Key Takeaways

- Analysts expect an EPS of $1.32 versus $5.22 in Q2 2019.

- Amazon Web Services (AWS) is expected to a strong increase in turnover.

- The company’s revenue growth is expected to increase strongly in the middle of COVID-19.

Amazon.com Inc. (AMZN) has proved to be one of the stars during the COVID-19 crisis in the middle of the surging online purchases and a strong demand for cloud computing services. Amazon stock has increased by nearly 80% since the March lows of this year has significantly exceeded that of the market. Amazon superior performance has come despite missing earnings estimates in its most recent quarter, and as CEO Jeff Bezos spends billions of dollars to ramp up Amazon’s supply chains and warehouse and safety procedures in the middle of the pandemic.

Investors will watch closely how these trends affect the company, when Amazon releases its results after the market close on 30 July for the 2nd quarter of the FISCAL year 2020. Analysts currently expect a very mixed quarter. They estimate earnings per share (EPS) is going to plunge for the third time in four quarters as the company posts healthy gains in income in seven quarters.

A key metric for Amazon investors to look at in the results is the rapid growth of the cloud segment, Amazon Web Services (AWS). The world’s largest cloud services company, Amazon Web Services is a major contributor to the company’s revenue growth, and also has the highest profit margins of any business on Amazon, and far. For the 2nd quarter, the analysts expect AWS to strong sales, although growth will be slower than in recent quarters.

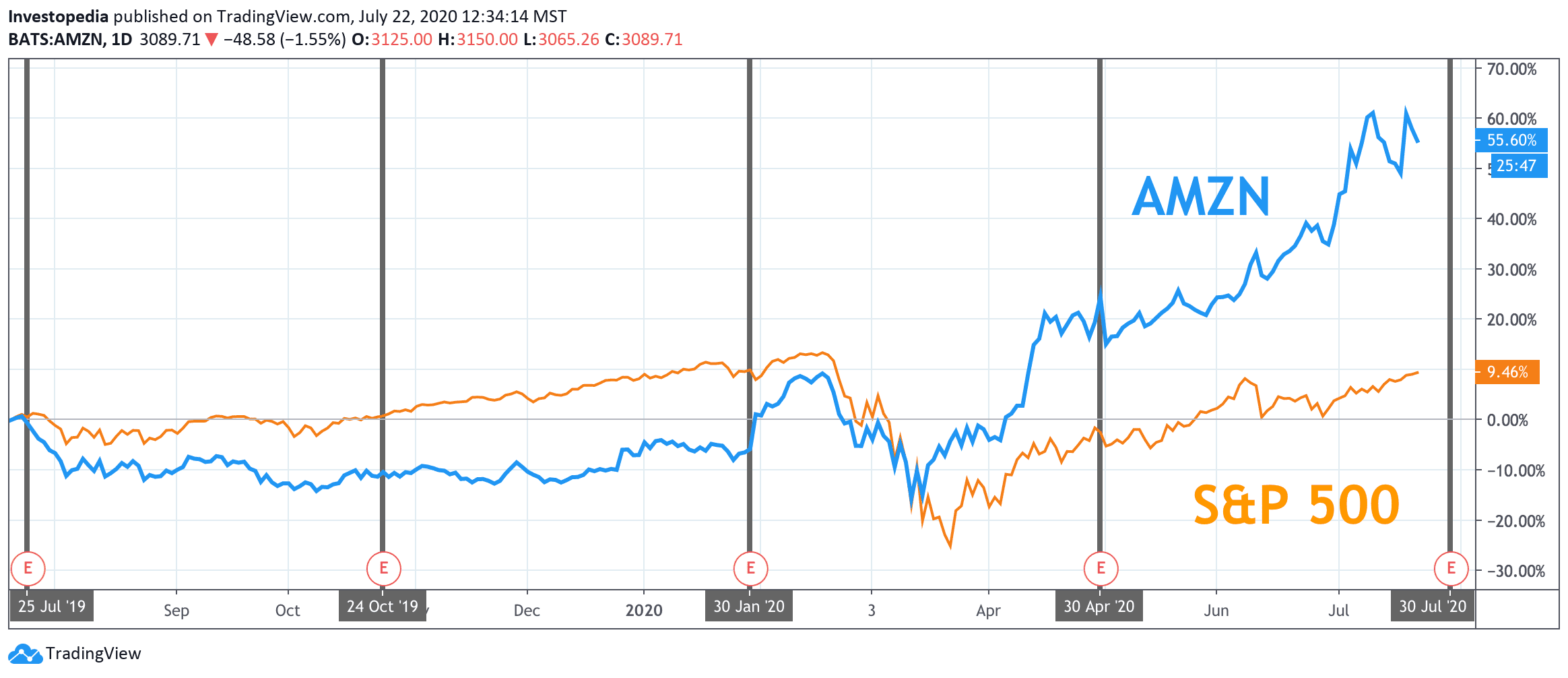

In addition to outperform in the last few months, Amazon stock has exceeded the market in the last 12 months, has posted a total return of 55.6% compared to 9.5% for the S&P 500.

Source: TradingView.

Amazon missed analysts ‘ earnings estimates for the 1st quarter of FISCAL year 2020 as Amazon grapples with how to respond to the surge in consumer orders in the middle of the pandemic. While the stock has dropped the day after the April 30, for the publication of the results, it is then reassembled for the next three months. Amazon’s EPS performance, historically, has been erratic as chief executive officer Bezos has put great emphasis on the long-term growth instead of quarterly profits. This is illustrated by EPS performance in Q2 periods in the course of the last three years, with an EPS decline of 77.6% in FISCAL year 2017, the increase of 1,165.7% in 2018, and is essentially flat to growth of 3.0% in FISCAL 2019. Now, analysts estimate EPS will fall to 74.6% in year-on-year to $1.32 per share in Q2 of FISCAL year 2020. A force to the origin of this decline is that Bezos said the company expects to spend all of Amazon’s estimated $ 4 billion in Q2 operating profit on the maintenance-related expenses COVID-19.

By contrast, Amazon has reported strong quarterly year-over-year revenue growth every quarter for more than four years. Analysts expect this trend to continue, with the year-on-year revenue growth of 27.8% for the 2nd quarter of the FISCAL year 2020. At this rate, Amazon’s Q2 revenue is expected to more than double between 2017 and 2020. In spite of the pandemic, analysts estimate Amazon revenue will increase from 24.3% for the full YEAR 2020. While it is faster than the YEAR 2019, there would the lowest rate in five years.

Amazon Key Measures

Q2 2020 (Estimate)

Q2 2019

Q2 2018

Earnings Per Share (in dollars)

1.32

5.22

5.07

Turnover (in billions of dollars)

81.0

63.4

52.9

AWS sales (in billions of dollars)

11.0

8.4

6.1

Source: Visible Alpha

A major contributor to Amazon’s long-term success is steady growth in its highly profitable, Amazon Web Services segment. This part of the company provides corporate and individual clients with cloud services that are used to run web sites, databases, and a variety of programs. It is less costly to many businesses in the purchase and operation of independent servers. AWS revenue is a key indicator for investors to watch because the cloud profit margins are extremely high, and contribute a disproportionate percentage of Amazon’s profit. On the other hand, while most of Amazon’s sales of e-commerce, these sales are relatively low profit margins. Thus, any improvement that AWS revenue will provide an outsized boost to the overall profits compared to a similar enhancement to the e-commerce sales.

AWS sales have grown at an impressive clip in the past several years, although the growth rate seems to have decreased slightly in recent quarters. Year-over-year quarterly AWS revenue has grown by at least 45.0% in each quarter of 2018 and by at least 34.0% for each quarter in 2019. In Q1 of FISCAL year 2020, this growth slowed slightly to 32.8%.

For the 2nd quarter of FISCAL 2020, analysts estimate that cloud revenues increased by 31.1%, the lowest level in at least four years. In spite of this slowdown, the AWS is more important than ever in the strengthening of the company’s top line, its revenue growth. And the rich, the margins from AWS are crucial to help its bottom line as expenses soar to the Amazon, giant, with a low margin e-commerce.

Source: investopedia.com