AMC Entertainment Holdings, Inc. (AMC) shares plummeted downward, before recovering during the Monday session after Credit Suisse downgraded the stock from Outperform to Neutral and reduced its target price in half from $4.00 to $2.00 per share. The new target price implies a 52% drop from Friday’s closing price COVID-19 cases rise across the united States.

Analyst Meghan Durkin assumes that the company will be successful in its transition to exchange $ 2.3 billion of subordinated debt for a combination of new second lien debt and common stock. While this could support the drama of the string through March, Durkin sees more risk for the AMC is a business model if there is a slow recovery of COVID-19.

Earlier this month, the company announced that all of its approximately 600 theatres to be opened the 24th of July, with more than 450 of the opening here on July 15. The recent increase of the COVID-19 cases in all states, such as Texas and Florida, however, has expressed doubts about these plans. It is also unclear how enthusiastic consumers will return to theaters in the middle of the course COVID-19 epidemic.

TrendSpider

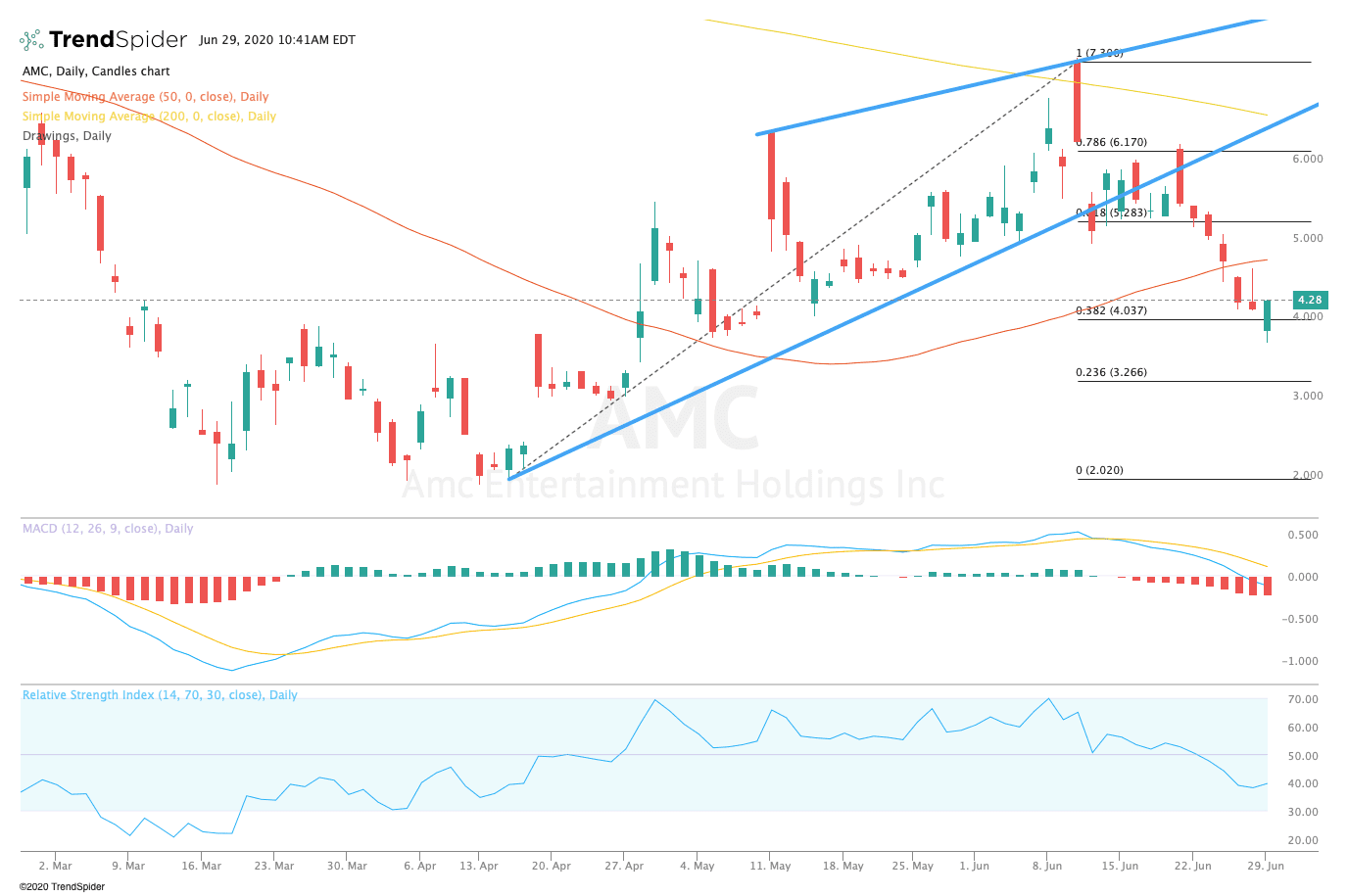

From a technical point of view, AMC’s stock briefly dipped below $4.00 during the Monday of the session before regaining ground. The relative strength index (RSI) remains oversold with a reading of 39.30, but the moving average convergence divergence (MACD) remains in a bearish trend. These indicators suggest that the stock could see some respite before a move to the downside.

Traders should watch for consolidation near $4.00 before a potential move lower. In addition to strong support at $2.00 per share, the operators could see the support at the key Fibonacci support levels of $4.04 and $3.27. If the stock breaks out from the 50-day moving average, traders could see a move towards the 200-day moving average of $6.53 per share.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com