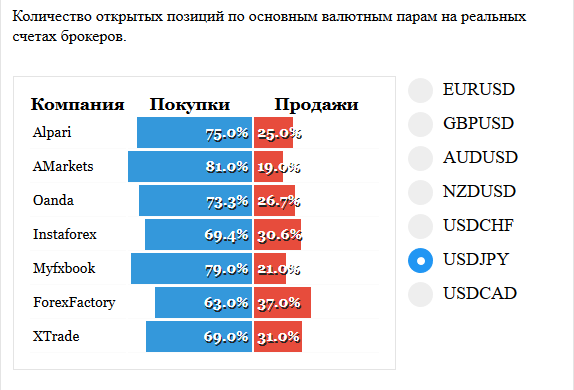

Hello. Below are a few recommendations for trading in the Forex market on 19.02.2018

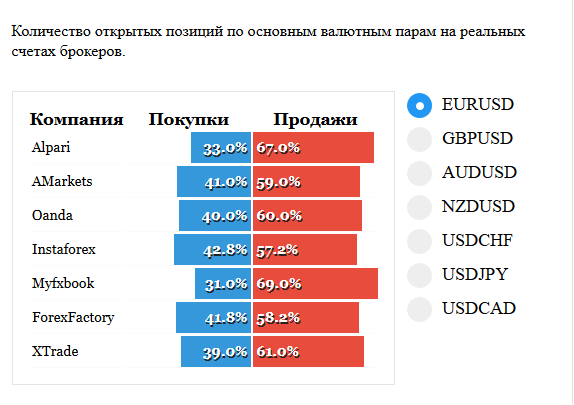

EURUSD

EURUSD currency pair rebounded from the level 1,2500 and formed the pattern of Absorption. The bulk of transactions already began to move into sales. Probably a little down in the correction. Shall find sellers and try it again, at their expense, to pass the resistance level of 1.2500 again. Sales do not see here.

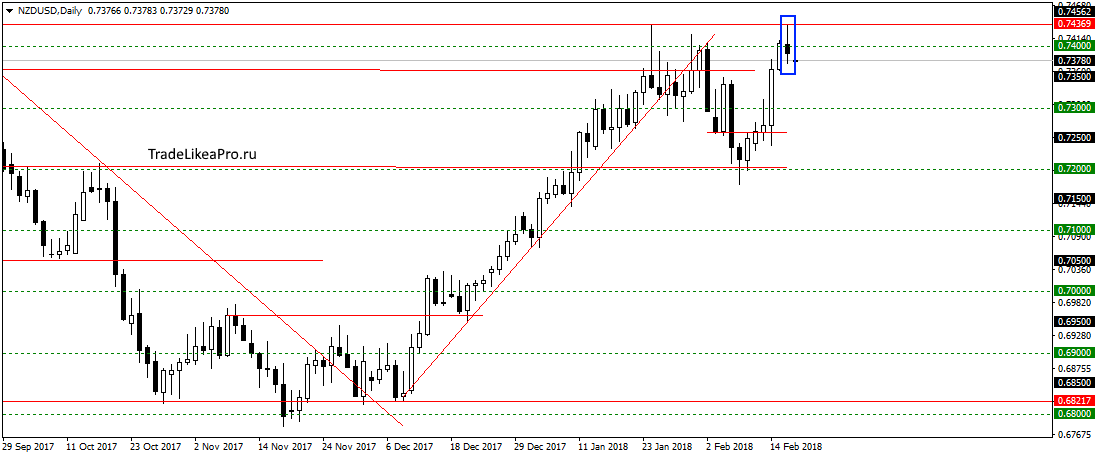

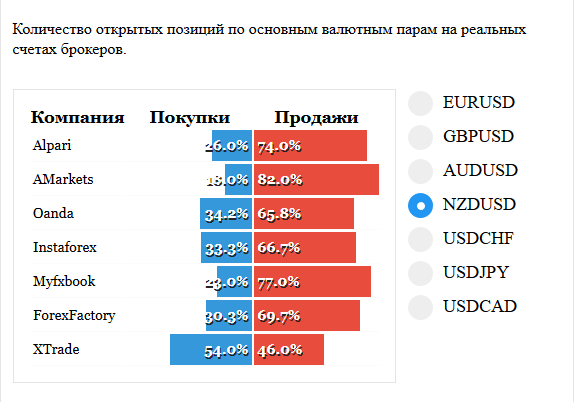

NZDUSD

On a pair NZDUSD update the highs failed and formed a pattern Doji at the level 0,74350. The preponderance of deals obviously on the side of sales. I from deals until the refrain. The uptrend is still not broken. Will probably continue to increase, then the trend is up.

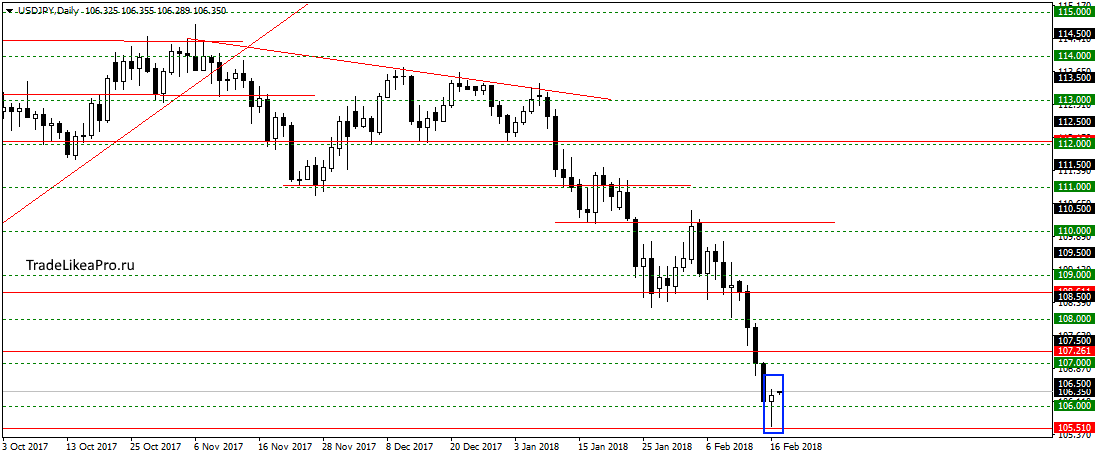

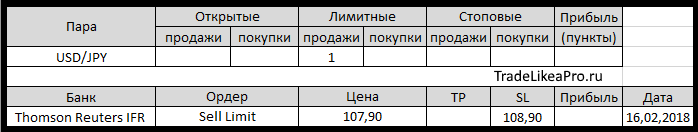

USDJPY

On USDJPY pair formed a pattern Pin-bar on a weak level 105,510. Think we’ll go a little bit up in the correction and then continue falling due to buyers. Buy here do not consider, as against the trend.

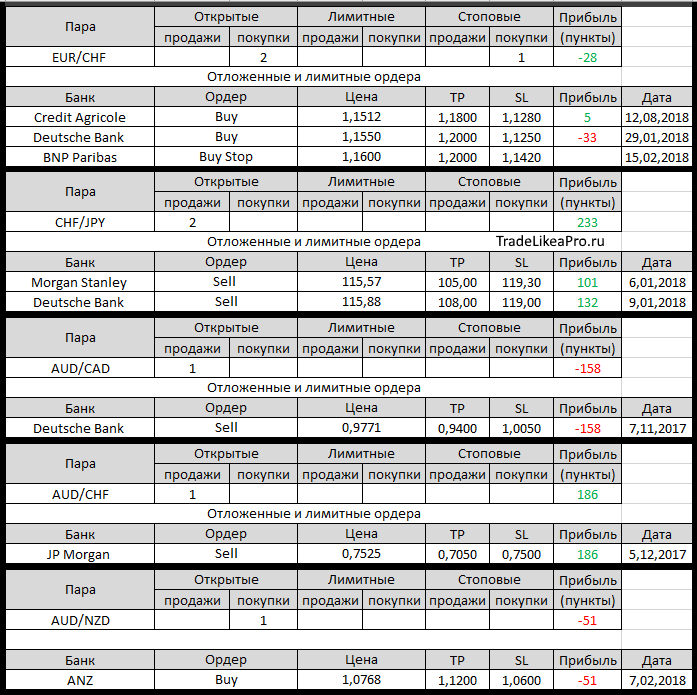

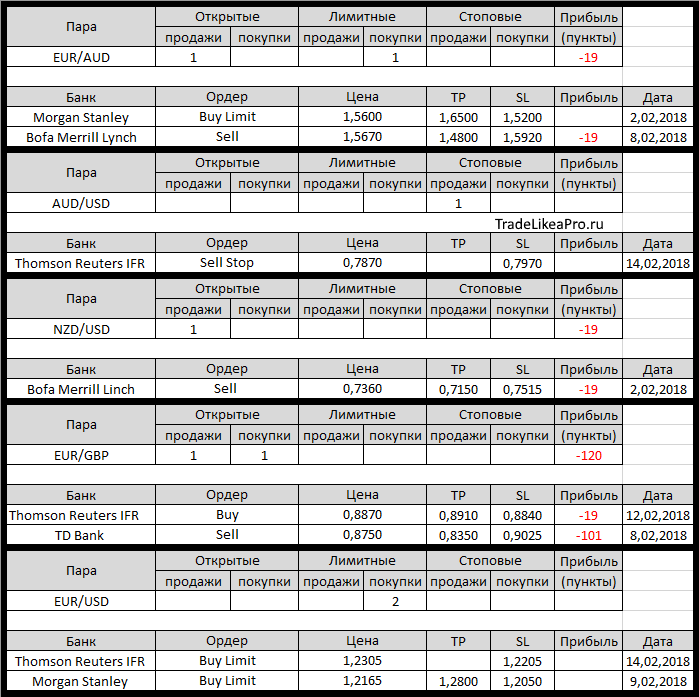

Open orders big banks

Changes in 16.02.2018

- Barclays has changed SL from 79.00 at 78,75-up in NZD/JPY

- Thomson Reuters IFR has placed a Sell Limit on USD/JPY with 107,90,

SL 108.90 - Thomson Reuters IFR has changed the Buy Limit on EUR/USD/ sign in with 1,2375 on 1,2305, SL 1,2275 on 1,2205

- Morgan Stanley closed the market to Buy EUR/CHF with 1,1507 for 1,1507. Breakeven 0пп

- Citi closed market Buy on EUR/AUD with 1,5667 for 1,5687.

Profit +20пп - Barclays has closed the market to Sell NZD/JPY with of 78.78 for 78,53.

Profit +25пп