Takeaways

- Shares Google parent Alphabet fell more than 9% in intraday trading Wednesday after the tech giant's cloud revenue fell short of expectations in the third quarter.

- Analysts say investors shouldn't worry because Google's cloud revenues represent just 11% of the total, while growing demand for AI could boost revenues in coming quarters.

- Alphabet CEO Sundar Pichai attributed the weaker-than-expected gains to customer choice. to optimize their spending, while Jefferies analysts cited challenges in scaling up AI infrastructure.

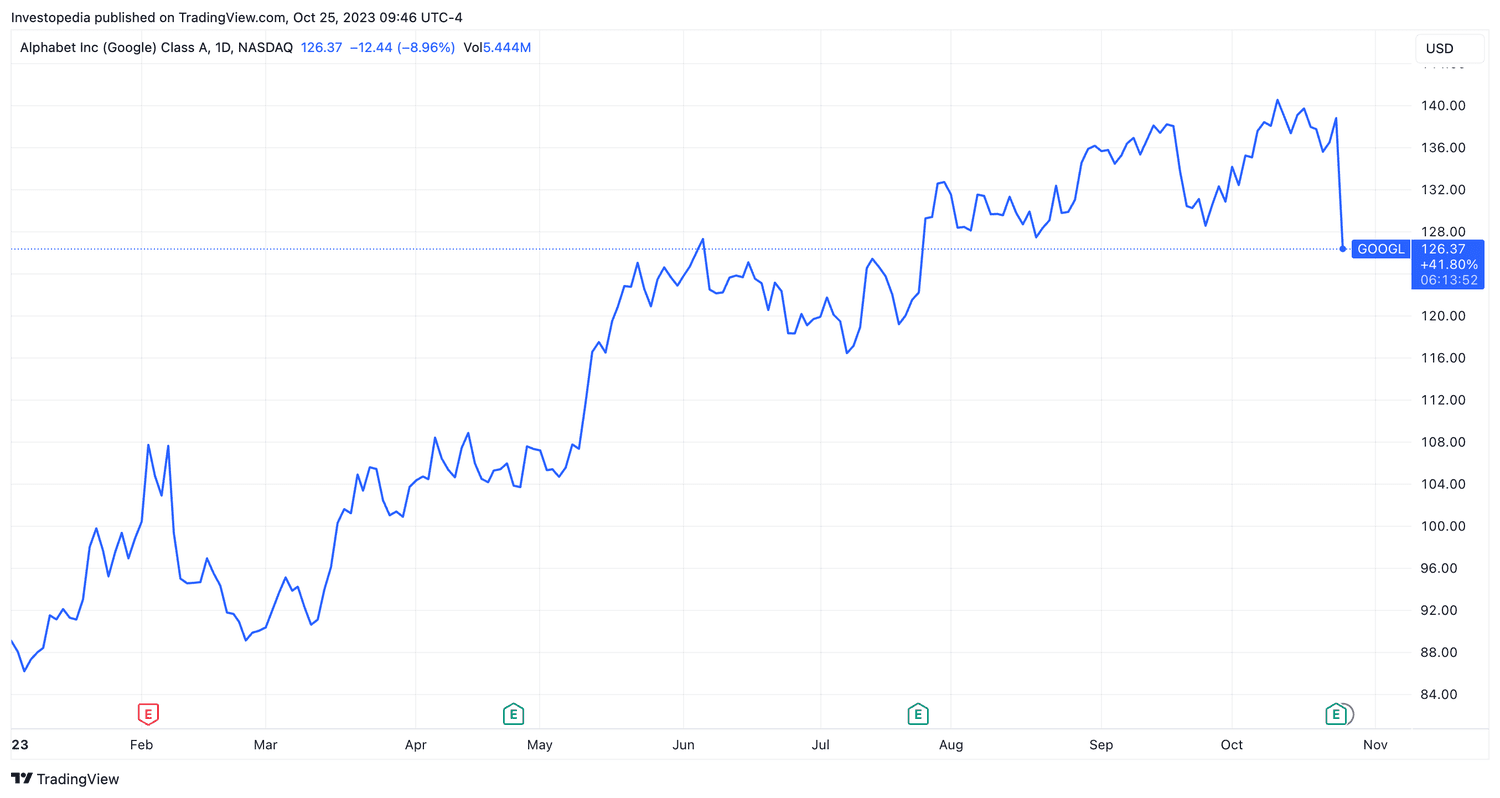

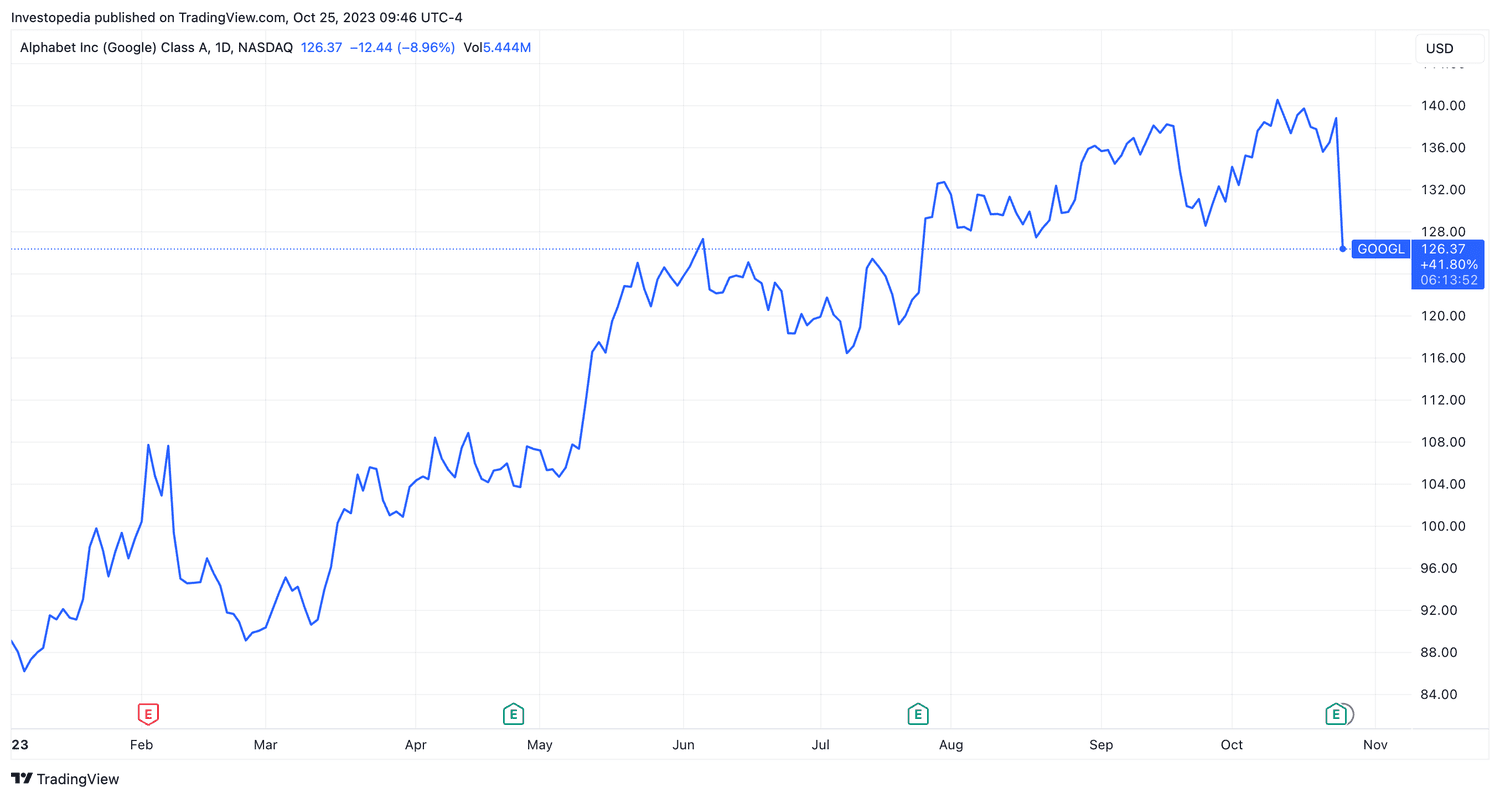

Shares of Google parent Alphabet (GOOGL; GOOG) fell more than 9% Wednesday in intraday trading after the tech giant's cloud revenue fell short of expectations in the third quarter, despite a quarter overall better than expected. However, analysts say Alphabet's cloud results shouldn't worry investors too much.

Why analysts say investors shouldn't worry

Industry analysts say investors shouldn't worry about Google's weaker-than-expected cloud performance. Wedbush Securities' Dan Ives said on X that the stock's negative reaction was “overblown.” and that investors attach “too much relative value” to investments. on the cloud, which only represents about 11% of Alphabet's revenue.

Google cloud revenue totaled $8.41 billion, about 2% below expectations of $8.6 billion, although it was up 22% from the same quarter's $6.87 billion. last year.

During the company's earnings conference call Tuesday, Alphabet CEO Sundar Pichai attributed the lower-than-expected gains to customers choosing to optimize their spending, likely due to of economic uncertainty. Analysts at Mizuho Americas said they expected the weakness in cloud revenue to be “transient,” based on what they observed at rival Amazon (AMZN) .

In an X post, Ives said that holding Google shares solely for its cloud business “is like cheering for Michael Jordan to play baseball.”

Wedbush maintained its “outperform” rating on Alphabet shares, targeting a price target of $160 per share. GOOGL was trading at around $126 per share on Wednesday, up just over 40% since the start of 2023.

Analysts at Jefferies were also upbeat and said higher revenue growth from Google Search and YouTube more than offset the slowdown in the cloud segment. They attributed part of the slowdown to challenges related to the ramp-up of AI infrastructure, but said headwinds could ease as soon as next year.

In a research note, Bank America's analysts said it was a “tough night” to miss on cloud projections. However, they added that the company could benefit from investments in AI in the long term, particularly the integration of AI tools with advertisements, which what they believe Google is best placed for.

"L" AI helps advertisers find the maximum number of people in their ideal audience at the lowest possible price. Early testing delivers 54% increased reach at 42% lower cost," said Philipp Schindler, Google's chief business officer.

Trading view

Tech giants vie for the influence of cloud and AI

Alphabet's cloud results could attract more attention because they contrast sharply with Microsoft's stellar results, released the same day.

With an 11% share of the global cloud computing market in the second quarter, Google ranks third among tech giants, according to the latest available analysis from Synergy Research Group, behind Amazon and Microsoft (MSFT) with 32% and 22%.

And the cloud is not the only segment where Alphabet faces stiff competition from Microsoft. The latter's advantage in artificial intelligence projects, which can also impact a company's cloud platform, has left Google's parent company playing catch-up.

Microsoft has looked into Generative AI as early as January, when it invested $10 billion in ChatGPT maker OpenAI, deepening a partnership that dates back to 2019. It also rolled out the integration of generative AI tools. 39;AI with its Bing search engine and a subscription service for its suite of products.

The continuation of Google's Generative AI now includes products like Bard, a chat-based AI tool released in March, and Studio Bot, an AI-powered coding assistant introduced in May. Bard's debut left much to be desired, although Google has since launched several applications of its AI tools.

Do you have any news advice for news journalists? Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com