Probable resumption of the Covid-19 pandemic from American Airlines Group (AAL) was flat in the first quarter as high fuel costs and interest charges eroded the revenue rebound.

American expects to earn $0.01 to $0.05 per share for the recently ended quarter, according to an April 12 regulatory filing. That's up from a loss of $2.32 a share in the first quarter of last year, when airlines still hadn't shaken the full impact of the pandemic.

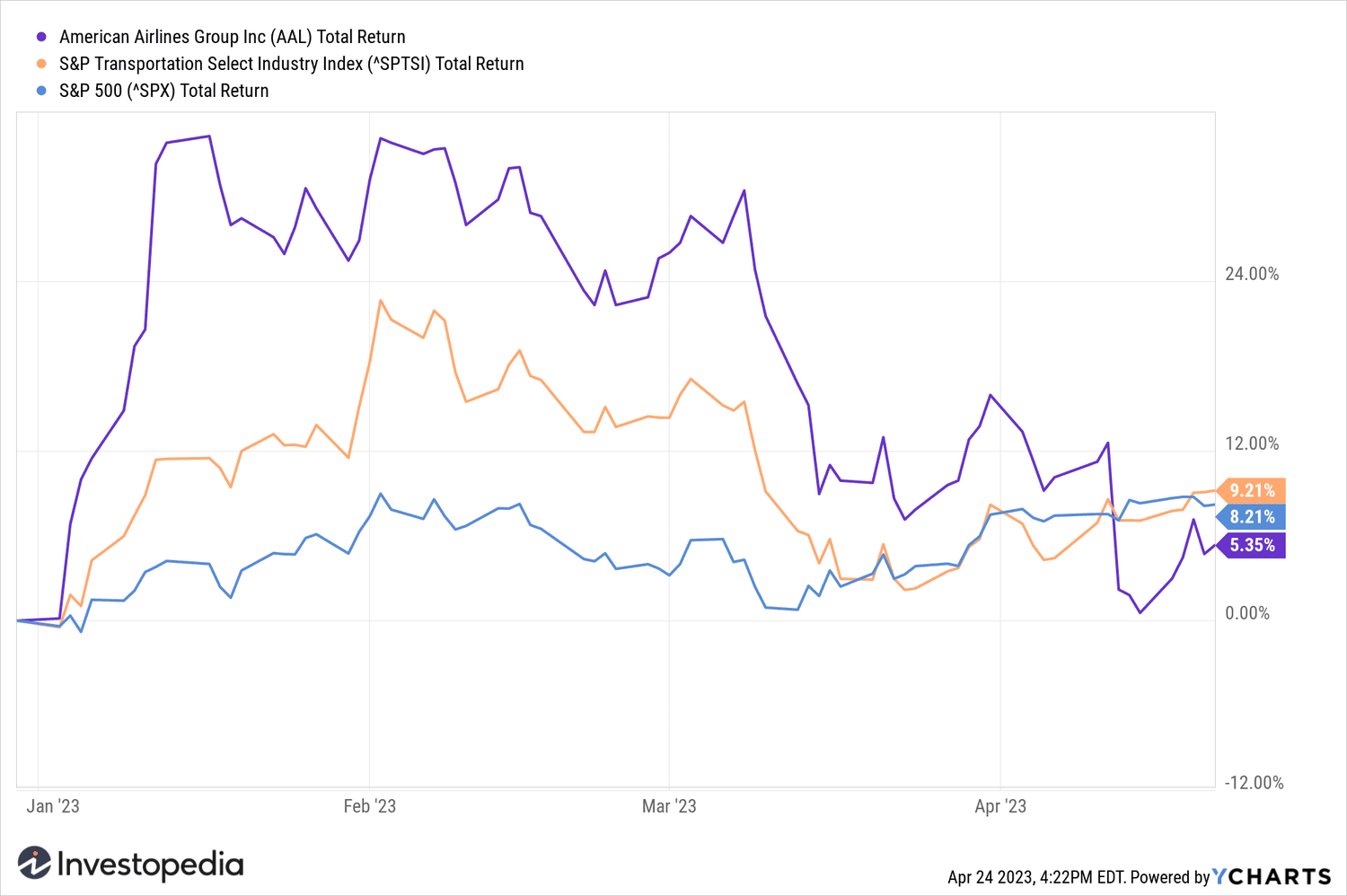

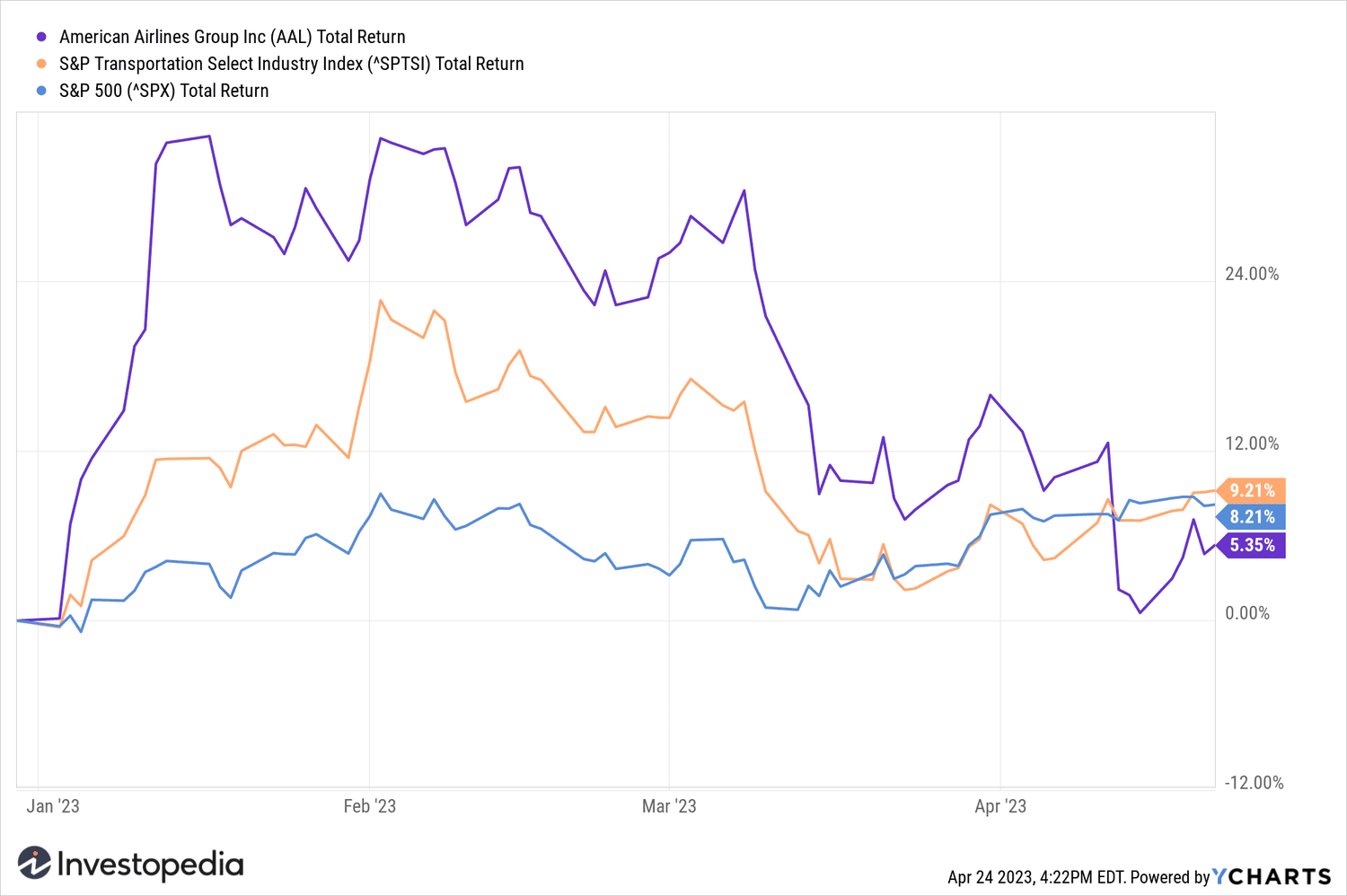

This is, however, a regression from the airline's recovery in the last three quarters of 2022, when diluted EPS ranged from $0.69 to $1.19 per share. U.S. stocks fell 9% on the day they updated their earnings forecast, giving up much of their 16% gain in the first quarter.

Since then, two other major US carriers, Delta Air Lines (DAL) and United Airlines (UAL), have released their first quarter results. Although United reported a loss, both airlines said they expect strong demand for the peak summer travel season, and investors will be watching whether American anticipates the same.

American will post its earnings before markets opened on Thursday.

First Quarter Projections

American's revenue likely rose 37% to $12.2 billion in the first quarter, according to estimates compiled by Visible Alpha. However, fuel costs likely increased by 28%, wiping out a quarter of that revenue and fueling an estimated 12% increase in overall operating expenses.

Operating profit likely totaled $403 million, a marked improvement from an operating loss of $1.7 billion in the first quarter of last year. But non-operating expenses of roughly the same amount likely generated little to no net income for the quarter.

The first quarter typically represents the weakest travel period for US carriers. American's load factor in the quarter likely declined for the third consecutive quarter to 82.7% after reaching 86.9% in the second quarter of 2022. American's load factor was 74.4% in the first quarter of last year.

Q1 2023 (est.) Q1 2022 Q1 2021 Adjusted earnings per share ($) 0.04 -2.32 -4.32 Revenues ($B) 12.2 8.9 4 Load factor (%) 82.7 74 ,4 59.5

future

Visible Alpha forecasts the US load factor will rebound to 85.8% in the second quarter, bringing revenue to $13.8 billion, up 3% from a year ago. Profits are expected to total $724 million, which would mark a 52% increase from the second quarter of last year.

Despite the expected resumption of travel , US forecasts from two weeks ago raised fears that current expectations for the coming months remain too optimistic.

Andrew Didora, Analyst at Bank of America, said in a research report earlier this month that a slowdown in airline bookings in March prompted more caution about second-quarter revenue.

"There usually has more off-peak leisure time by Memorial Day, & # 34; Didora wrote: “We therefore believe that there is a greater risk in domestic leisure-oriented airlines in 2Q23.

Source: investopedia.com