Hello. Below are a few recommendations for trading in the Forex market on 5.02.2018

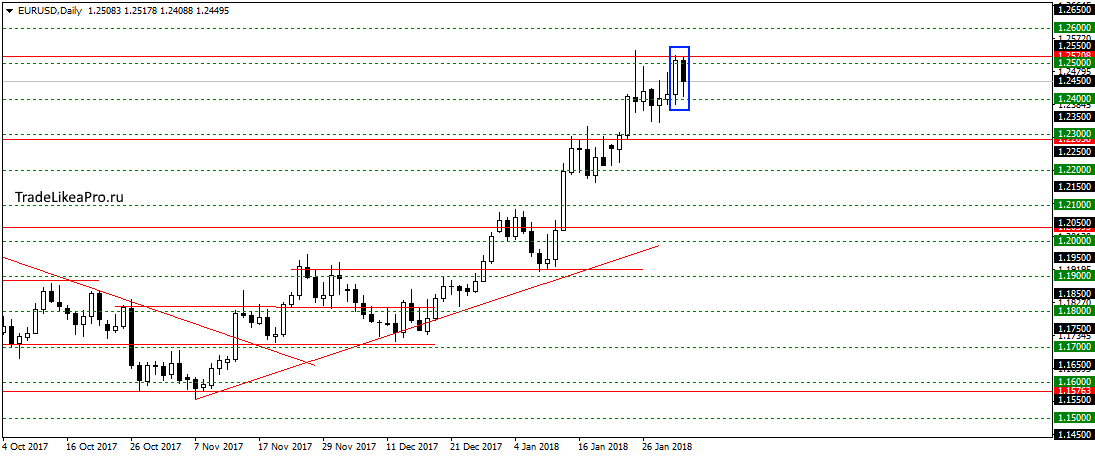

EURUSD

EURUSD formed a inside bar below the level of 1,25000. Probably forces to pass the level is not enough and should wait for a deeper correction. Sales here do not consider, as a trade against the trend.

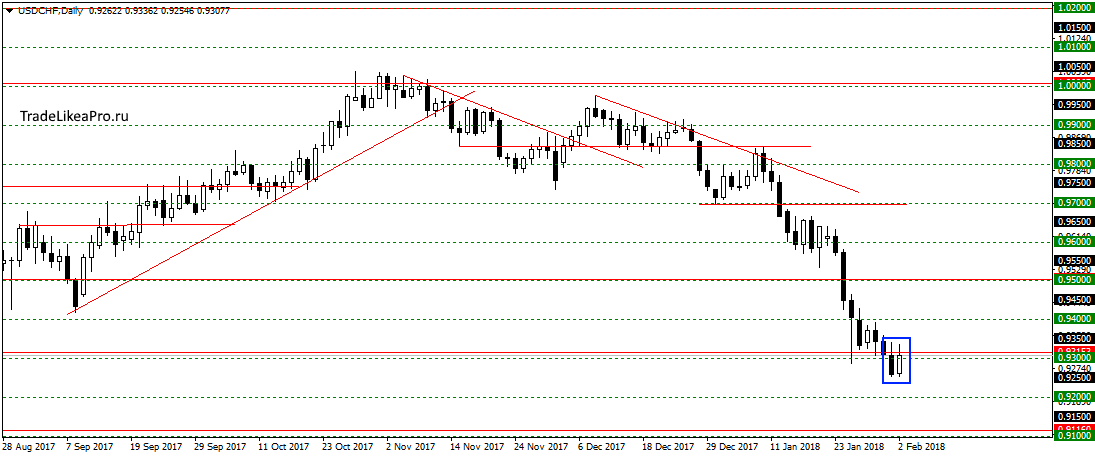

USDCHF

On the pair USDCHF formed a pattern of Rails in the area of level 0,93000. Perhaps the breakout was false and we go to the upside correction. Or bullish candle is just a small correction before it continues to fall. The pattern is bullish, but buying against the trend here.

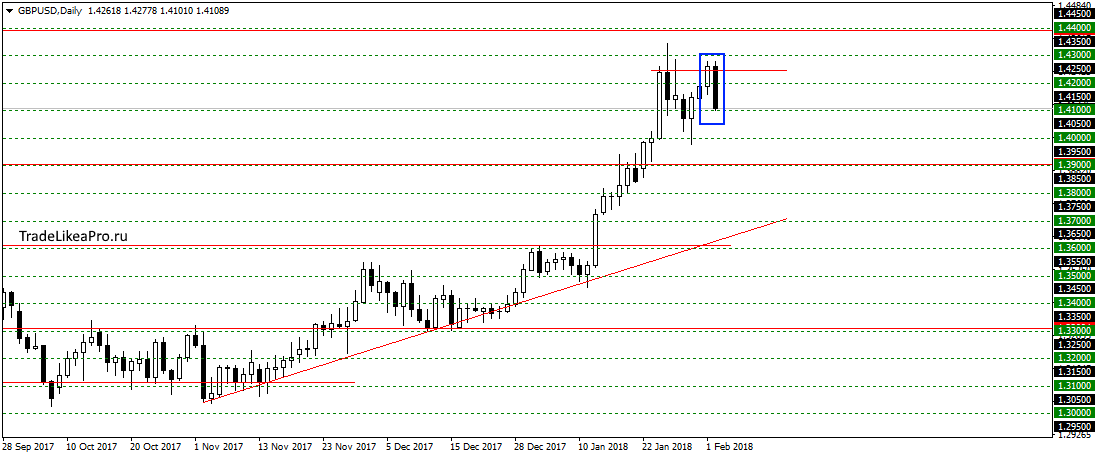

GBPUSD

On GBPUSD formed a pattern of Absorption in the area 1,42500. Also formed Double top. Probably will go into a deep downward correction, because forces to continue the trend is not enough.

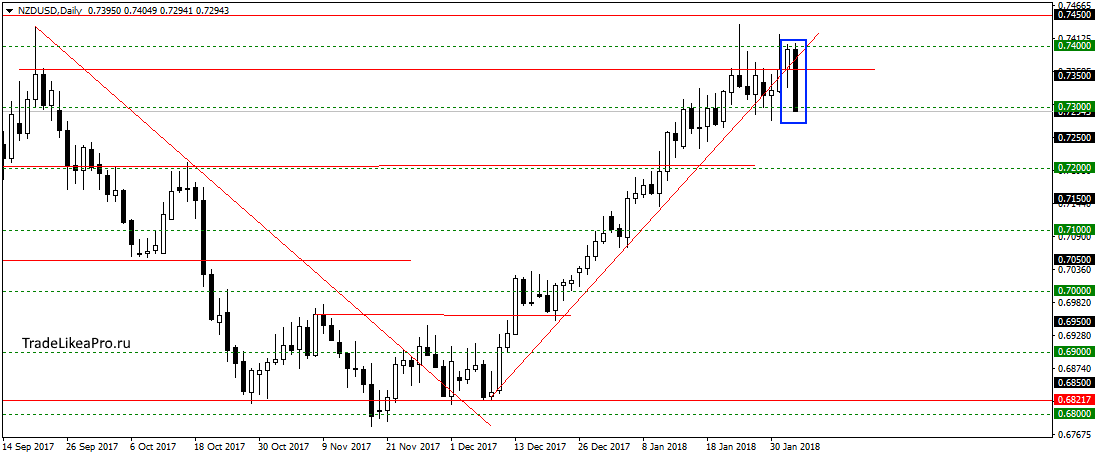

NZDUSD

On a pair NZDUSD also the pattern of Absorption in the area 0,74000. Price has broken trend line and likely will deploy the current trend for the downward. Lovers of aggressive trading can catch the sale peak, I’ll wait for confirmation of reversal for sales.

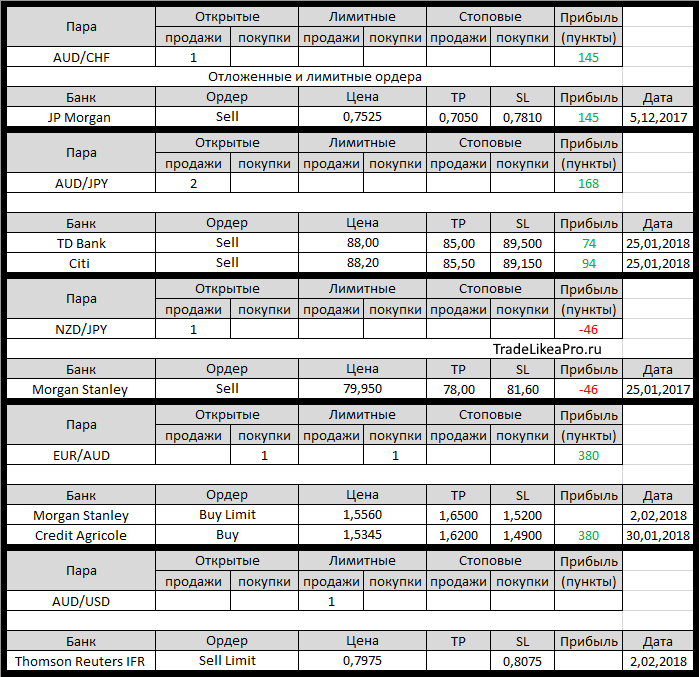

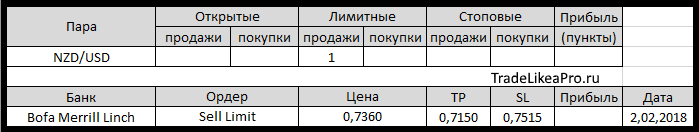

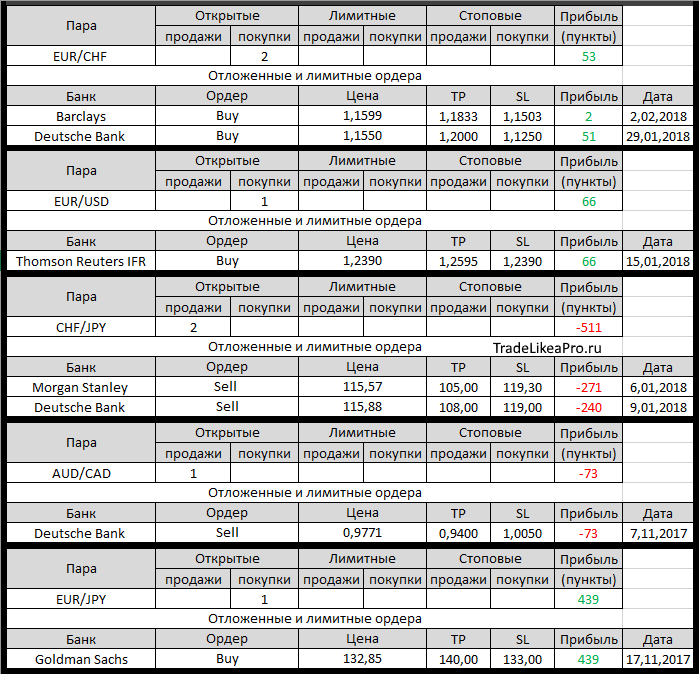

Open orders big banks

Changes in 2.02.2018

- Morgan Stanley placed a Buy Limit on EUR/AUD with 1,5560, TR – of 1.6500,

SL – 1.5200 - Thomson Reuters IFR changed SL with 1,2285 on 1,2390 in buying EUR/USD

- Barclays has opened a Buy EUR/CHF with 1,1599, TR – 1,1833, SL – 1.1503

- Thomson Reuters IFR otstupite in selling USD/JPY with 109,49 for 110,05. Loss-56пп

- UOB otstupite in selling USD/JPY with 109,30 for 110,30.

Loss-100пп - Thomson Reuters IFR otstupite buying on GBP/USD with 1,4220 for 1,4130. Loss-90пп

- Bofa Merrill Lynch placed a Sell Limit on 0,7360, TR – 0,7150,

SL 0.7515 - Thomson Reuters IFR has placed a Sell Limit on AUD/USD with 0,7975,

SL – 0.8075 - Thomson Reuters IFR otstupite in selling EUR/GBP with 0,8755 on 0,8820. Loss-65пп