Key Takeaways

- Analysts estimate that the adjusted EPS of 1.66 yuan against 1.57 yuan in Q1 2020

- Annual consumer assets, is expected to increase year-on-year.

- Revenue growth is expected to accelerate from the previous quarter, the impact of COVID-19 in China starts to fade.

Alibaba Group Holdings Ltd. (BABA), the giant of the online retail company is often referred to as the Amazon.com of China, has significantly outperformed the overall market in 2020, in the middle of the COVID-19 in the event of a pandemic and the worst economic crisis in decades. Alibaba outlook has brightened as the spread of the coronavirus has slowed sharply in China, the company’s biggest market, by far.

Investors will be looking to see if Alibaba growth rebounded when the company publishes its results on August 20, 2020, for the 1st quarter of FISCAL year 2021. The enterprise of 2020 for the fiscal year ending March 31, 2020. Analysts expect year-over year (yoy) growth in adjusted earnings per share (EPS) and revenue to slow down dramatically compared to the same quarter a year earlier. But the good news may be that the analysts believe that the revenue growth will accelerate significantly compared to the previous quarter.

Investors will also be focused on Alibaba’s annual active consumers, a key measure indicating the number of people who make purchases on its platform. Analysts are forecasting annual average annual growth of consumer assets to be slightly lower than the previous two quarters, but significantly slower than for the same period a year ago.

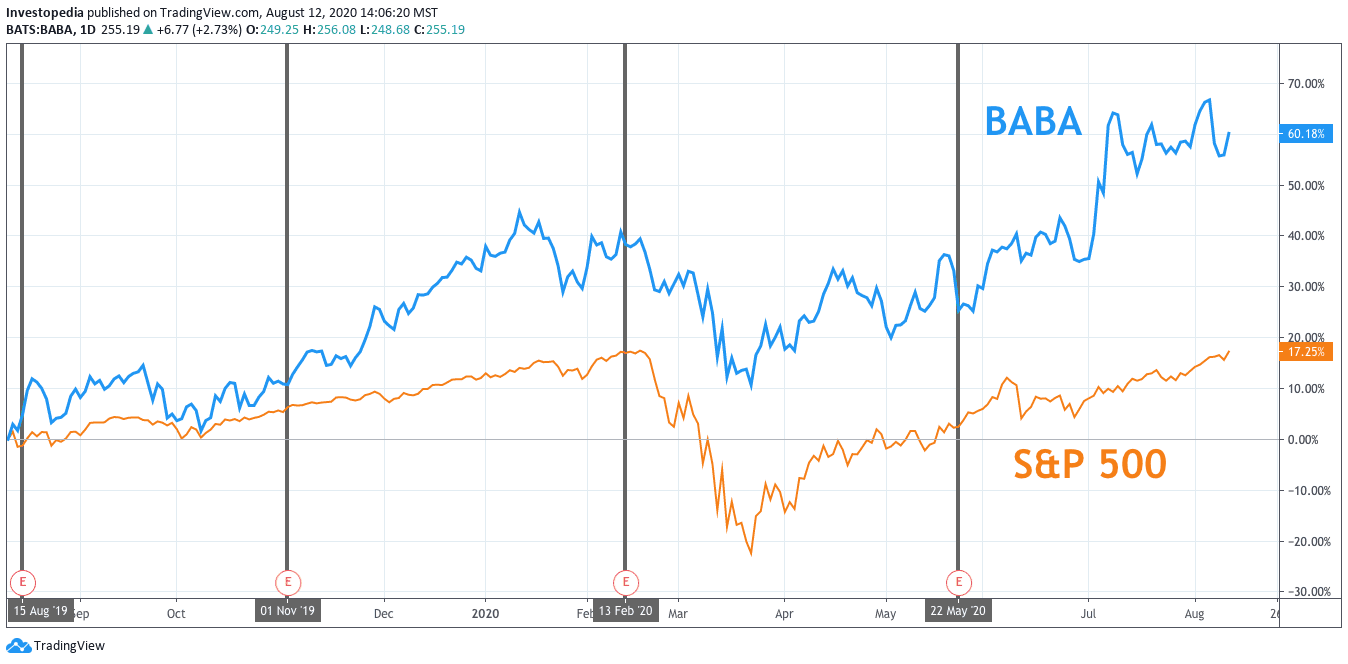

Shares of Alibaba have outperformed the broader U.S. stock market over the last year. While the stock was not immune to the coronavirus-induced market collapse that started at the end of February, it has since rebounded and reached new heights. Alibaba stock has provided investors with a total return of 60.2% over the last 12 months compared to the S&P 500 index total return of 17.3%.

Source: TradingView.

Alibaba shares initially slumped after reporting earnings that beat estimates for Q4 of FISCAL 2020, ending March 31, 2020. It was during the fourth quarter that the coronavirus was first begun to spread rapidly. The adjusted EPS has increased by 7.4%, a dramatic slowdown from the previous four quarters where the year-on-year growth ranged from 36% to 56%, and the slowest pace since the 1st quarter of FISCAL year 2019. Revenue grew 22.3%, the slowest pace since at least 16 quarters and the fourth consecutive quarter of declining year-over-year growth. But the stock quickly regained its upward momentum for the following week.

It was a stark contrast to Alibaba’s Q3 of FISCAL year 2020, a quarter are not yet affected by COVID-19. The adjusted EPS has increased at a robust pace of 49.0%. The growth in revenues, 37.7%, was also strong. However, the persistence of the slowdown trend that began in the 4th quarter of FISCAL year 2019. Regardless, the mounting fears about the spread of the virus has caused the company’s stock to crash along with the rest of the market at the end of February.

Analysts predict a resumption of growth for the Q1 of FISCAL year 2020, now that the worst of the pandemic in China may be more. They estimate that adjusted EPS will grow 5.6% for the quarter ended June 30, 2020. That would mark the slowest pace of growth since the 1st quarter of FISCAL year 2019. The turnover is expected to grow by 28.6% to 147.8 billion yuan ($21.3 billion), a net improvement compared to the previous quarter’s growth rate, but is still the second-slowest pace recorded in recent years.

Alibaba Key Measures

The estimate for the Q1 2021 (AF)

Actual for Q1 2020 (AF)

Real for the 1st quarter of 2019 (FY)

The adjusted EPS

1.66 yuan

1.57 yuan

1.01 yuan

Recipes

147.8 billion yuan

114.9 billion yuan

80.9 billion yuan

Annual Consumer Assets

745.6 million

674.0 million

576.0 million

Source: Visible Alpha; note that the adjusted EPS figures are based on the adjusted data for Alibaba is one-to-eight stock split approved by the shareholders in July 2020.

As previously mentioned, many investors will also focus closely on Alibaba’s annual active consumers. This key metric is the number of user accounts with one or more confirmed orders on Alibaba’s platforms in the course of the previous 12 months, regardless of whether or not the transaction has been settled. Retain and attract active consumers is important to Alibaba’s business model, which in large part consists of the sale of marketing services for merchants who sell their goods on the company’s online platforms. The more active consumers Alibaba attracts, the more the company is able to generate advertising revenues from merchants.

Alibaba reported a total of $ 726 million annual active consumers for the Q4 of FISCAL year 2020, marking an increase of 11.0% compared to the same quarter a year earlier. It was the lowest growth rate the company has posted since the 1st quarter of FISCAL year 2018 and is a continuation of the deceleration trend that had begun in the 4th quarter of FISCAL year 2019. Still, it beat the expectations of analysts and has been only slightly lower than the 11.8% increase recorded in the previous quarter. Alibaba created this growth, even if it was the first quarter that Alibaba has been affected by COVID-19. This trend of moderate growth should continue in the 1st quarter of FISCAL year 2021. Analysts estimate that, each year, active consumers will be on the rise 10.6% to 745.6 million.

Another challenge potentially facing Alibaba investors could be the delisting of the shares of the company from U.S. exchanges. The Advantage of the administration earlier this month proposed a plan that would force Chinese companies listed on U.S. stock exchanges to comply with U.S. financial audit requirements. The following proposal bipartisan legislation that has passed the UNITED states Senate in May, which would be non-compliant, Chinese companies three years to delist in the UNITED states Alibaba shares trade on several stock exchanges, including the New York stock Exchange (NYSE).

Source: investopedia.com