Dow component Apple Inc. (AAPL) may be at or near a long term top that will not be disputed, for months or years to come. The potential drop would be to finally acknowledge the long term damage to the brand iconic as a result of the pandemic, and tens of millions of job losses. More precisely, these people will not have the necessary resources to keep up with the company, endless upgrade cycles, instead of choosing to apply limited funds to household products.

The share price-to-earnings ratio (P/E) raised to a high of 30 in recent weeks, despite the obvious headwinds. More importantly, the speculation by so-called “Robinhood traders” has led a large part of the increase, with young Americans using the stimulus checks to the open commission-free trading accounts. The increase of the explosion in the tech-heavy Nasdaq 100 reflects this speculative fervor, the widening of the performance gap with the S&P 500 index to record levels.

Mean reversion has proven to be the market’s most reliable force in the last 100 years, with counter-trends of relieving the extreme of the price action to the upside or to the downside. We have seen this mechanism in all its glory after the March lows, with very oversold technical readings, producing one of the strongest rally of the pulses on the recording. However, the two-edged sword, and the same technique, measures are now being raised in a very overbought readings.

Market insiders also display the Robinhood crowd as “dumb money” in spite of their short-term profits, the hedge funds, to directly target this offer in an effort to empty the increase of their accounts. The strategy should not be too difficult, because the vast majority of these people do not have risk management skills. We have also been here before, in 1987, 1999 and 2007 – although we don’t really know how things will turn out, this time.

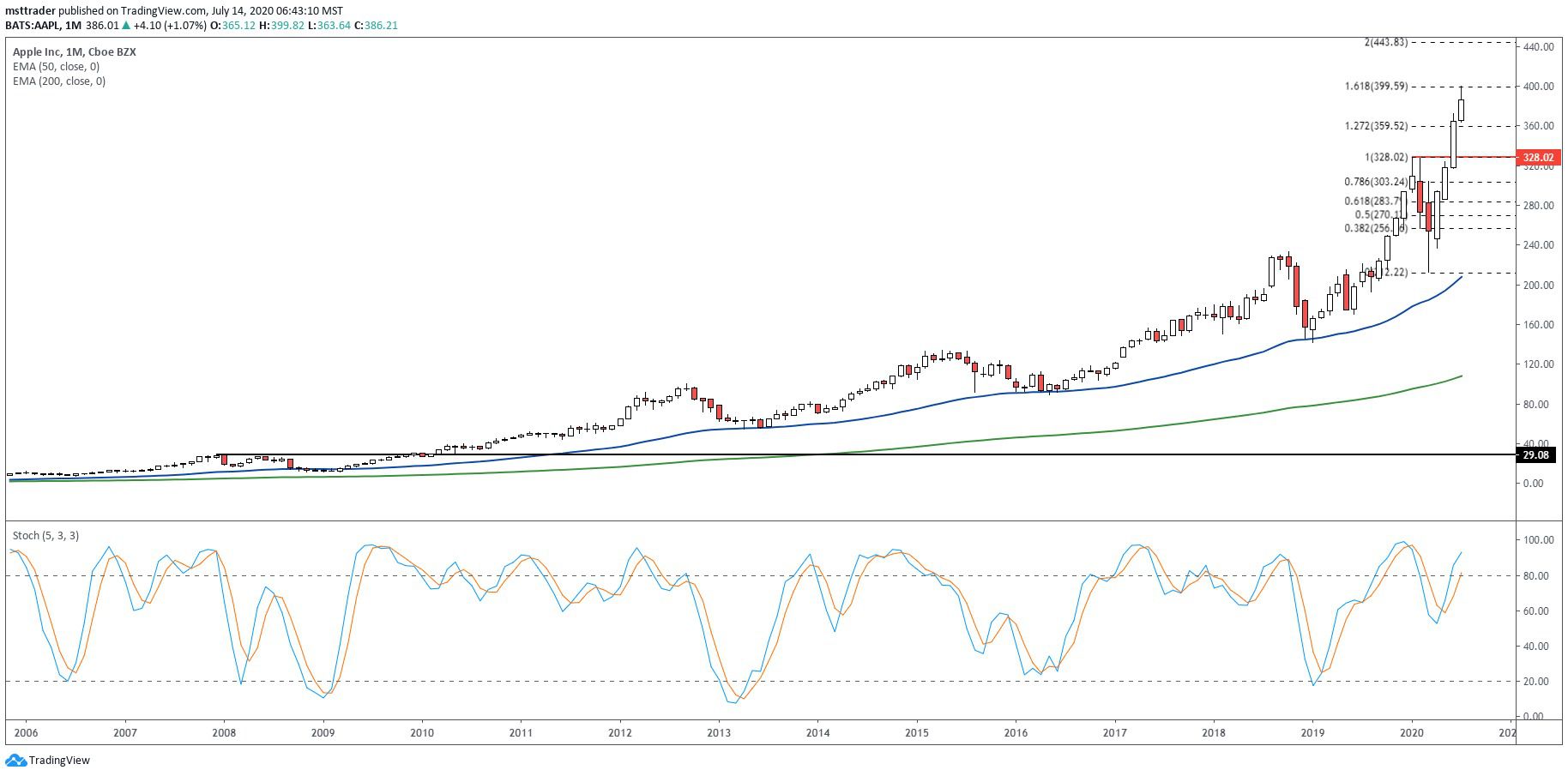

Apple’s Long-Term Chart (2007 – 2020)

TradingView.com

Apple stock has broke above the 2007 high in the upper $20 in 2010, entering into a strong uptrend in the lead just above $100 in 2012. A decline in the 50-month exponential moving average (EMA) has found support in the second quarter of 2013, while the subsequent increase, reaching new highs around 18 months later. It topped out once again in the $130’s in 2015, while the decline in subsequent finished to the same moving average in 2016.

As the level of support has worked as effectively for the third time in December 2018, setting the stage for a month of November 2019 breakout that has won over $320 in February 2020. The stock displayed a low in March and turned sharply in the second quarter, breaking out once more, in June. These impulse buys posted an all-time high on Monday, before a broad range intraday reversal that could signal the end of the current rally wave.

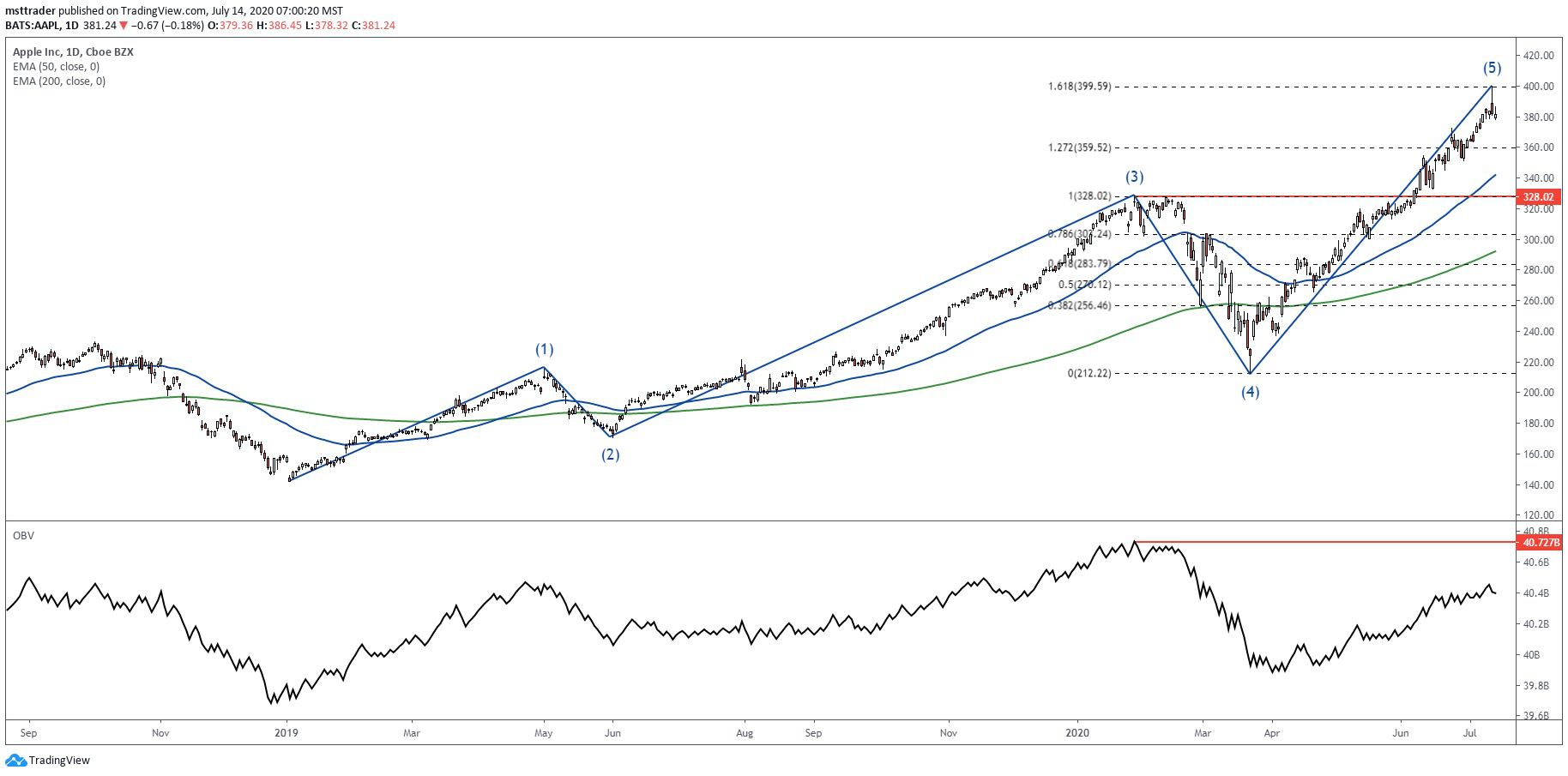

Apple’s Short-Term Chart (2018 – 2020)

TradingView.com

The price action since December 2018 has carved a classic Elliott five-wave rally pattern. Certainly, the structure meets most, but not all, Elliott requirements because the bottom of the fourth wave covers the top of the first wave, which “should not” occur. However, this occurs frequently in the real world because the support and resistance levels, have expanded due to the influence of algorithmic trading routines in the last two decades.

The parables and the purchase of the climax are closely associated with the fifth wave, and Apple-2020 action is not an exception. It is the longest of the three impulse waves by a wide margin and has not carved out of a single level of support among the establishment, at $212 and the (unconfirmed) termination of$ 400. In turn, this may result in volatility to the downside of the action that has the potential to provide up to 100% of the final event of the wave.

While it is too early to consider the worst-case scenario, shareholders and other stakeholders must pay particular attention to the price action in the vicinity of the rising 50-day EMA at $340, which will mark the first downside target if the selling pressure continues. If the breaks, the red line at $328 this will mark the bulls ‘ line in the sand because of a violation generate a failure of the escape, which triggers an additional series of sell signals.

The Bottom Line

The action Apple may be close on a long-term, which will not be disputed, for months or years.

Disclosure: The author held no securities in the aforementioned securities at the time of publication.

Source: investopedia.com