Hello. The market stopped a little and let’s see what interesting for trading on 17.01.2018

Calendar of anticipated events

13:00 Europe. The consumer price index

18:00 Canada. Publication of the report of the Bank of Canada’s monetary policy

18:00 Canada. Interest rate decision

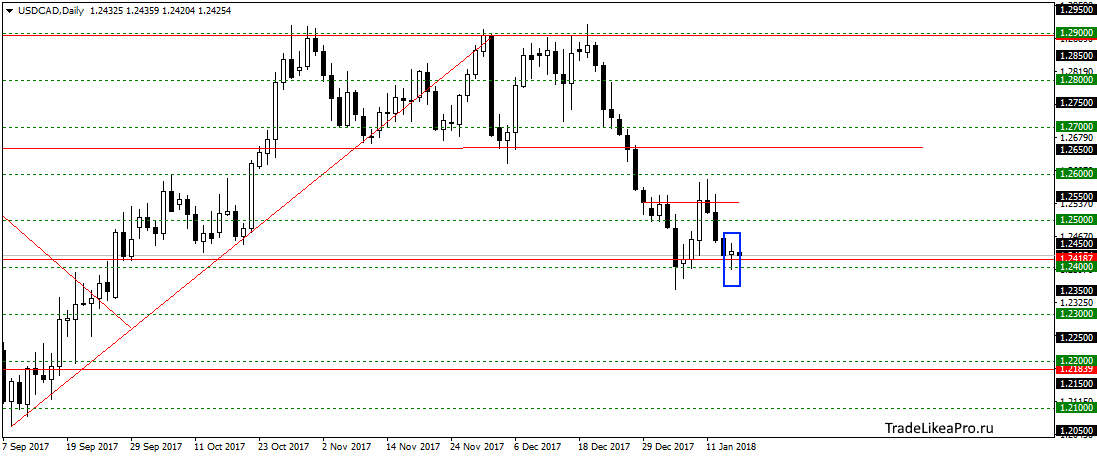

USDCAD

On a pair USDCAD formed a pattern Doji at the level 1,2400. it seems that the strength to go further down yet. Probably again start a correction, perhaps even to 1,26500. buy here do not consider, as they are against the trend.

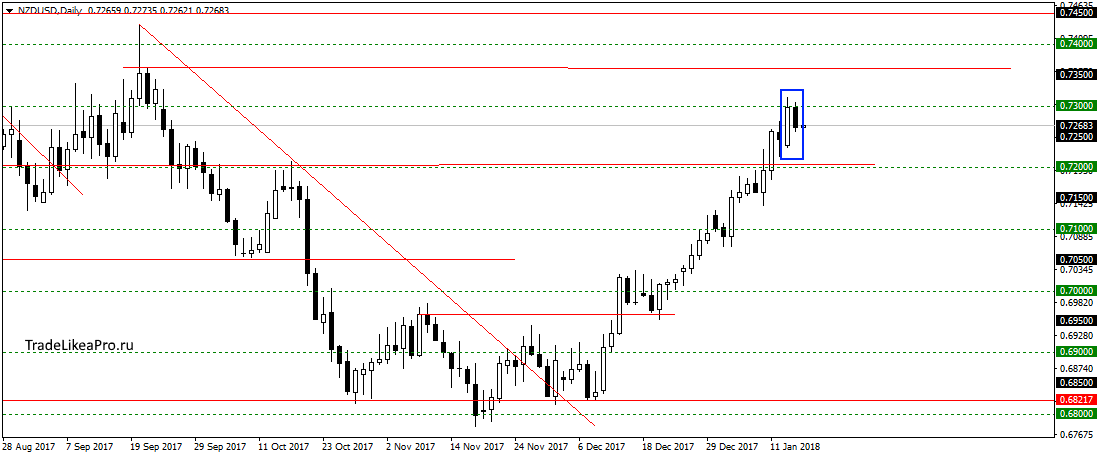

NZDUSD

On a pair NZDUSD formed the pattern inside bar. Support from pattern no. A correctional downward movement is likely within the day. To expect continuation of growth to 0,73500 and above. Purchase pattern here do not consider, as the nearest resistance is a small move in price.

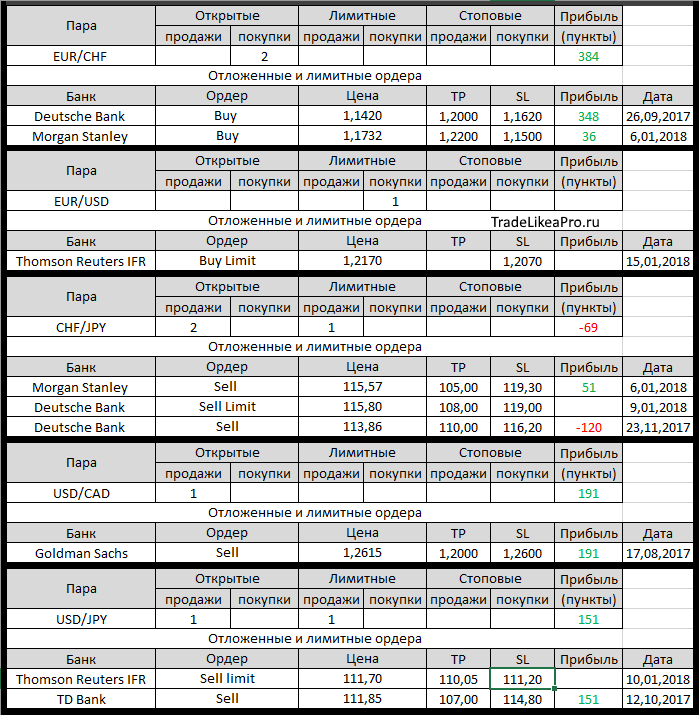

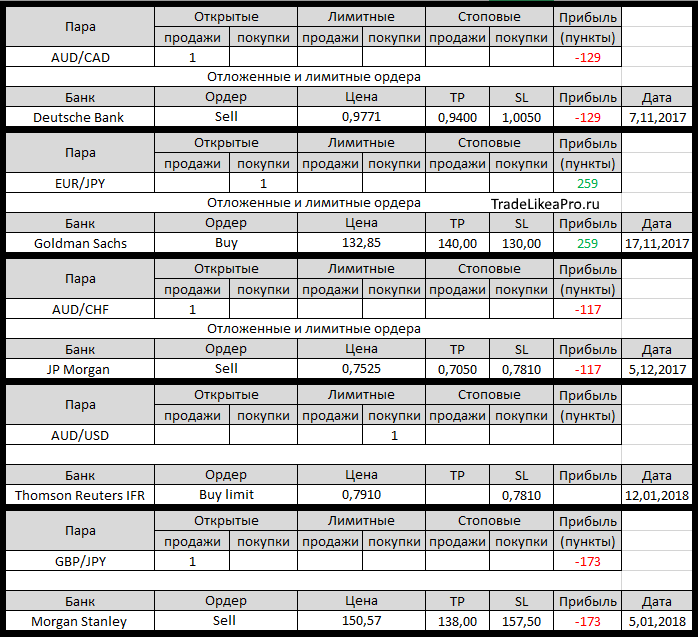

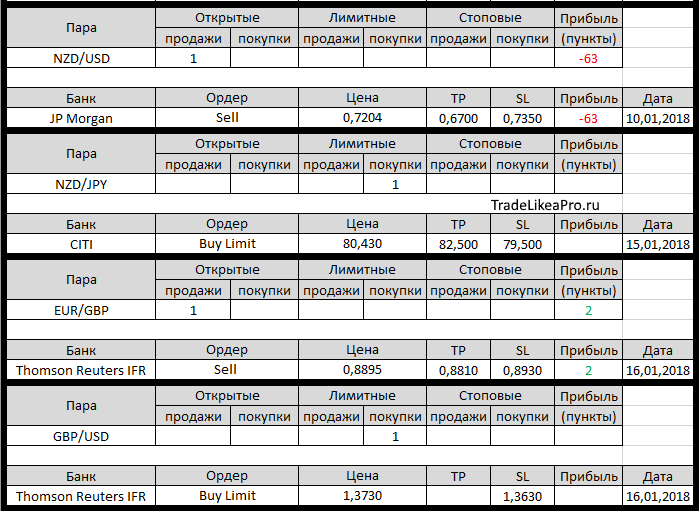

Open orders big banks

Changes in 16.01.2018

- Deutsche Bank changed with SL at 1,1520 1,1620 in buying EUR/CHF

- Thomson Reuters IFR placed Buy limit on GBP/USD with 1,3730,

SL – of 1.3630 - Citi worked Buy Limit on NZD/JPY with of 80.43

- Thomson Reuters IFR placed Sell limit on EUR/GBP with 0,8895,

SL 0.8995 - Thomson Reuters IFR triggered the Sell limit on EUR/GBP with 0,8895

- Morgan Stanley otstupite buying on USD/CAD with 1,2520 at 1,2400. Loss-120пп

- Thomson Reuters IFR has changed the Buy limit on AUD/USD/ Entrance on 0,7910 near 0.7885, SL 0,7785 on 0,7810

- Thomson Reuters IFR changed a Sell on EUR/GBP. Set TR at 0,8810.

SL 0,8995 on 0,8930 - Goldman Sachs changed with Sl at 1,2600 1,2500 in selling USD/CAD

Fundamental analysis

APR

USD fell to three-week low against its major counterparts today, losing scaling prospects of an early rebound, as the main competitor of the EUR strengthened after was thrown risks of failure of Angela Merkel in a “Grand coalition” among the German parties.

Central banks around the world are guided by bearish monetary policy in the medium term

The us dollar index DXY calculated against six major competitors in the currency markets, is still able to retreat from session lows on 90.113 to 90.446, and on Tuesday traded at 90.826 — and then began to fall on expectations that major Central banks will move to stimulate action to stabilize the monetary policies.

On the Bitcoin cryptocurrency markets fell by 7.2% to $10570,00 on Bitstamp, losing 16% on Tuesday, when BTC fell below 1-1/2-month low at 10162 USD because of the news that South Korea may ban cryptocurrency trading. And again going back to the dollar here, many market participants are convinced that global monetary policy is aimed at stimulating the normalization processes, which usually requires the weak dollar during the periods when such views prevail.

Europe

Problems in the German elections inclined towards the adoption of any of the possible coalitions, and formal coalition Merkel is not welcome, but prospects for re-election unlikely. Leftists insist on changing the composition of the coalition that was seen as moderately bullish for the Euro key.

Ms. Merkel is finally closer to realization of the project “Grand coalition” of Germany

But stock markets failed to please, failed to gain a foothold amid the current political uncertainty. The pan-European Stoxx 600 added 0.13% or 0.52 to 398.35, along with the increase of 0.35% or 45.82 points to 13246.33 for the German DAX, and nearly 0.01% increase of 4.13 points for the German CAC 40 in France.

EUR closed 0.05% higher at USD 1.2266, eliminating the drawdown session and to session highs at 1.2323, which is the strongest level since Dec 2014. Earlier Tuesday, the single currency weakened to 1.2195 after the news, after the members of the center-left social Democrats in one of the regions of Germany, voted against the negotiations with the conservative Christian Democrats Merkel. To date, however, the political prospects of the coalition look much more convincing and likely to be adopted in favor of Merkel.