Key takeaways

- Advanced Auto Parts reported earnings well below estimates.

- The auto parts retailer cut its full-year earnings and sales forecast.

- The company cut its quarterly dividend by more than 83%

Advance Auto Parts (AAP) was by far the worst performing stock in the S&P 500 in early trading on Wednesday after the auto parts retailer significantly missed its quarterly profit forecast, cut its outlook and cut its dividend.

The company first released fiscal 2023 quarterly earnings per share (EPS) of $0.72, well below analyst estimates of $2.57. Revenue rose 1.3% to $3.42 billion, also below forecast.

Advance Auto Parts attributed the disappointing numbers to higher than expected costs for professional sales, supply chain issues, inflationary pressures and an unfavorable product mix. CEO Tom Greco said that “although we expected the quarter to be difficult, results were below our expectations.”

He warned that the company sees “the competitive dynamics we faced in the first quarter continue, resulting in a miss in our expectations for 2023”.

Advance Auto Parts now anticipates full year EPS of $6-$6.50, well below its earlier guidance of $10.20-$11.20. It projects net sales of between $11.2 billion and $11.3 billion, down from its previous forecast of $11.4 billion to $11.6 billion.

The company also reduced its quarterly results dividend per share at $0.25 instead of $1.50. Greco called it a “difficult decision”.

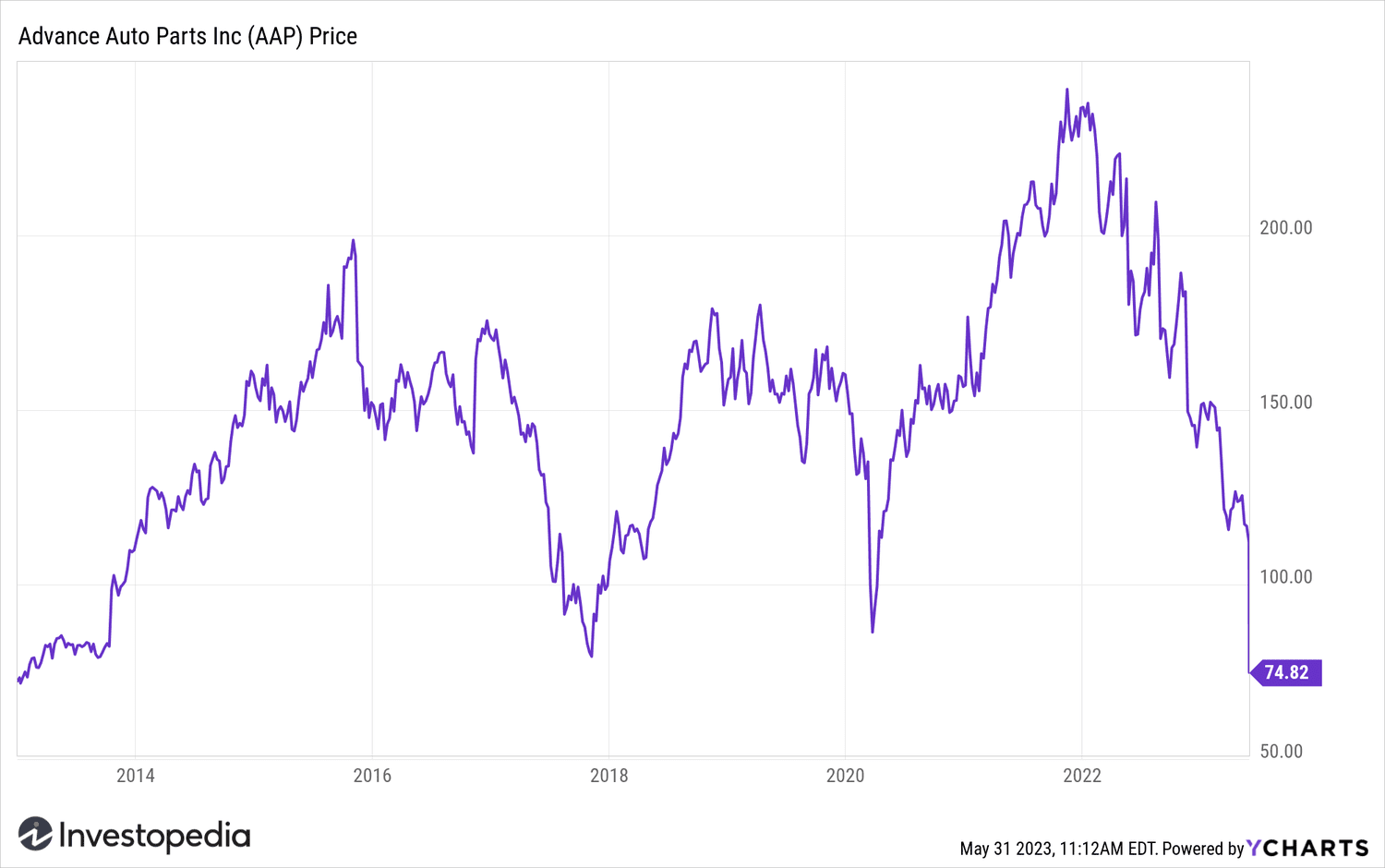

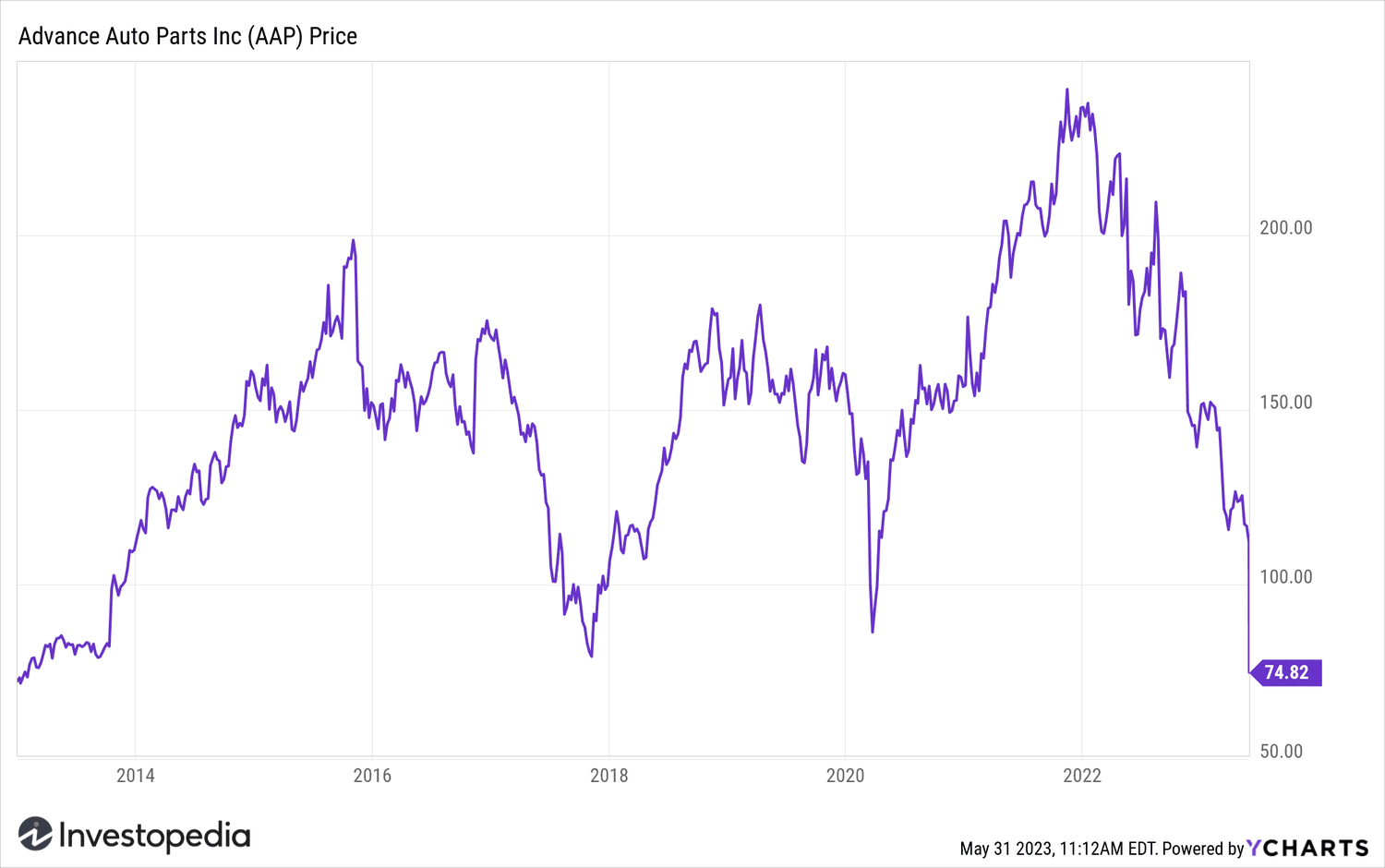

Advance Auto Parts were down 33% to their lowest level in more than a decade as of 11 a.m. ET Wednesday.

YCharts

Source: investopedia.com