Takeaways

- Albemarle shares fell after Bank of America downgraded the stock due to expected weakness in the lithium market.

- BofA cut Albemarle to 'underperform'; from "neutral," and also reduced the price target from $212 to $161.

- Additionally, BofA reduced its Albemarle earnings forecast for next year and 2025.

The producer Lithium Albemarle (ALB) was the worst- On Wednesday, the high-performing S&P 500 stock fell 9.8% after Bank of America downgraded the stock and reduced its price target, arguing that the outlook for the metal used in batteries is “contested”.

BofA downgrades Albemarle to “underperform” from "neutral," warning that the lithium market will move from adequate supply to excess supply in 2024 and 2025. The bank also reduced the price target from $212 to $161.

Additionally, BofA lowered Albemarle's earnings forecast due to a change in the outlook for lithium prices, which are now expected to fall 20% to 50% between this year and 2025. Analysts say 39;s expect earnings before interest, taxes, depreciation and amortization (EBITDA). in 2024 to $1.816 billion, down from the previous estimate of $3.595 billion. They forecast EBITDA in 2025 to be $2.873 billion, up from $4.472 billion.

The bank added that With earnings declining and associated cash flow headwinds, he projects Albemarle will need to take on $2 billion in debt over the next two years to cover a capital spending funding gap. He noted that this would also lead to lower profits.

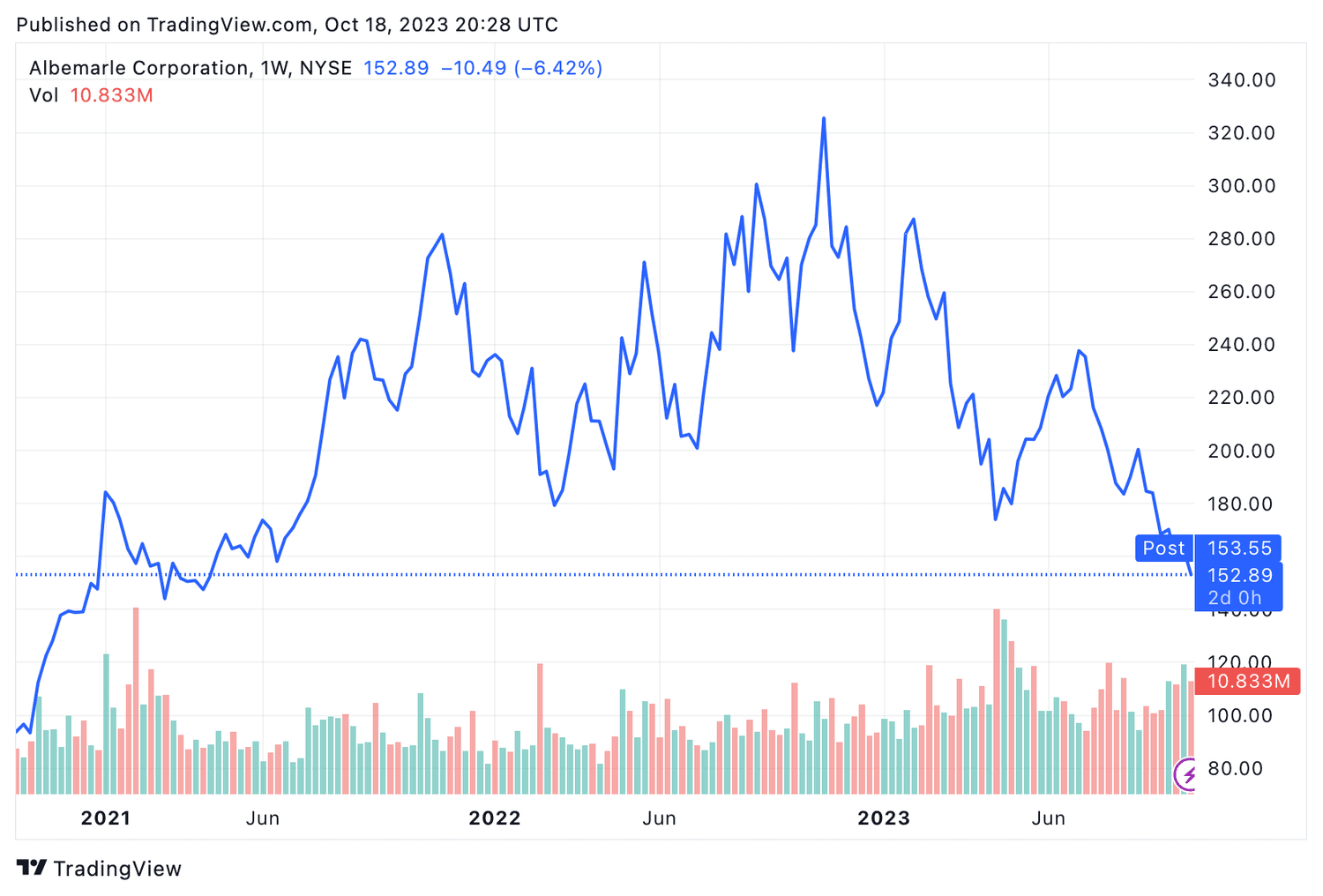

The actions of Albemarle plunged to their lowest level in two and a half years after the news.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com