Key Takeaways

- EPS was $2.58 against $2.21 analysts had expected.

- Revenue also far exceeded expectations.

- Revenue matched expectations, but the big sales surprises is significantly higher-than-expected iPhone sales.

What Happened

Apple smashed earnings and sales expectations this quarter, where it stated that its finance July 30, 2020, the continuation of the antitrust investigation does not appear to have slowed the technology behemoth in the bottom at all. A second surprise came from the fact that the major revenue of the surprise does not come from Apple, the services sector, which relies on the collaboration to concentrate its action, but from its iPhone sales. iPhone revenues significantly exceeded expectations, while the services revenue simply adapted. iPhone revenue have declined significantly since the beginning of the Apple from the year 2019, in order to see this segment in the fires of the ramp is a change of pace. In addition, Apple announced a 4:1 share split, which means that each investor has the right to four shares for each one they currently own. This will bring the price of each share back down to around $100 to $403. Shares of AAPL are up sharply in after-hours trading.

(Below, Investopedia’s original earnings preview, published on July 23, 2020)

What to Look for

Apple Inc. (AAPL), is resilience during the sars coronavirus pandemic, is reflected in the company’s share price. Apple shares have climbed nearly 73% since mid-March, amid growing optimism after a fall in the beginning of the year on the initial market concern about the virus. Investor confidence has been fueled in addition, when Apple has surpassed expectations in its quarterly report at the end of April.

Investors will be looking for more signs that the company can withstand the COVID-19 induced by the economic shock when Apple reports earnings on July 30, 2020 for the Q3 of FISCAL 2020. Analysts believe both the earnings per share (EPS) and revenue down year on year (yoy). Apple’s last fiscal year ended in September 2019.

One key metric investors will focus on is Apple’s services revenue. Apple CEO Tim Cook has focused on the growth of services rapidly in recent years, but the services still represent less than a fifth of Apple’s overall revenue. In the 3rd quarter, analysts expect revenue services of the health post gains, although slightly slower than in the three quarters.

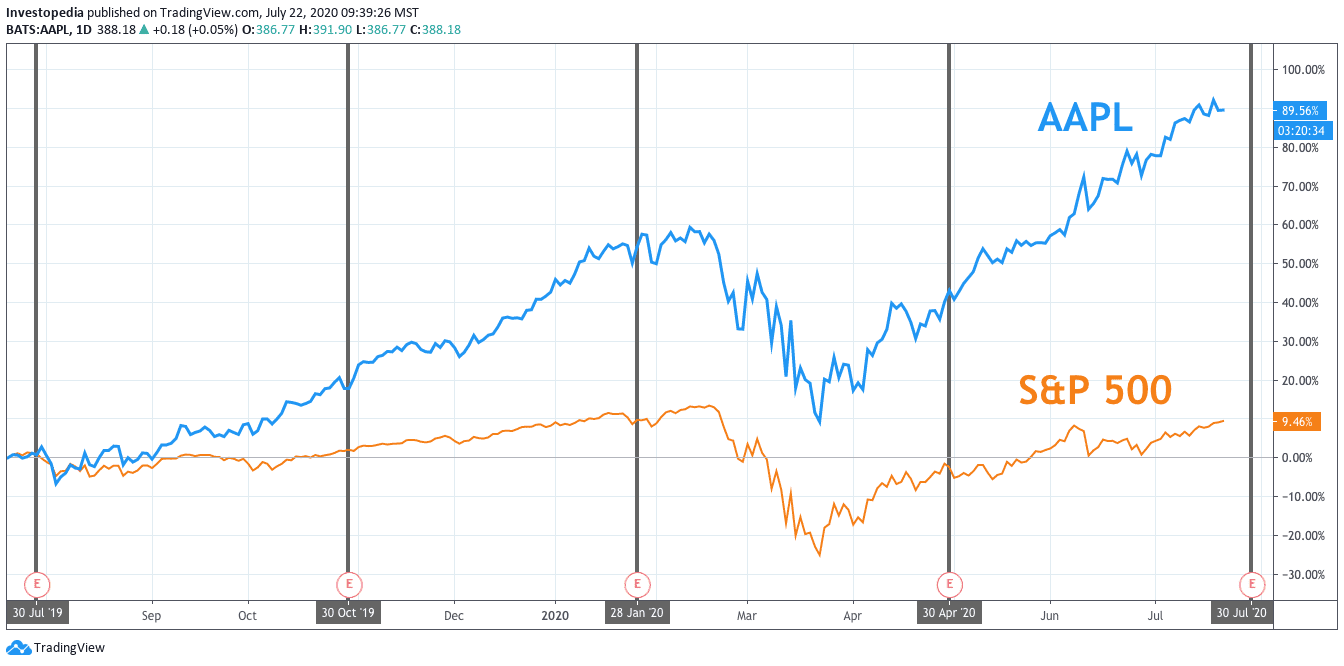

Investor enthusiasm about Apple’s long-term strategy, as well as the introduction of new products, has allowed Apple to dramatically dominate the general market. The tech giant’s shares posted a total return of 89.6% over the last 12 months, nearly nine times greater than the S&P 500 total return of 9.5%. All figures are as of the date of 22 July 2020.

Source: TradingView.

Apple shares fell slightly following the statement of income for the 2nd quarter of FISCAL 2020 ending March. But underlying fundamentals have been strong. Apple has exceeded analysts ‘ estimates, and also reported a growth in both top and bottom lines during the spread of the virus, which has been the biggest shock for the global economy since the financial crisis of 2007-2008. This has allowed the stock quickly resume its upward trend. During this quarter, EPS rose 5.7% on revenue growth of 0.5% in the midst of these prohibitions in China, where many of our key suppliers are located, and following the closure of many of its consumer stores around the world. These trends have constrained the two products, the supply and the demand of consumers for many Apple products.

For the 1st quarter of FISCAL year 2020, was announced at the end of January before the COVID-19 epidemic, Apple reported revenue of $91.8 billion. EPS increased 19.4% on revenue growth of 8.9%, which represents the fastest growth for the top and bottom of the line since the Q4 of FISCAL 2018. That growth was driven in large part by sales of Apple’s newest iPhone as well as its services and ready-to-wear business. The company’s shares has increased more on the report, but traded mostly sideways over the weeks before the market collapsed, as fears about the spread of COVID-19 mounted.

Analysts do not expect that the continued growth in the 3rd quarter of the FISCAL year 2020. They believe that a 10.1% decline in EPS and a decline of 3.7% of the turnover. This will mark the largest EPS decline since the fourth quarter of FISCAL 2016, and the first decline in sales since the 2nd quarter of the FISCAL year 2019.

Apple Key Measures

Q3 of the financial YEAR 2020 (estimated)

Q3 of FISCAL 2019

Q3 of FISCAL year 2018

Earnings Per Share ($)

2.21

2.46

2.58

Revenue ($B)

51.8

53.8

53.3

Services Revenue ($B)

13.2

11.5

10.2

Source: Visible Alpha

As mentioned, a major concern for investors in this quarter may be on Apple’s services revenue. The company has been pivoting toward services such as the sale of materials, including the flagship, the iPhone, has slowed. Apple services include streaming services such as movies and TELEVISION entertainment provider Apple TV+ video games, seller of Apple Arcade, news services and digital content stores including the iTunes Store and the App Store, and Apple Pay, and AppleCare. It also includes a variety of other Apple services hardware devices. The income of Apple is a service company tends to be more stable and predictable revenues generated by the products and services have much higher margins. Apple’s gross margin for services was between 61% and 65% over the past two years, nearly double Apple’s gross margin for the products ranged from 30% to 34% over the same period. This means that each dollar of sales of services contributes to approximately the double of the gross profit margin, and therefore potentially twice the benefit, of Apple to other companies.

Services currently represent approximately 17.8% of our revenues, but this share has increased rapidly over the past two years. Services revenues accounted for 14.3% of the total in 2017. The main source of the strength of the company during the last quarter, Q2 of FISCAL year 2020, has come from revenue growth services, which increased 16.6% to hit an all-time record 13.3 billion dollars in spite of the pandemic.

Analysts expect services revenue to resist, the forecast growth of 15.4%. This shows that Apple’s strategic pivot to these services is still at work even as global economic demand continues to falter. But there are also warning signs. The estimated growth rate of services in Q3 would also be less than half of its 40% growth rate, at its peak in the 2nd quarter of FISCAL year 2018, and it is also the second slowest growth quarter-on-quarter to about four years.

Source: investopedia.com