Takeaways

- Shares of chipmaker Advanced Micro Devices (AMD) jumped more than 9% on Wednesday after the company said sales of its AI chips could exceed $2 billion next year.

- However, revenue for the current quarter is expected to be $300 million. below analysts' consensus estimates.

- AMD is accelerating its investments in artificial intelligence (AI) in a bid to catch up with larger rival Nvidia, a leader in the global AI race.

- The company's MI300 processor , which the company described as “the world's most advanced generative AI accelerator,” could help the chipmaker catch up with its biggest rival.

Shares of Advanced Micro Devices (AMD) jumped more than 9% on Wednesday after the company announced it plans to sell $2 billion worth of AI-powered chips the 39;s next year, aiming to catch up with its market leader and rival. NVIDIA (NVDA).

The company, which reported better-than-expected third-quarter results yesterday, forecasts revenue of $6.1 billion (give or take $300 million) over the past three month of the year. That figure is up from $5.8 billion in the third quarter, but lower than the $6.4 billion analysts expected.

However, according to some analysts, AMD's AI processor line is larger than its integrated chip business for the industrial, automotive and networking sectors.

According to Wedbush Securities analyst Matt Bryson, the AMD's annual embedded business market is less than $10 billion, while rival Nvidia alone will likely surpass that figure in terms of quarterly GPU sales. The opportunity is therefore great for AMD.

'In our opinion, it's significantly better Growth expectations for AMD's AI products outweigh questions of where and when (Field Programmable Gate Arrays ) FPGA sales will bottom out and what is the normalized revenue for AMD's embedded business, he said. Bryson wrote in a note Wednesday. Field programmable gate arrays are a type of circuit.

AMD accelerates its investments in AI

AMD accelerates its investments in #39;artificial intelligence (AI) in a bid to catch up with rival Nvidia, which has become one of the world's largest semiconductor companies with a market capitalization exceeding $1 trillion.

AMD's MI300 processor, which the company described as “the world's most advanced generative AI accelerator,” could help the chipmaker catch up with its biggest rival. Sales of AI-based graphics processing units (GPUs) are expected to reach $2 billion next year, AMD Chairman and CEO Lisa Su said at the #39;call on the company's results.

Earlier this year, Su called AI “the defining technology that will shape the next generation of computing and the greatest strategic growth opportunity for AMD”; and said the company is “steadfastly focused on accelerating the deployment of large-scale AI platforms in the data center.”

Deliveries of MI300 processors are expected this should begin by the end of 2023, Su said during a product presentation in June.

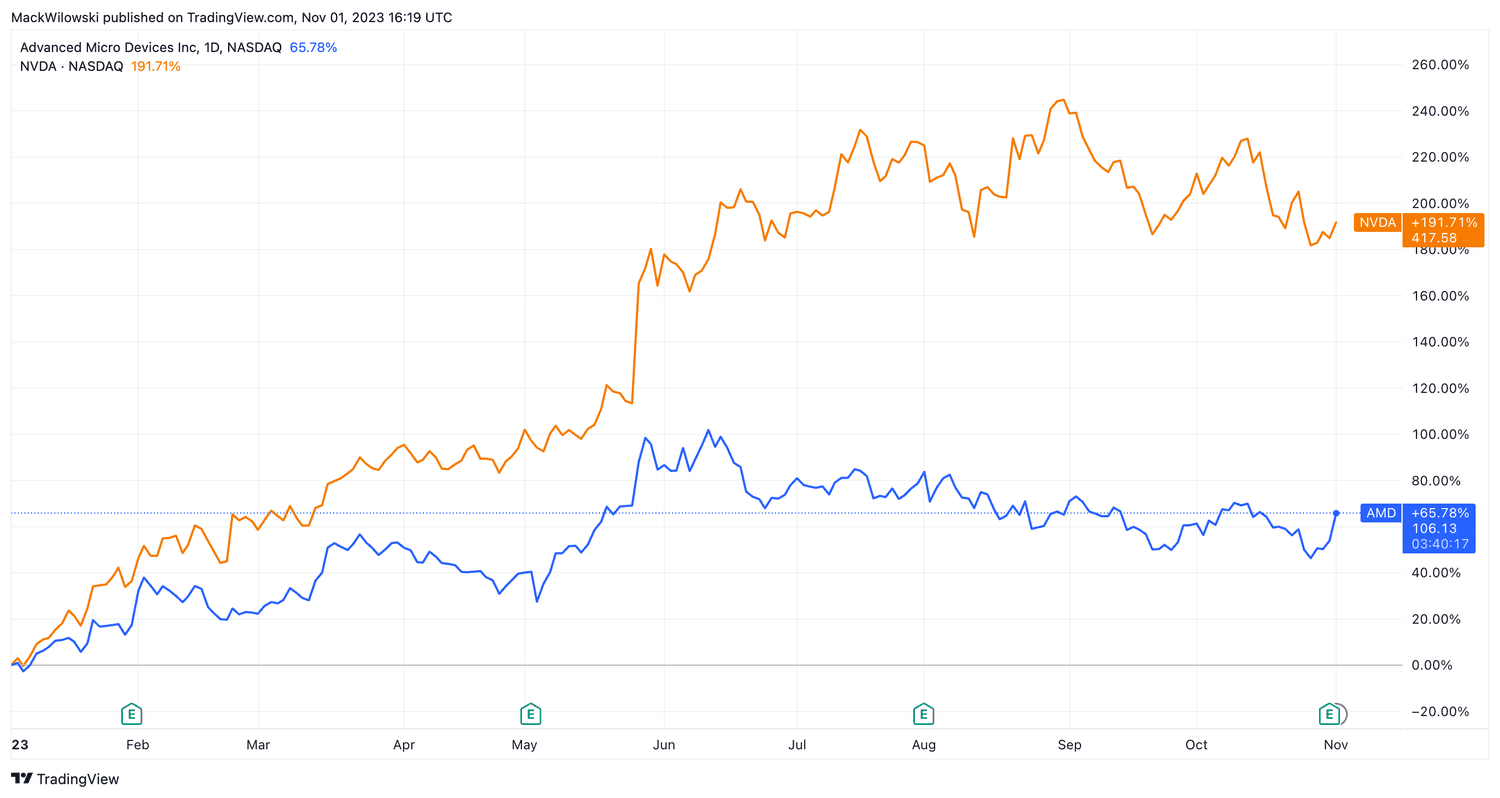

With Wednesday's gain, AMD shares are up nearly 69% so far this year. While impressive, it's a small gain compared to rival Nvidia, which has nearly tripled year-to-date and is the stock's fastest-growing stock. best performer in the S&P 500 this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com