Advanced Micro Devices Inc. (AMD), among the best seven semiconductor makers by market value, will likely say first-quarter net profit fell more than 83% as revenue fell for the first time in four years amid continued global declines in fleas.

Key Points to Remember

- AMD is expected to post Q1 2023 Adjusted EPS of $0.08 versus $0.56 in the prior year quarter.

- Revenue could fall year-over-year for the first time in four years.

- Semiconductor sales plunged industry-wide and revenue of AMD's data centers is expected to grow at a slower rate than recent quarters.

AMD likely generated net income of around $137 million, up from $786 million a year earlier, according to analyst estimates compiled by Visible Alpha. Adjusted earnings per share (EPS) is expected to dip to $0.08 from $0.56 in the prior year quarter. Semiconductor maker could say revenue was $5.3 billion, down nearly 10% from $5.9 billion at the same time last year .

In its fourth quarter earnings report, AMD reported $21 million in net profit, a 98% drop from the year-ago quarter. The company also forecast that a 10% drop in revenue for the first quarter was likely. AMD releases its fiscal results on May 2 after market close.

The dire analyst forecast underscores the significant headwinds that have plagued the semiconductor space in recent months, as inflation and interest rate hikes have combined with falling commodity prices. sales to harm businesses in the industry. The Semiconductor Industry Association said industry-wide sales fell nearly 21% year-over-year for the month of February, the sixth consecutive month. of decline. Global PC shipments, a key driver of semiconductor sales, fell by a third in the first quarter.

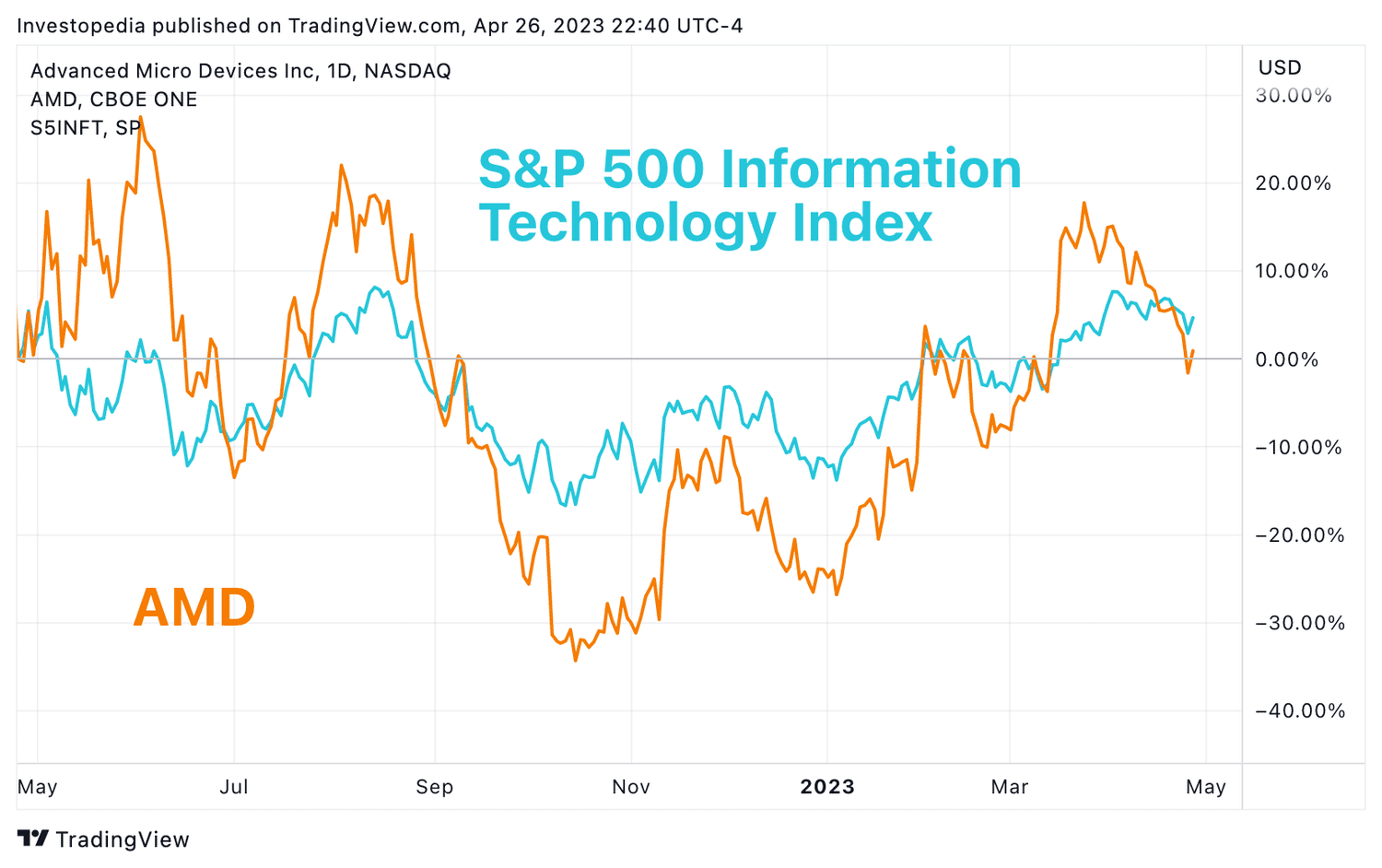

AMD shares rose by less than 1% in the past year, compared to a 5% gain for the S&P 500 Information Technology Index over the same period.

Source: Trading View. AMD Key Stats Estimate for the first quarter of fiscal 2023 Actual for the first quarter of fiscal 2022 Actual for the first quarter of fiscal 2021 Adjusted earnings per share ($) 0.08 0 .56 0.45 Revenue ($B) 5.3 5.9 3.4 Data Center Revenue ($B) 1.5 1.3 0.6 “mntl-sc-block_1-0-15” class= “comp mntl-sc-block finance-sc-block-html mntl-sc-block-html”>Source: Visible Alpha

The Key Metric: Data Center Revenues

AMD's peak performance could also be affected by weakening revenues for its data centers. The company's data center revenue for the first quarter is expected to increase 14% to $1.5 billion. This is the slowest rate of growth in this area for at least three years.

Source: investopedia.com