The Continued Push From Apple Inc. (AAPL ) to finance products and services could spell trouble for regional banks trying to hold on to deposits amid recent banking system distress and rising interest rates.

Key Points to Remember

- Apple's High Yield Savings Account with Goldman Sachs brought in nearly $1 billion within four days of its launch.

- Robinhood (HOOD) also unveiled this week a high-rate savings product.

- Over the past two months, regional banks have faced their most significant challenges since the global financial crisis.

- The applications offer extremely attractive rates for consumers.

Apple last month extended its foray into finance by launching a high-yield savings account allowing Apple Card users to store their daily cash rewards in a Goldman Sachs savings account. (GS) offering an annual percentage rate of 4.15%, more than 10 times the national average. Anticipation for Apple's product has been building since its first announcement in October 2022.

Apple isn't the only tech-focused company offering non-traditional alternatives to hiding money and potentially making big bucks by doing it.

Online discount brokerage Robinhood on Thursday unveiled a new 4.65% annual return savings account. Robinhood “Gold” members paying a monthly fee of $5 will be eligible for the account; non-Robinhood subscribers earn 1.5% for uninvested brokerage cash.

In recent weeks, some bank customers have grown nervous about depositing money in the US banking system, whose foundation recently showed its widest cracks since the global financial crisis. “A bank's greatest vulnerability is loss of trust, banking culture is defined by stability, prudence and governance,” Michael J. Hsu, acting Comptroller of the Currency, said Wednesday.

For its part, Apple's timing turned out to be impeccable. The company's brand loyalty and consumer confidence are unmatched. People are actively searching for the best high-interest savings accounts, and Apple's new savings account option has attracted nearly $1 billion in deposits over the of its first four days; $400 million on day one.

Turmoil drains bank deposits

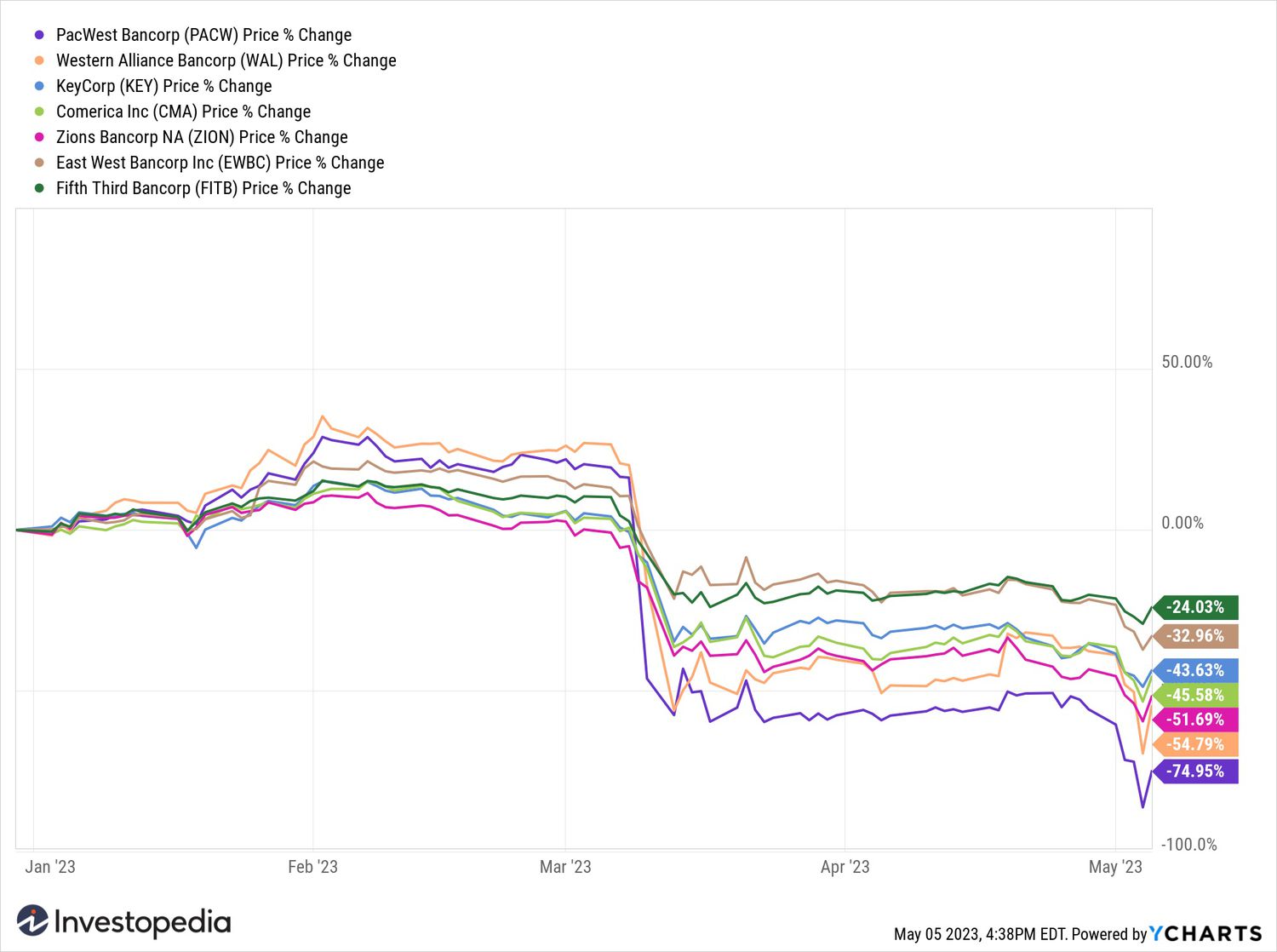

Since March, concerns about unrealized balance sheet losses at regional and mid-sized banks have caused many of these banks to flee deposits. Amid three U.S. regional bank failures and the takeover of 166-year-old Credit Suisse by Swiss rival UBS, median deposits fell 3% and 2%, respectively, at nine key regional banks and 23 retail banks. medium size tracked by Wedbush Securities.

>

>

YCharts

Uncertainty around regional banks continues. Shares of banks such as PacWest (PACW), Western Alliance Bancorporation (WAL) and Zions Bancorp (ZION) have fallen dramatically since the start of the year.

Meanwhile, Apple's move builds on the Apple Pay feature that launched on iPhones in 2014. It followed the launch of Apple Cash in 2017 and Apple Card in 2019. Then earlier this year it unveiled its Apple Pay Later feature, offering loans through its Apple funding. , subsidiary LLC.

By traditional standards, Apple is not a bank. But it's starting to look like it.

Apple believes in the value of owning the relationship between consumers and suppliers. And thanks to the reach of Apple's iPhone, fintech has the infrastructure to enable this ownership relationship. After all, to get an Apple Savings Account, you need an Apple Card account, which means you need an iPhone. There are over 2 billion iPhones worldwide on the market, and iPhone users touch their devices an average of 2,617 times per day, which means if you're shopping, your phone is likely already in your hand and it's probably an iPhone.

"If you 're a salesperson and take the iPhone for payment is easier, Apple is now your boss," Matt Stoller, research director of the antitrust advocacy group American Economic Liberties Project, told Vox.

Offers attractive rates and FDIC protection

The interest rates that& The #39;s currently offered by Apple and Robinhood far exceed those found at most traditional banks.

In April, U.S. savings deposit accounts averaged just 0.39%, according to data from the Federal Deposit Insurance Corporation (FDIC). Giant, diversified banks such as JPMorgan Chase (JPM) – less dependent on deposits to fund their operations than smaller banks – still pay rates as low as 0.01%.

Some depositors may be concerned that nascent enforcement accounts do not offer the same regulatory deposit protection as FDIC-insured bank accounts. This is true for PayPal (PYPL) and Venmo balances, although the FDIC protects balances in these accounts from direct deposits through paychecks or government benefits.

Because Goldman Sachs provides the services of Apple's accounts, deposits of up to $250,000 in these accounts qualify for FDIC protection, just as they do at physical banks. Similarly, Robinhood uses a so-called “sweep account” to transfer cash from its brokerage account to a network of FDIC-insured banks.

The Apple Savings Account interest rate of 4.15% doesn't make the top 15 financial institutions offering the highest rates. But that hasn't slowed his success.

It should be noted, well Certainly, the FDIC has also insured deposits with the three recently bankrupt banks and the regional and mid-sized banks that are currently experiencing a decline in deposits.

However, reflect accounts that exceed maximum coverage of the FDIC, regional and mid-sized banks tracked by Wedbush have a median of just 57% and 69% of their total deposits insured, respectively.

The Essentials

Apple is not a bank ; he relies on Goldman Sachs for that. But the duo have already made a dent in the financial market, and some project the success will continue. At the same time, consumer confidence in regional banks is likely fragile, but Apple was the world's favorite brand for the 10th consecutive year in 2022, according to Interbrand's annual Top Global Brands ranking. The only bank to make the top 25 brands was JPMorgan.

Source: investopedia.com