Points to remember

- AMC shares plunged 36.8% on Wednesday after announcing it would sell up to 40 million shares of Class A common stock.

- The operator of the movie theater chain said the sale would be done from time to time through an “at-the-market”; offering program.

- The move came less than a month after AMC announced a 1-for-10 reverse stock split to raise capital.

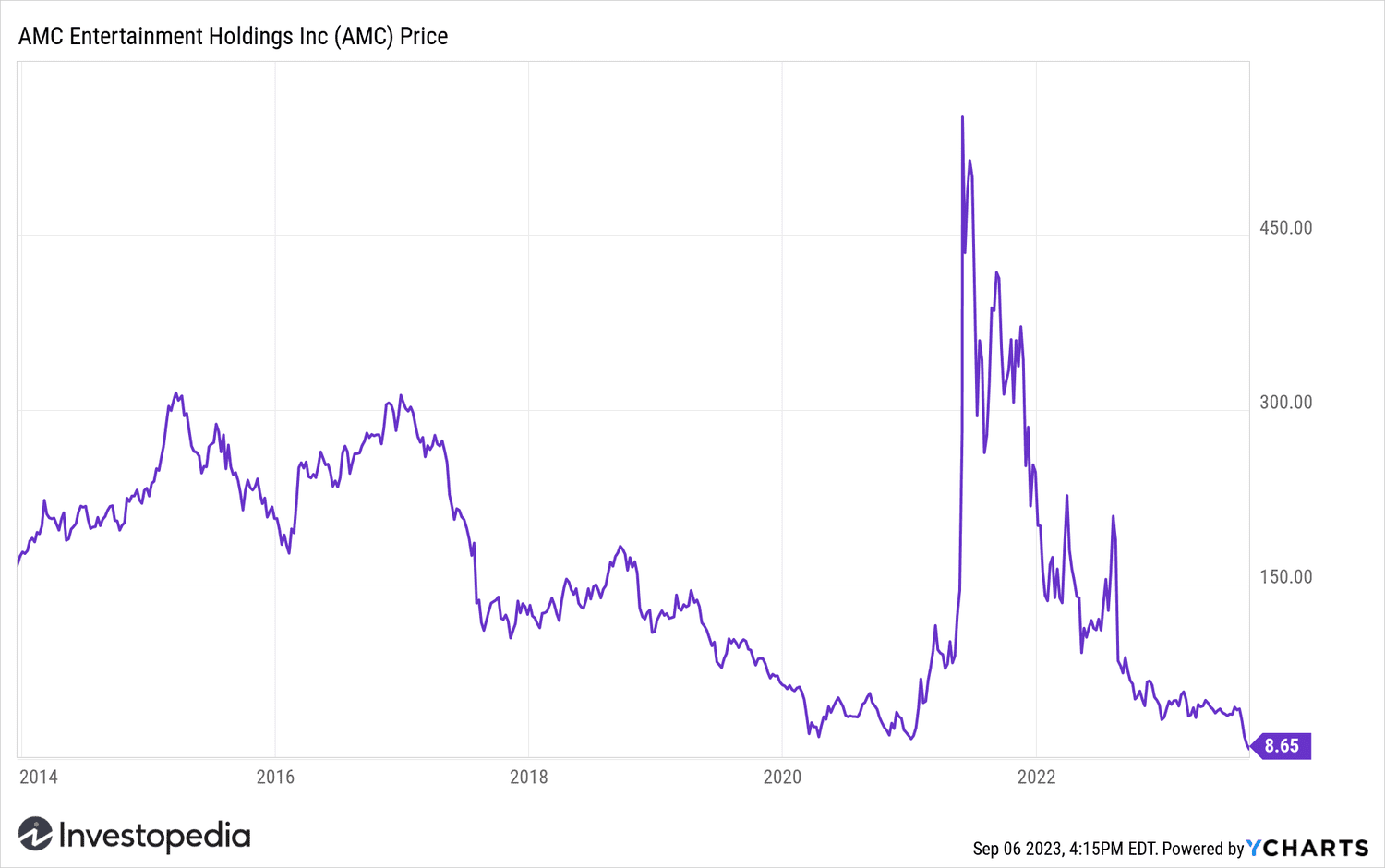

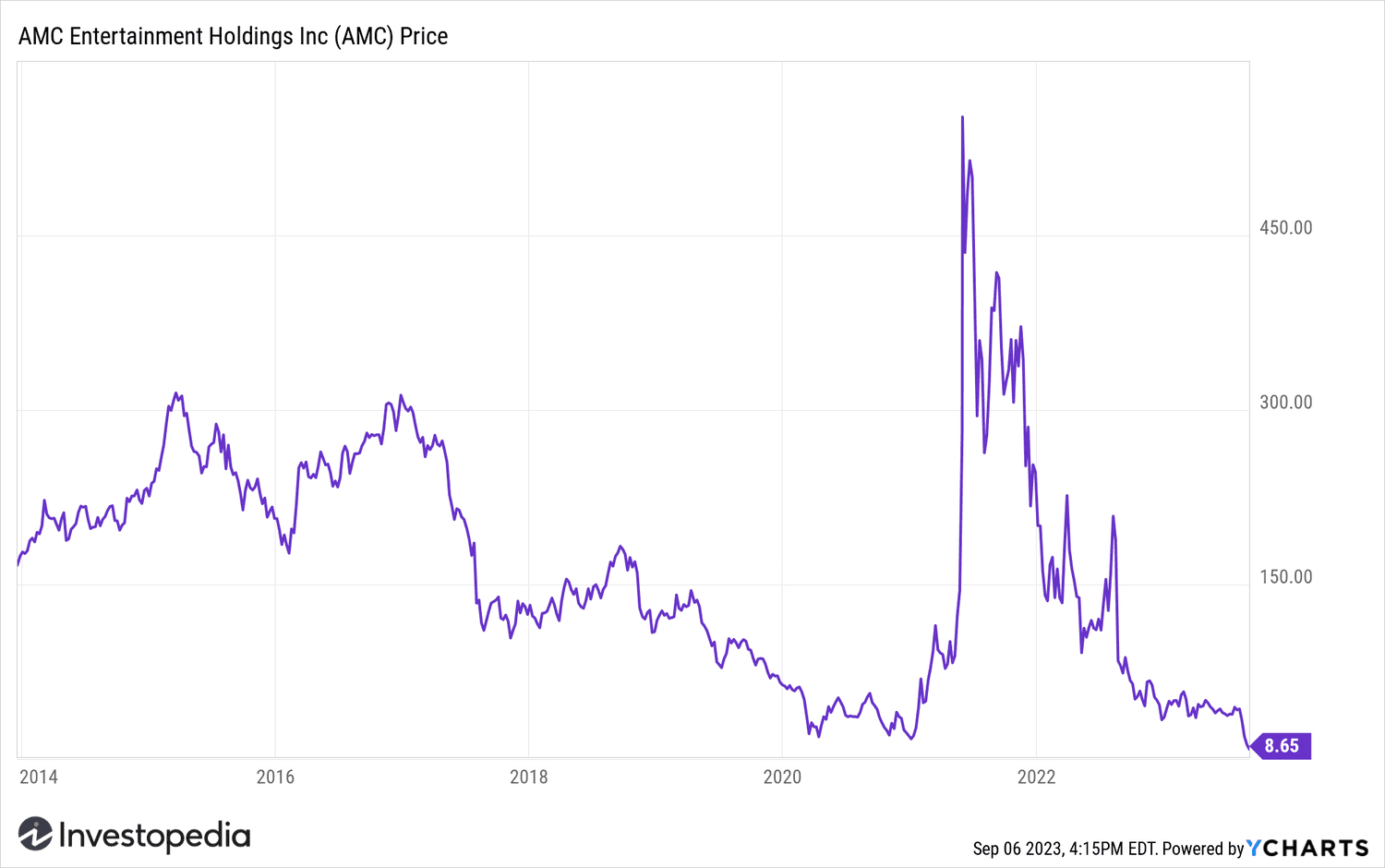

Shares of AMC Entertainment Holdings (AMC) plunged 36.8% to an all-time low on Wednesday after the cinema chain operator announced it would sell up to 40 million shares of Class A common stock.

The company said in a filing that it had entered into a stock distribution agreement, and that sales would be made “from time to time” as part of a stock distribution program. offer “at the market”. He noted that Citigroup Global Markets, Barclays Capital, B. Riley Securities and Goldman Sachs would be the sales agents and they would receive a commission of up to 2.5%.

AMC explained that the money raised would be used to “strengthen liquidity, to repay, refinance, repurchase or redeem its existing debt (including expenses, accrued interest and bonuses, if any) and for corporate purposes. company generals. »

In its prospectus, the company warned investors that buying its shares is “highly speculative and involves risk”.

The move took place less A month after AMC received court approval for another plan to raise capital by converting its AMC Preferred Equity (APE) shares into common stock. This allowed the company to move forward with a 1-for-10 stock split, which caused the stock to crash.

YCharts

Source: investopedia.com