Key Takeaways

- Analysts estimate adjusted EPS of $11.23 for $17.25 in Q2 2019.

- Traffic acquisition costs are expected to fall.

- The revenue expected to decline in the middle of COVID-19 crisis.

Alphabet Inc. (GOOGLE), parent of search giant Google, have experienced strong gains in revenue, profits, advertising and online traffic earlier this year, on the background of the spread of government, these prohibitions and the global recession caused by COVID-19. Investors want to know if the Alphabet can capitalize on the gains, in particular the increase of the traffic of the Internet, when the company reports Q2 FISCAL 2020 earnings after the market close on July 30.

T2 will be the first quarter to take account of the Alphabet during the pandemic, and analysts indicate that most of the news will not be good. They are predicting a dip in revenues and plunging the adjusted EPS compared to the same period of the previous fiscal year.

Investors will be particularly attentive to a key metric: traffic acquisition costs (TAC), a measure of how much the company pays to attract people to their sites. The rise or high-traffic acquisition costs indicates the decrease of margins and profits. That may mean good news for the Alphabet in Q2 of FISCAL 2020, as the analysts believe that the general conditions of the fall (year-on-year). Investopedia is focusing on the TAC because the Alphabet is the yoy percentage change in paid clicks in its earnings press release.

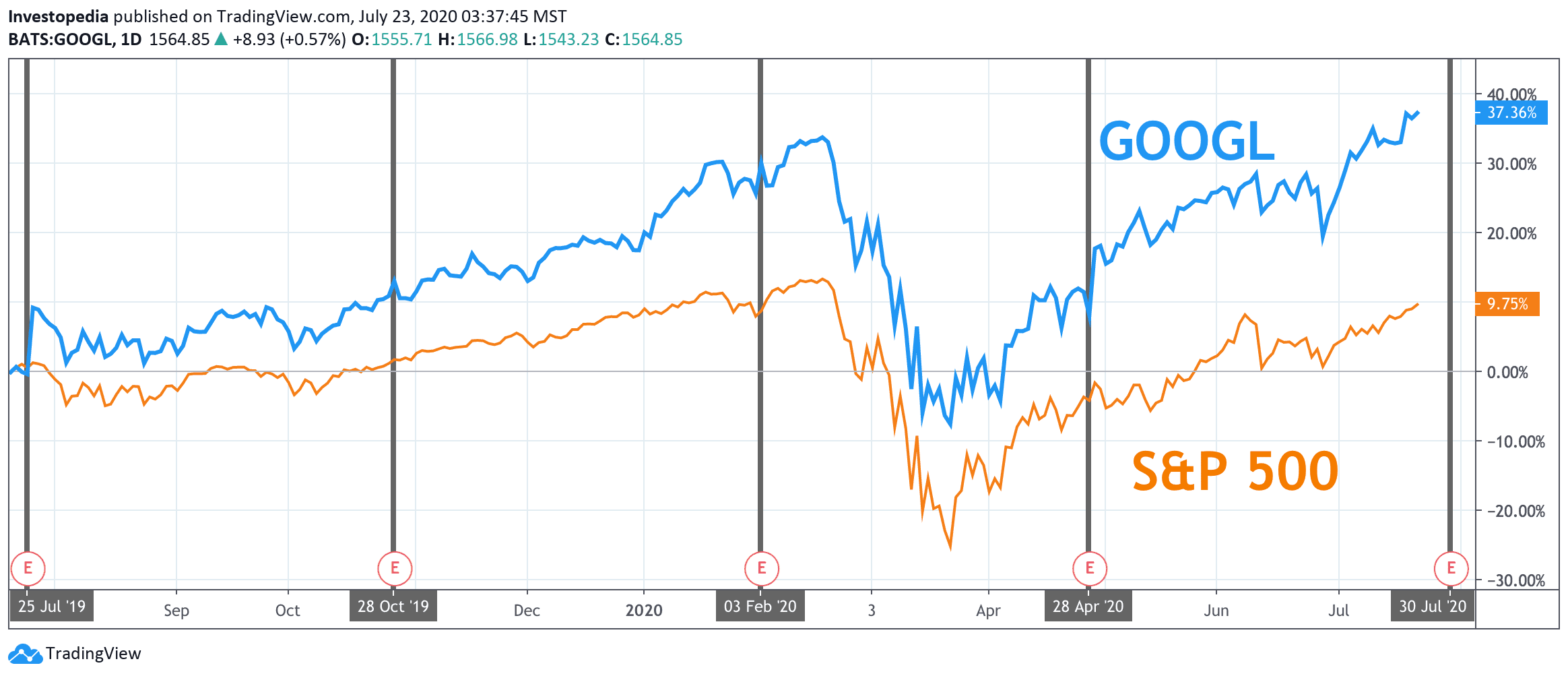

Alphabet has outperformed during the last 12 months, posting a total return of 37.4% compared to the S&P 500 index total return of 9.8%.

Source: TradingView.

In Q1 of FISCAL year 2020, the adjusted EPS came in short of analysts ‘ expectations, but the strong EPS and revenue growth has still sent Alphabet stock breaks out in the following months. Adjusted EPS increased 21.7% on a 12.8% increase in turnover. Alphabet of adjusted EPS has generally been volatile, showing large fluctuations in performance and the decrease in two of the last five quarters since the 1st quarter of FISCAL year 2019. Now, for the 2nd quarter of the FISCAL year 2020, investors predict EPS to fall by 34.9% year-on-year.

On the other hand, the Alphabet of revenues stable year-on-year increases every quarter for nearly four years. In the course of the last T2 periods, this increase went from 19.3% year-on-year in Q2 of FISCAL year 2019 to 25.6% in Q2 of FISCAL year 2018. Even with the initial impact of the COVID-19 pandemic, the company has seen the year-over-year quarterly revenue increase of 12.8% in Q1 of FISCAL 2020. For the 2nd quarter of the FISCAL year 2020, the analysts expect revenues to a fall of 4.2% to $ 37.3 billion.

Alphabet Key Indicators

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

Adjusted Earnings Per Share ($)

11.23

17.25

11.75

Revenue ($B)

37.3

38.9

32.7

Year-on-year Growth in Traffic Acquisition Costs (%)

-8.2

12.7

26.1

Source: Visible Alpha

As mentioned, investors are also likely to focus on the Alphabet of traffic acquisition costs, one of the main expenses for the companies of the Internet. This measure reflects how much the company has to pay to affiliates in order to direct or attract traffic on their sites. TAC is an important measure of the cost of sales for the Alphabet, and the increase in these costs, the decline of the Alphabet of the margin once it has generated money by selling ads for the viewers, it has established. If TAC increases from year to year for a company, this can negatively affect profit margins in the long term. Alphabet, historically, has cited the increase in the TAC as one of the “Risk Factors” for investors to take into account.

Alphabet of the TAC usually has more than doubled, from $ 4.2 billion in Q3 of FISCAL 2016 to $ 8.5 billion in the 4th quarter of FISCAL year 2019. Now, the analysts believe that the cost of acquiring the traffic will be a decline of 8.2% yoy in the 2nd quarter of the FISCAL year 2020. This would be the first decrease in the TAC in the last 16 quarters. This may indicate that the company is paying less for its traffic at a time when the volume of traffic may in fact be on the rise. Given analysts ‘ bearish forecasts of declining revenues and profits, which could represent a bit of good news for the Alphabet during a difficult period.

Source: investopedia.com