Takeaways

- AbbVie is buying rival biotech company ImmunoGen for $10.1 billion, giving it access to ImmunoGen's flagship ovarian cancer treatment.

- The deal Prices ImmunoGen's shares at $31.26, nearly double its Wednesday closing price.

- ImmunoGen shares hit their highest level since 2000.

Shares of ImmunoGen (IMGN) soared more than 80% in early trading Thursday after AbbVie (ABBV) agreed to Buy the rival biotech company for $10.1 billion to expand its cancer drug portfolio.

The deal will see AbbVie pay $31.26 per share for ImmunoGen, a whopping 96% premium to yesterday's closing price. The transaction is expected to close in the middle of next year and AbbVie has indicated that it expects the transaction to be accretive to earnings per share (EPS) in 2027. p>

The acquisition gives AbbVie ImmunoGen's lead cancer drug, Elahere, an antibody-drug conjugate (ADC) to treat platinum. -resistant ovarian cancer (PROC). AbbVie noted that the move accelerates its commercial and clinical presence in the treatment of solid tumors. The agreement also provides access to ImmunoGen’s portfolio of next-generation ADCs.

The company explained that ovarian cancer is the leading cause of death from gynecologic cancers in the United States, and Elahere is the first targeted drug that increases survival rates for people with PROC.

CEO, Richard Gomez, said the merger has “the potential to transform the standard of care for people living with cancer”.

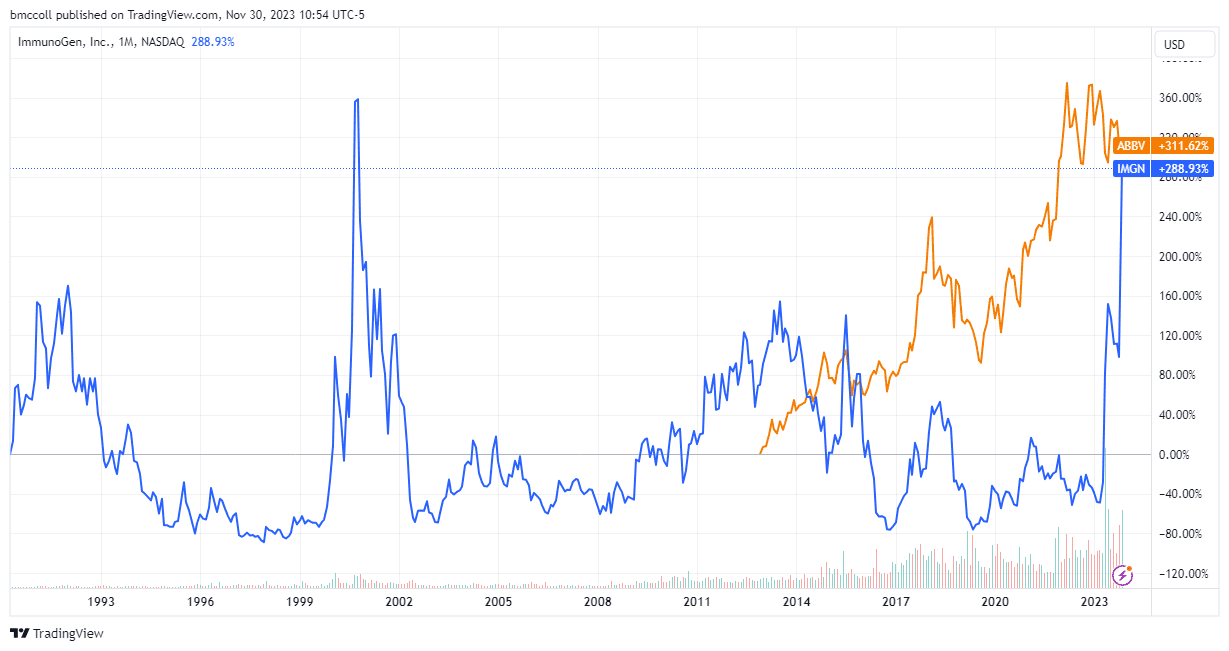

The news sent shares of ImmunoGen at their highest level in 23 years. AbbVie shares also rose.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com