Key Takeaways

- Analysts estimate adjusted net income of $ 2.4 billion, up from $ 3.2 billion in the 4th quarter of 2019.

- Annual Active Consumers tons is expected to increase year-on-year.

- The impact of COVID-19 slash Alibaba’s revenue growth.

Alibaba Group Holdings Ltd. (BABA), the giant of the online sale platform often referred to as the Amazon.com China is bracing for the financial impact of the worst global economic crisis in recent history. The coronavirus pandemic, caused a major crisis in Alibaba’s main consumer markets, including China. Investors will focus on how these forces that influence the growth of Alibaba’s annual active consumers, a key measure, when the company publishes its results on May 22, 2020 Q4 2020 fiscal year (FY). The company’s fiscal year ended March 31, 2020. Analysts estimate the company’s adjusted net income plunge in the midst of a slowdown in growth of annual revenue and active consumers.

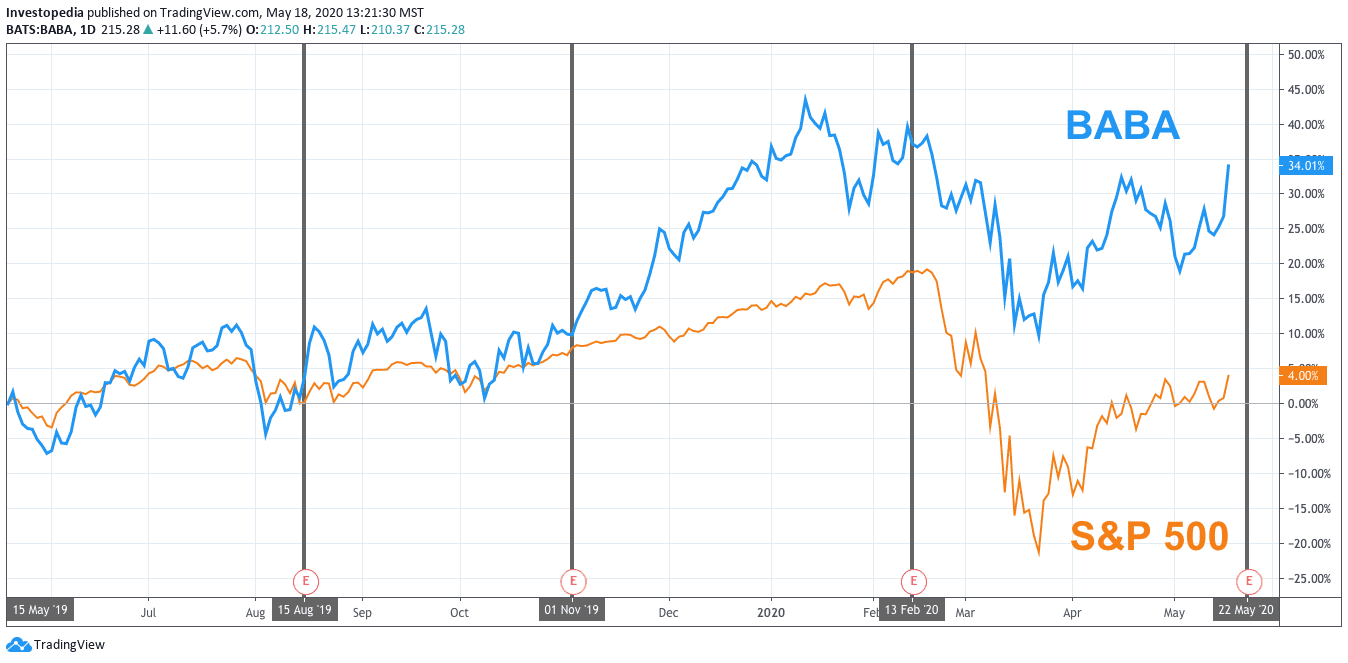

Despite crashing on the fear of the spread of COVID-19, Alibaba stock has rebounded and is currently higher than the market in general. The company’s shares have provided investors with a total return of 34.0% compared to the S&P 500 index total return of 4.0% during the last 12 months. For this story, of key to Alibaba’s financial data have been converted from Renminbi to UNITED states Dollars using an CNY/USD exchange rate of 0.140649 dated as of May 18, 2020.

Source: TradingView.

In the most recent quarter reported, Alibaba posted an adjusted net income growth of 51.9% for the Q3 of FISCAL 2020, compared to the same quarter a year ago. It was the second highest of the year-on-year (yoy) growth rate in nine quarters. However, revenues increased by only 37.7%, continuing a decelerating trend that started two quarters earlier, and which marked the lowest year-on-year revenue growth of at least 15 quarters. Alibaba shares fell slightly following the report before crashing on the fear, on the spread of the coronavirus.

If the stock market has rebounded, analysts expect one of its worst quarters in years. The net profit adjusted according to the autumn forecast of 23.2% year-on-year, marking the first decline in at least 16 quarters. Revenue growth is expected to slow to 14.3% year-on-year, well less than half the growth rate posted in the 3rd quarter of the FISCAL year 2020. With the exception of a few quick V-shaped recovery of the global economy, the shares of the company are likely to be under pressure for the rest of the year.

Alibaba Key Measures

The estimate for the Q4 2020 (AF)

Actual for Q4 2019 (AF)

Actual for Q4 2018 (AF)

The Adjusted Net Earnings ($B)

2.4

3.2

2.1

Revenue ($B)

15.0

13.2

8.7

Annual Consumer Assets (M)

723.4

654.0

552.0

Source: Visible Alpha

As mentioned above, the investors will also be focused on Alibaba’s annual active consumers. This key metric is the number of user accounts with one or more confirmed orders on Alibaba’s platforms in the course of the previous 12 months, regardless of whether or not the transaction has been settled. Retain and attract active consumers is important to Alibaba’s business model, which in large part consists of the sale of marketing services for merchants who sell their goods on the company’s online platforms. The more active consumers Alibaba attracts, the more the company is able to generate advertising revenues from merchants.

Alibaba reported a total of $ 711 million annual active users for Q3 of FISCAL year 2020, marking an increase of 11.8% compared to the same quarter a year earlier. It was the lowest growth rate the company has posted since the 2nd quarter of the FISCAL year 2018 and is a continuation of the deceleration trend that had begun in the 4th quarter of FISCAL year 2019. This slowing trend is expected to continue with analysts forecasting a rise of 10.6% to 723.4 million annual active consumers for the Q4 of FISCAL 2020. T4 covers only a part of the period when the pandemic has started to hurt the global economy. Alibaba is facing a major challenge in the culture the ranks of its active consumers in the coming year in the midst of job losses and lower incomes in China and other markets.

Source: investopedia.com