Key Takeaways

- The canopy of the Growth expected to report adjusted earnings per share of $ 0.34 vs$0.71 in Q4 2019.

- Negative free Cash flow is expected to improve, despite the great.

- Revenue growth is expected to slow down in the middle of COVID-19 pandemic.

The canopy of Growth Corp (CGC) has seen its financial losses extend dramatically in recent years, it has sacrificed profits to grow in the burgeoning marijuana sector. These losses have pushed the Canadian company’s stock down sharply over the last year. Investors will be watching closely to see if the company is on the path to profitability when it reports fiscal Q4 2020 profits, on the 29th of May. Analysts are currently forecasting a mixed quarter. They expect the company to report the slowest revenue growth in 5 quarters, as losses narrow on an adjusted loss per share.

A key metric investors will be looking for is the Canopy of the Growth of the free cash flow (FCF) to measure if the growth is sustainable. For Q4, analysts expect the company to report large negative free cash flow, even if this will decrease compared to the previous year.

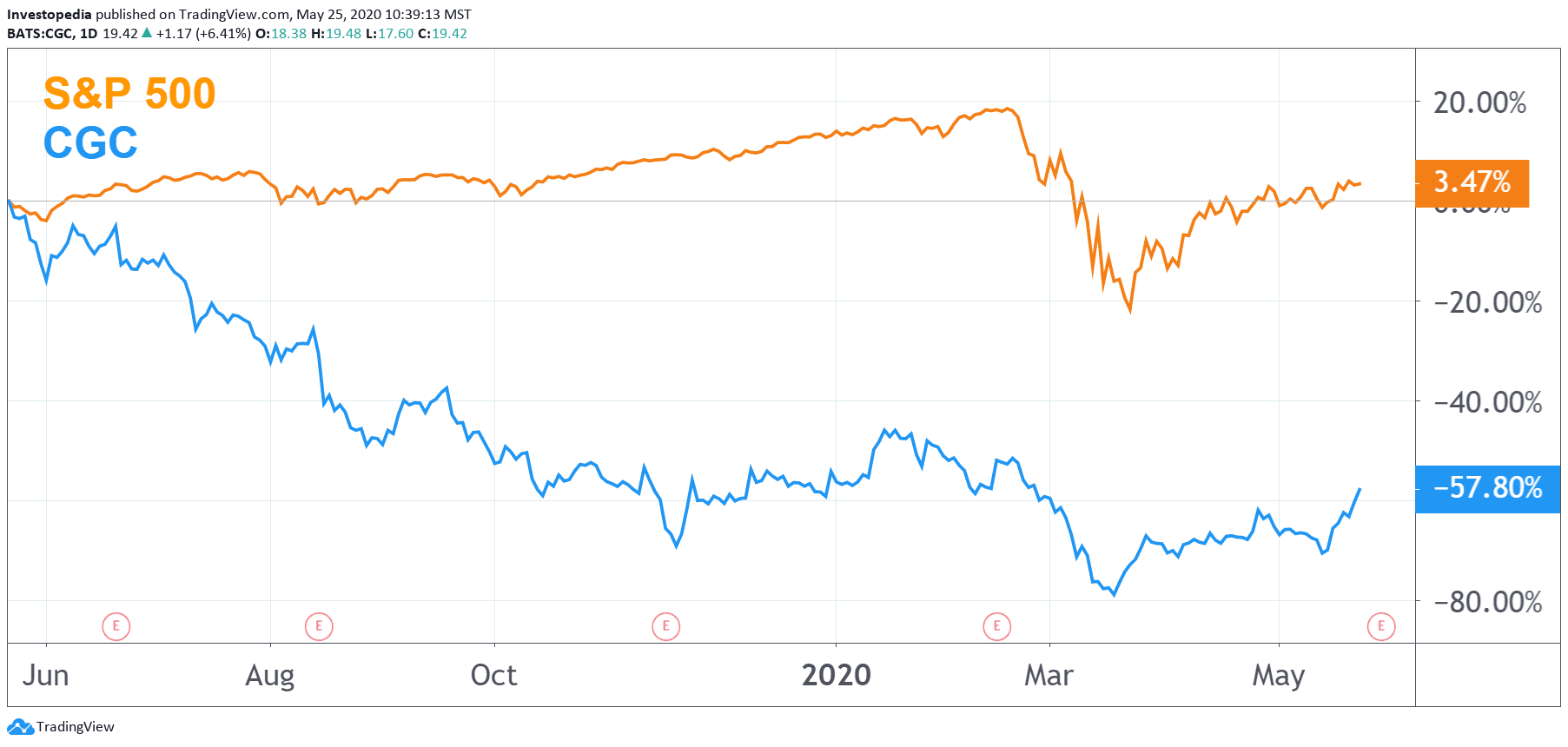

Due to these losses, the Canopy of the Growth of the stock has lagged the S&P 500 index by a significant margin, posting a total return of -57.8% compared with 3.5% for the index over the last 12 months, effective from 25 May.

Because the company reports its figures are in Canadian dollars (CAD), all dollar amounts referred to in this story have been converted to US dollars (USD) using the exchange rate of approximately .72 USD / CAD May 25, 2020. Also, please note that this article refers to a diluted earnings per share figures as “adjusted earnings per share.”

Source: TradingView.

Shares of the Awning of the growth have swung unpredictably in response to the financial results of the company. On the 14th of February, for example, Canopy Growth has recorded a profit for the Q3 of FISCAL 2020, which have been considerably better than expected. But in spite of that generally good news, the stocks have fallen by more than half by mid-March and since then, it has rebounded, to cover most of its losses.

Looking at Q4 2020 results, the analysts expect revenues of $92.4 million, about 36% higher than a year earlier. This corresponds to a dramatic slowdown in the 312% growth rate in the 4th quarter of FISCAL year 2019, which fell to 49% by Q3 of the YEAR 2020. The good news is that the Canopy of the Growth of losses on an adjusted earnings per share-basic-shrunk in Q2 and Q3 of the financial YEAR in 2020, compared to the same period a year earlier. And these losses are expected to shrink again, by nearly half in the 4th quarter of FISCAL 2020 year-on-year, potentially a good sign.

The Canopy Of The Growth Of Key Indicators

Estimate for the Fiscal Q4 2020

The actual expenditures for Fiscal year Q4 2019

The actual expenditures for Fiscal year Q4 2018

The Adjusted Earnings Per Share

-$0.34

-$0.71

$0.22

Recipes

$92.4 M

$ 67.8 M

16.4 M

Net Cash Flows

-164.4 M

-$269.6 M

-$91.5 M

As stated previously, a metric that is of particular concern to the Canopy of the Growth of analysts and investors is free cash flow. As a new and growing industry, cannabis businesses as the Canopy of the Growth must spend significant amounts of money on new equipment, facilities, and administrative expenses. Many analysts therefore see the CLF as a key factor to determine if the Canopy of the Growth will be in position for a long-term profitability.

The canopy Growth has been the difficulty of cash flow, management issues, reported a negative free cash flow of 15 consecutive quarters of growth, through Q3 of FISCAL 2020. In its most recent Q3, 2020 deposit, for example, Canopy Growth reported free cash flow of$258.9 Million, which was much larger than a year earlier in Q3 of FISCAL year 2019. This deterioration occurred in spite of the fact that it has received a significant influx of capital in 2018 when the beverage company Constellation brands Inc. (STZ) has invested 4 billion dollars in a marijuana company.

The canopy of the Growth in financial position, as measured by the free cash flow should also improve slightly in the 4th quarter of FISCAL 2020. The analysts believe that the negative free cash flow significantly narrow compared to a year earlier, but still, it should be – $ 164.4 M. This FCF number indicates the Canopy of the Growth has a long way to go to prove its model of sustainable development.

Source: investopedia.com