Advanced Micro Devices, Inc. (AMD) shares rose over 12% during Wednesday session after the semiconductor company reported better-than-expected financial results for the second quarter. Turnover increased by 26.1% to $1.93 billion for the quarter, beating the consensus estimates of$ 70 million, and non-GAAP earnings per share came in at 18 cents, beating the consensus estimates by one cent. The better-than-expected performance was driven by strength in AMD’s Enterprise, Embedded and Semi-Custom business units.

Several analysts raised their price targets on AMD shares following the second-quarter financial results. Bank of America reiterated its Buy rating and raised its price target of $100 per share, citing secular tailwinds in the core of PC, games, and cloud segments. JPMorgan and other neutral analysts have also raised their price targets, but has warned that the stock is trading with high expectations.

The manufacturer of micro-components has seen significant strength since Intel Corporation (INTC) has announced unexpected further delays in its 7nm chips. Lync Equity Strategies and other analysts think the delay could fundamentally transform the PC/server industry that Intel has dominated in recent decades and open the door to competitors such as AMD.

TradingView.com

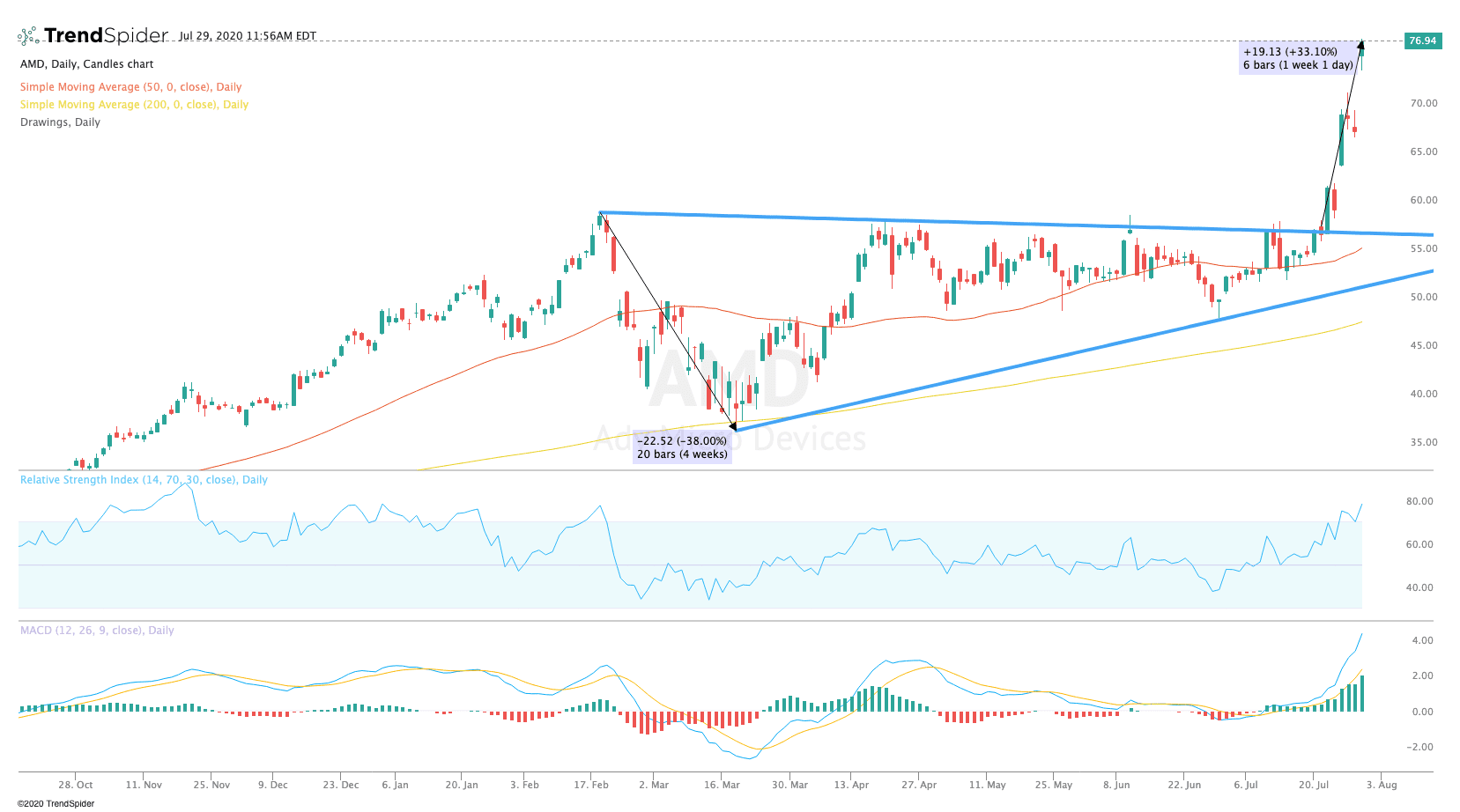

From a technical point of view, AMD expanded stock of his escape from earlier this month to new highs. The relative strength index (RSI) has been moved further into overbought territory with a reading of 78.35, but the moving average convergence divergence (MACD), has extended its bullish recovery. These indicators suggest that the stock could see some short-term consolidation, but in the medium term, the trend remains bullish.

Traders should watch for consolidation above prior highs of $71.63, or trendline support at $57.20 in the coming sessions. If the stock continues to break out, traders could see a move towards an ascending triangle price target of around $79.75. If the stock breaks down from a trendline support, traders could see a move towards the 50-day moving average at $55.64, or bottom of the trend line support at around $51.80.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com