed the proposal with the advisors, but it does “not currently interested in selling or merging with another big pharmaceutical company, preferring to focus its business strategy on partnerships and smaller acquisitions.” Analysts are skeptical the deal will happen, and Gilead’s chief executive officer, Daniel O’day has just took the job 15 months ago. Regardless, AstraZeneca stock is down, and Gilead shares are up this morning, as investors digest the news.

YCHARTS.

AstraZeneca currently has a market capitalization of more than $ 140 billion, and Gilead is valued at$ 96 billion. The merger of the two would be the largest health-care or pharma deal in history. The biggest so far is Bristol-Myers Squibb $ 74 billion acquisition ($88 billion, including debt) of Celgene in 2019. Both AstraZeneca and Gilead are in the top 20 pharma companies in the world in terms of the 2019 turnover. The two are also working on solutions to the COVID-19 pandemic. AstraZeneca is preparing to manufacture and distribute billions of doses of the University of Oxford’s vaccine, one of the 10 candidates in the clinical evaluation stage. Its antiviral drug calquence reduces markers of inflammation and improved clinical outcomes of patients with severe COVID-19 of the disease, according to a new study. It also works on the research of antibodies to treat the infection. Gilead antiviral drug remdesivir is currently being studied in clinical trials throughout the world on patients with the disease.

The pharma sector saw high levels of M&A activity each year, and most of the giants that we know today are products of it. Mergers are driven by the need for new innovative products, business model transformations and consolidation in the midst of difficult market conditions, tech disruption and low rates of interest. Big Pharma is currently faced with upcoming patent deadlines/generic medicines, downward pressure on prices and a growing number of regulations. Cancer and gene therapies have been the subject of merger and acquisition activity in the sector, but the pandemic could lead to a change of course. John Rountree pharmaceutical consulting firm Novasecta says that it is possible Astra sees a big future for antivirals in the post-COVID era. “Snapped one of the leaders in the field to give him a platform for future growth beyond oncology,” he told Bloomberg. Analysts at UBS also speculated that the Astra may be after Gilead’s big pile of cash to fund its dividend payments, according to CNN.

Source: investopedia.com