A basket of under-the-radar tech stocks are reaching new highs in the second quarter, providing benefits to practitioners traders and investors. These less well-known issues do not have the press or the attention of the big tech household names, but many are best placed to succeed in the post-virus world that the companies that sell smartphones or digital advertising, because they offer services that have increased demand in recent months.

This leadership list of cuts across a number of tech sub-sectors, including telecommunications, internet, software, and peripherals. Stay-at-home, the commands are the basis of many of these gatherings, making us more dependent on digital communications, entertainment, and daily activities that include cyber-conference, document-sharing, virtual, and human resources management.

TradingView.com

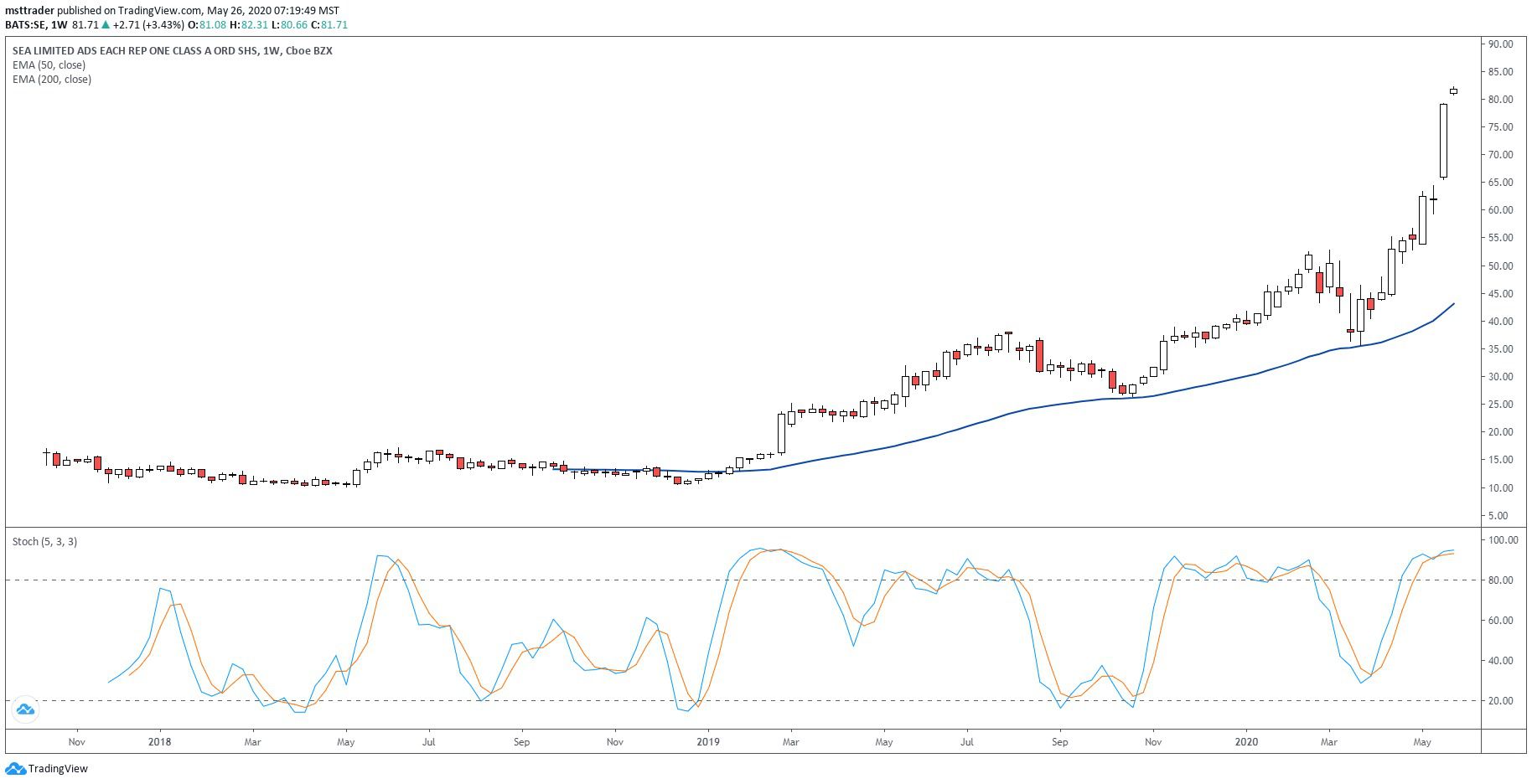

Based in singapore, the Sea Limited (SE) offers digital entertainment and e-commerce in South-east Asia. It came public on the U.S. stock market in October 2017 to $16.25 and entered a downward trend which has posted lower at $10.06 in May 2018. The subsequent increase of the impasse in the vicinity of the opening date high at $16.99, giving way to a decline that persisted through the rest of 2018. The buyers are back in force at the beginning of 2019, the lifting of the reserve through a series of new highs.

The stock has rebounded at the March 2020 top-down $50 in April and began on 5 May, the sculpture of a healthy upward trend, which has now added 23 points. The balance volume (OBV), the accumulation-distribution indicator has risen to a new high, contributing to the strong recovery. The sky is the limit for this problem as long as the Asian virus the recovery is continuing at a very fast pace, with a potential for the stock to post a rapid advance in the three figures.

TradingView.Com

Ciena Corporation (CIEN) to abandon its household name status after the internet bubble burst in 2000. The network hardware and software provider of hitting of all time to the reverse split-adjusted $1,057 in the fourth quarter of this year, and then crashed into a severe decline which bottomed out in the single digits, in March 2009. A slow moving recovery waves finally completed a 100% retracement in 2007 turnover in April 2020, triggering an immediate escape.

The rally is now approaching resistance at the 200 month exponential moving average (EMA), which is not likely to get mounted on the first attempt. As a result, a pullback to test new breakout support in the low to mid-$40 may be needed before a sustained bullish trend. A bounce at or around this price level could be rewarding, with a potential upside to $70, but tight stops a lot of sense, because a breakdown by the prosecution could define new sell signals.

TradingView.com

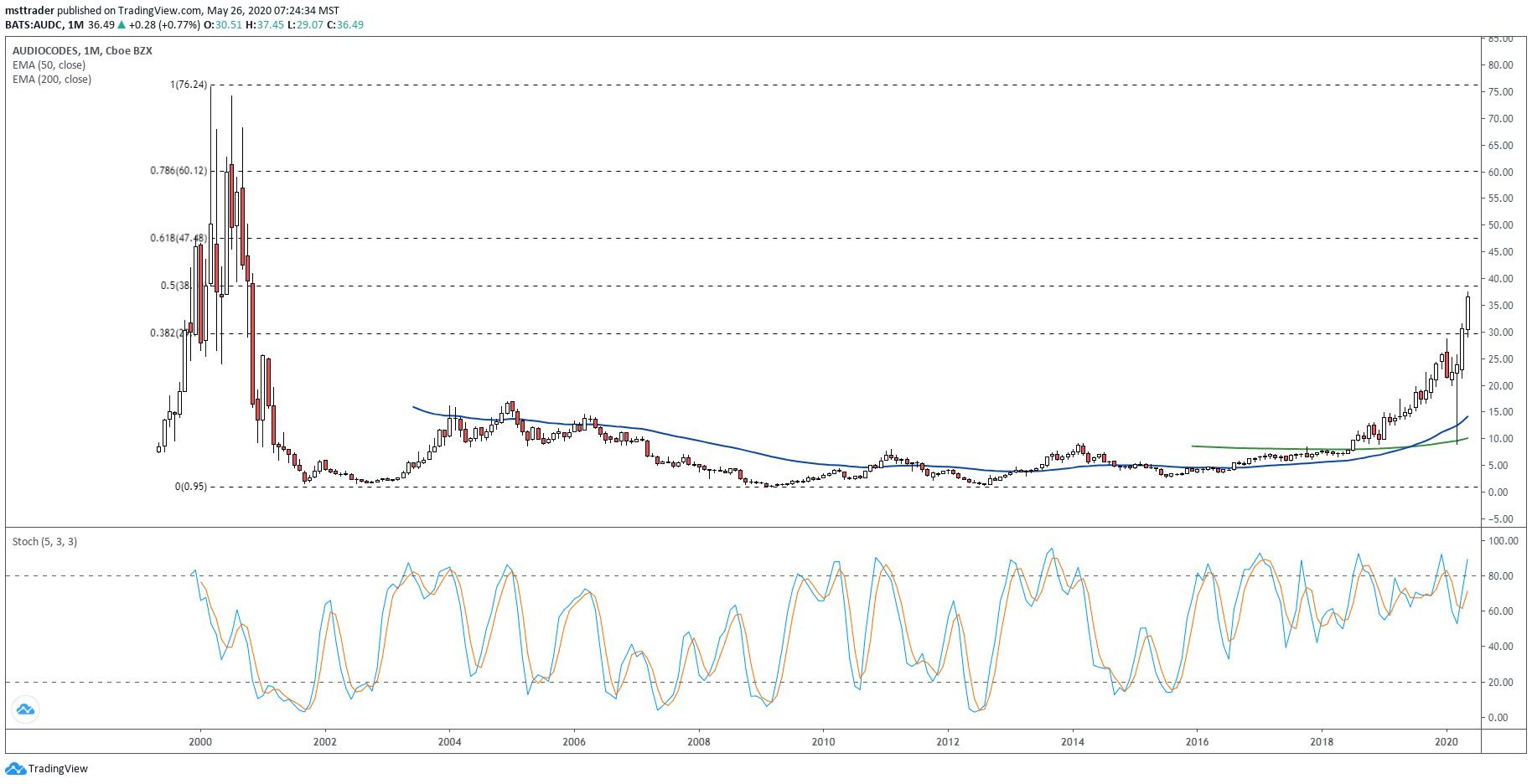

Israel-based AudioCodes Ltd. (UDCA) gives voice over internet protocol (VoIP) and data networking solutions. The stock opened on the U.S. stock markets in 1999 and reached a record high of $76.00 a year later. Then, it crashed through most of the decade, like Ciena, finally back down to 92 cents compared to 2009. The subsequent bounce back above $8.00 in 2011, while a 2014 breakout attempt has failed, and this gives the second lowest since the bear market low in 2015.

2018 breakout attracted steady interest from buyers, to reach the upper $20 in January 2020. A 14-month low in March is bought in an aggressive manner, which gives a bounce to the top, followed by a late April breakout. The stock has added about 10 percentage points since this time, and entered a rising channel, which bodes well for more upside. The rally is now approaching the .50 retracement of several years of decline, with strong chances that it would reach the .618 retracement level in the upper part of $40.

The Bottom Line

A modest number of mid-cap tech stocks are taking advantage of the pandemic and the transition to home working requirements, rallying above the strong resistance levels of multi-year and all of the vertices.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com