Dow component Apple Inc. (AAPL) is trading all time high above $400 on Friday pre-market after beating top and bottom line third-quarter 2020 estimates and the declaration of a four-for-one stock split, effective at the end of August. 24. The technology icon reported a double-digit growth in ipad, Mac, and ready-to-wear, while the iPhone, revenues rose 1.5% year on year to $26.4 billion, better than the $22.0 billion consensus. The company has chosen not to provide fourth quarter guidance because of the uncertainty as a result of the COVID-19 pandemic.

Key Takeaways

- Apple has posted solid results in all divisions and geographical areas.

- The technology icon to open Friday’s session at an all-time high above $400.

- A bearish volume divergence could undermine the increase in the next few weeks.

- The stock will be divided by four at the end of August. 24.

Exceptionally good results in all the divisions and geographical areas has led to the blowout quarter, with $59.69 billion in revenues, marking a 10.9% year-to-year increase that beat the estimates of more than $ 5.0 billion. It is clear that the pandemic has been extremely beneficial to Apple’s bottom line, with millions of people around the world forced to work at home and access to digital devices, whether it be for business or leisure.

The four-for-one split took market watchers by surprise, because the practice had been shunned by the big companies over the past two decades, with the assumption that higher prices would attract more and more desirable in the institutional participation. The Robinhood phenomenon, in which thousands of new traders have used stimulus funds to open commission-free trading accounts, has thrown this theory on the trash heap, it is likely that other large tech companies will follow.

A stock split is a share of a company divides its existing shares into multiple shares to boost liquidity of the shares. Although the number of shares outstanding increases by a specific multiple, the total value of the shares remains the same compared to pre-split amounts because the split did not add any real value.

Apple’s Long-Term Chart (2007 – 2020)

TradingView.com

The stock rallied above the December 2007 high in the upper part of $20 for the second quarter of 2010, grinding to a powerful trend in advance, which has stalled at $100.75 as of September 2012. It sold in 2013, finding support at the 50-month exponential moving average (EMA) in July, and rebounded to the front of the top in 2014. In October breakout made rapid progress in $135, before another pullback that found support at the moving average in 2016.

Apple broke out once again in the first quarter of 2017, rising to $233 in October 2018, which gives us a third rebound on the moving average in December. The increase was subsequently dropped to $328 in January 2020 and rolled over in a vertical 116-point decline that ended in a six-month low in March. Aggressive buyers then intervened, returning the stock for the first quarter peak in June, before an escape, which is trading at an all-time high above $413 before the Friday opening bell.

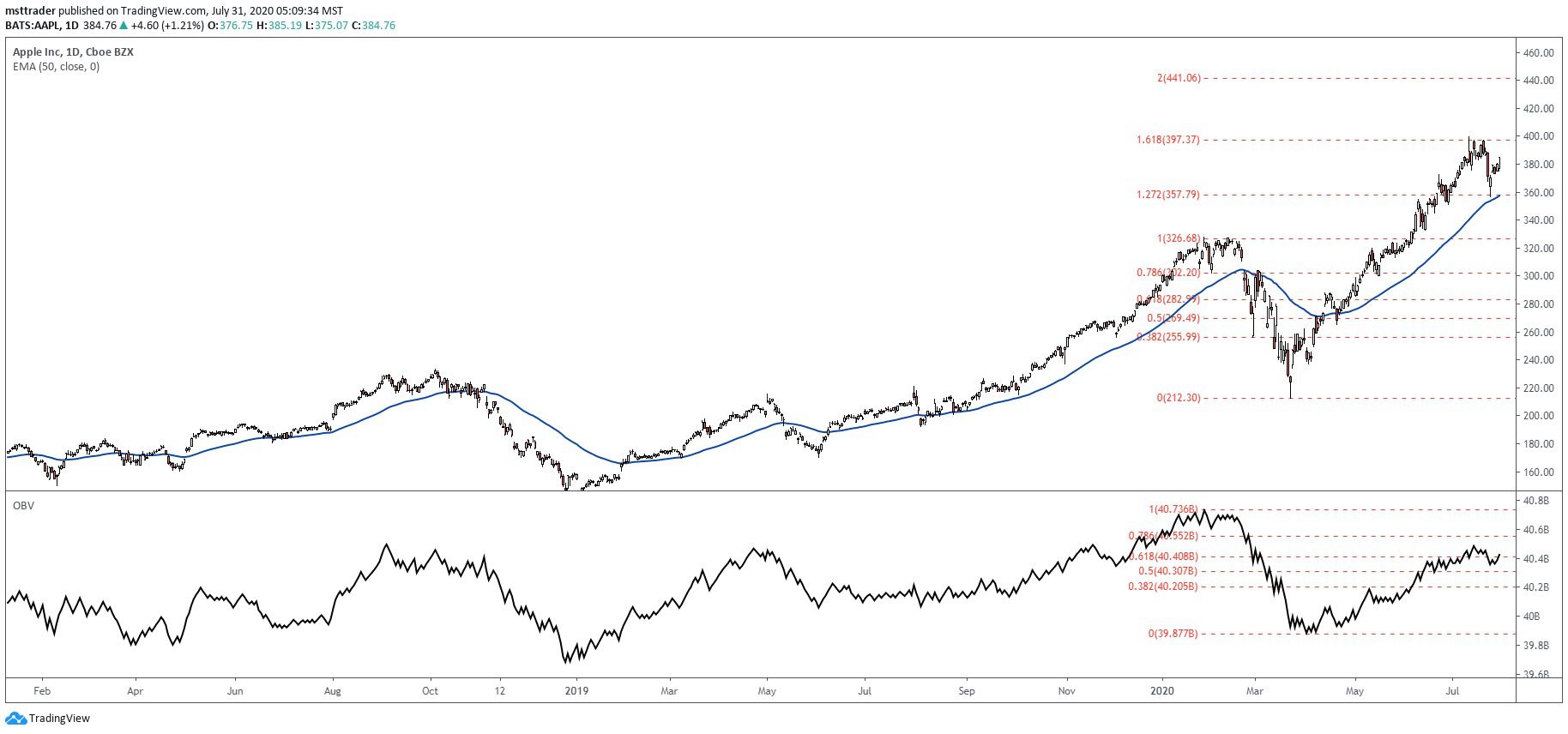

Apple’s Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator march a virgin technical outlook, the display of an all-time high in January and the decline in 14-month low in March. The buying pressure in July recovered only two-thirds of the accumulation lost in the first quarter, a bearish divergence when the exercise price of a new summit in June. This conflict will grow until that OBV plays catch-up and reached a new peak, or the stock reverses and failure of the escape. Now, the smart money is looking out for the health of the buying interest to end the conflict.

The June bypass opposite to the 1.618 Fibonacci extension earlier this month, a common turning point, while this morning’s opening print must climb the barrier. Even so, it is a magnetic area that could attract the price action from above and below for several weeks before succumbing to a sustained trend move higher or lower than. Watch OBV if these whipsaws take in hand, because volatile sideways action could finally correct the volume deficit.

Extensions of Fibonacci are a tool that traders can use to determine profit targets or to estimate the extent to which a price of a trip, after a retracement/pullback is finished. Extension levels are also possible areas where the price may reverse.

The Bottom Line

Apple stock is trading at an all-time high on Friday morning, after a blowout quarterly earnings report.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com