The last week has the oversold u.s. dollar tried rekylera up but so far without much success. The long downward trends are strong and the dollar therefore fell back again soon. With time, the risk is high for continued sharp weakening of the dollar. Relatively, the Swedish krona, the dollar has long-term important support levels at about 7,90-8.00.

Valutmarknaderna has the last week been affected by the turmoil of war between the united states and north Korea, which only enhanced but then slowed down considerably. For Sweden’s part, we have received both the strong GDP figures and high figures, which strengthened the Swedish krona. Even if the current rate of inflation were temporary factors that played a large role in the increase.

The euro has lost a little bit the last few days on the basis of the data, if no new policy messages coming from the ECB president, Mario Draghi at the Jackson Hole conference on August 25. But Wednesday night the publication of minutes from the Fed’s policykommitté the FOMC’s latest meeting, the us dollar again weakened.

The general view is also from the u.s. president and the government of the time would like to see a weakening of the u.s. dollar to strengthen the u.s. industry’s competitiveness.

Get Valutabrevet automatically to your e-mail every week!

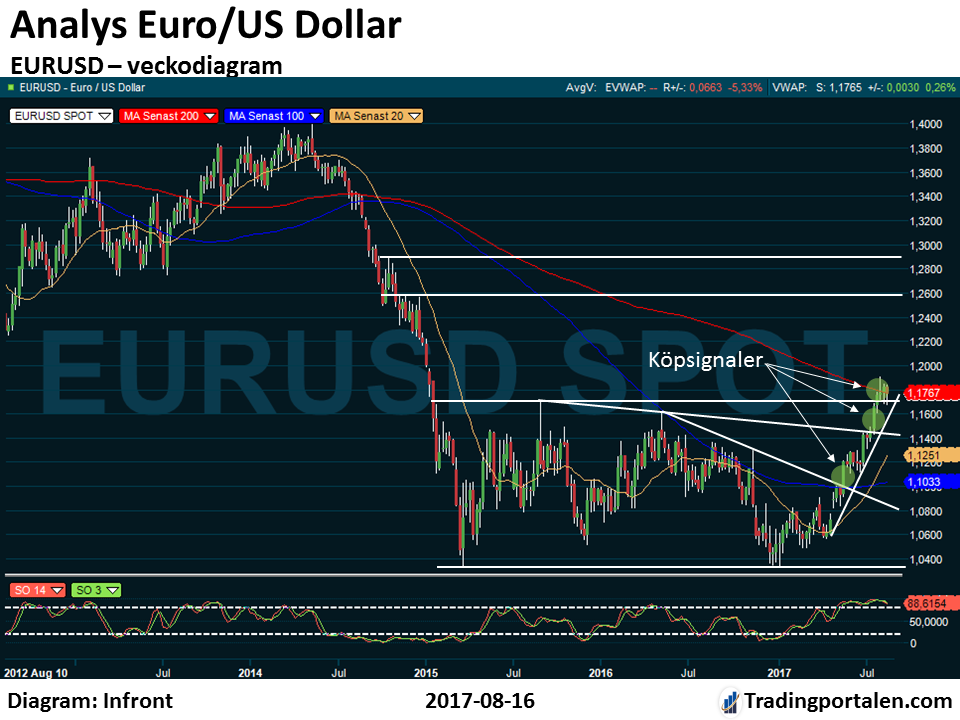

The long trend for the US dollar is also down against most other major currencies. In the weekly chart below we also see that the EUR/USD earlier in the year scored a number of buy signals (which then becomes the sell signal for the dollar) while the euro climbed the resistors at approximately 1,10, approx 1,14 and around 1.17.

The long-term sights are now set on gains to motståndsområdena at about 1,26-1,29. Important long-term support levels are now at around 1.17, and about 1,14.

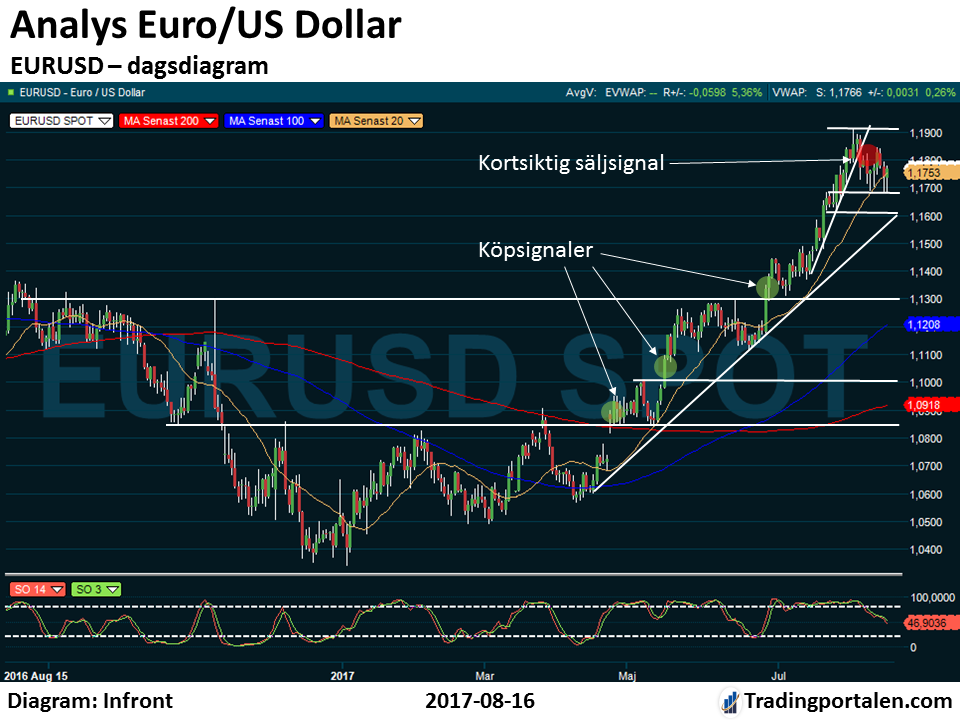

In the day chart we see the last days of profit-taking in the euro, which stopped at the support level just below around 1.17. New buy signals are obtained if the euro establishes itself above the resistance at about 1,19.

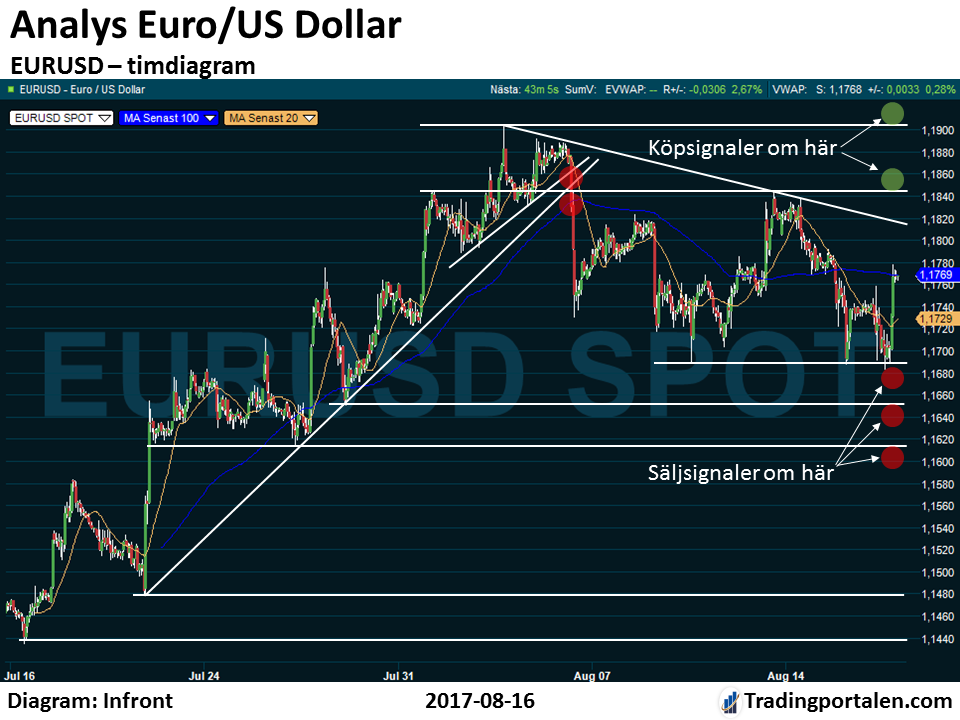

In timdiagrammet, we see more clearly the intensity that is above approximately 1,168. Establishing the euro during this aid may a short-term sell signal, and then we are aiming for the downs, primarily to the support at approximately 1,162. And in the other hand down to the supports at about 1,148 and approximately 1,144. But the long trend is upwards. So mainly we follow any buy signals across the resistors at about 1,184 and approximately 1,191.

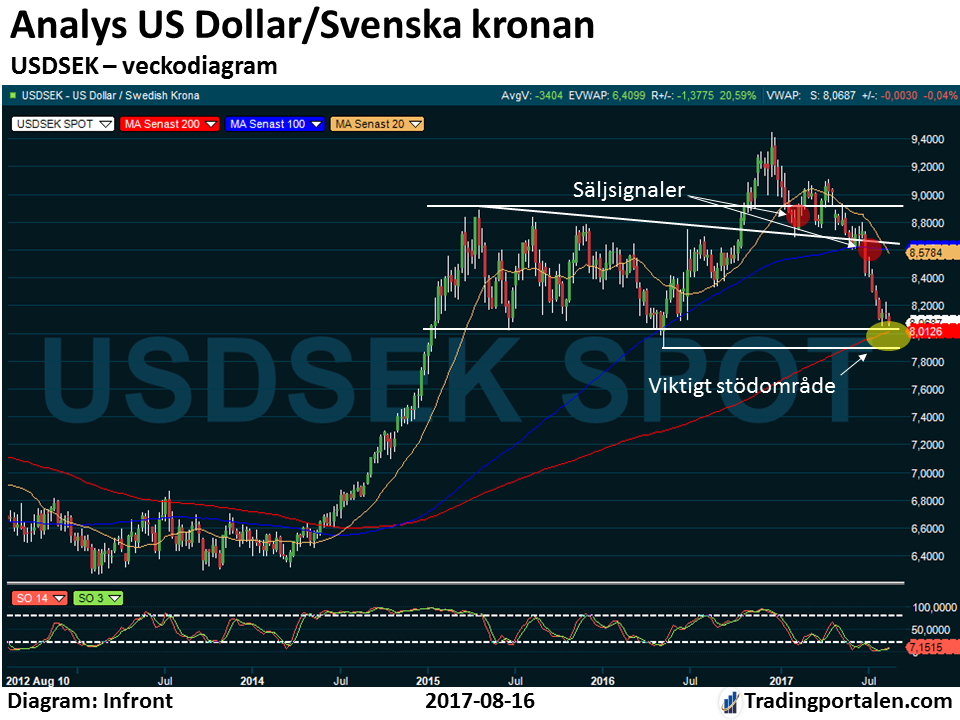

The Swedish krona vis-a-vis the u.s. dollar has had an irregular development in the last week. However, the long trend is clearly downward for the dollar relative to our Swedish pride.

Earlier in the year, the dollar strong sell signals when they aid at 8,90 and sek 8.60 in was broken. Now, the dollar has come down to the key support area at about 7,90-8,00 € Broken this level is obtained new strong sell signal for the dollar. Then there are the strong support levels at about 6,8-7,0 €

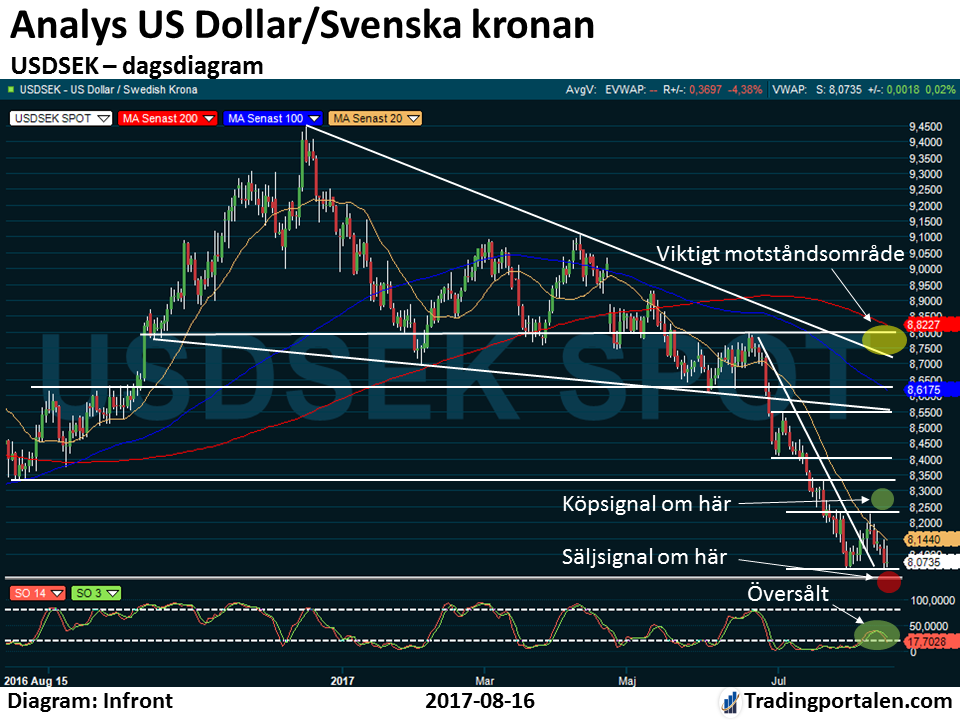

In the day chart we see the stochastic indicator to the dollar after the sharp downturn in recent months become really oversold. Therefore it was quite natural that now, when the dollar came down to strong support levels that it stops up a bit and also trying to learn some of the upward recoils. So far, however, the dollar only managed up to about 8,23 before it hit back to the time of writing, approximately 8,07.

Short-term buy signals is obtained, therefore, if the dollar would be able to go over of 8.23. In this case, we aim at temporary entrances to the resistors at about 8,34 and about 8,40. But with time, the risk of new strong sell signals in the support area at about 7,90-8,00 significant.

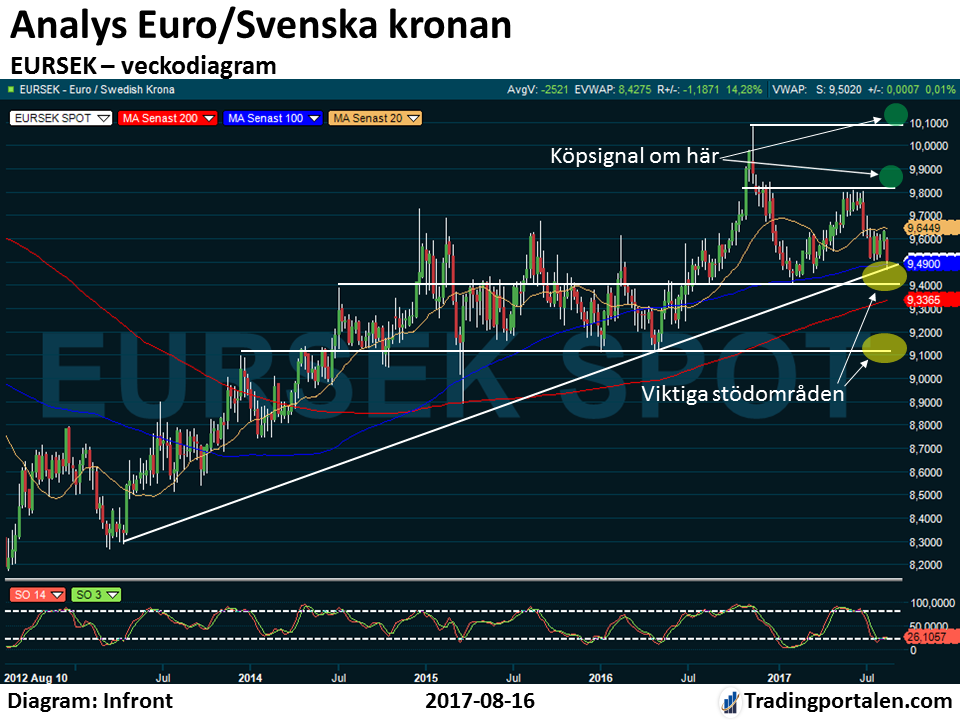

Against the euro , the Swedish krona strengthened somewhat in the last week. It is mainly the strong Swedish statistics that caused this movement. But compliance is, as usual, between the euro and the Swedish krona. So the movements are relatively small.

The euro, which at the time of writing is at 9,50€, has strong support levels at around 9,47, ca 9,40 and about 9,10 ce, Important resistance levels are located at about 9,80 and about 10,10.

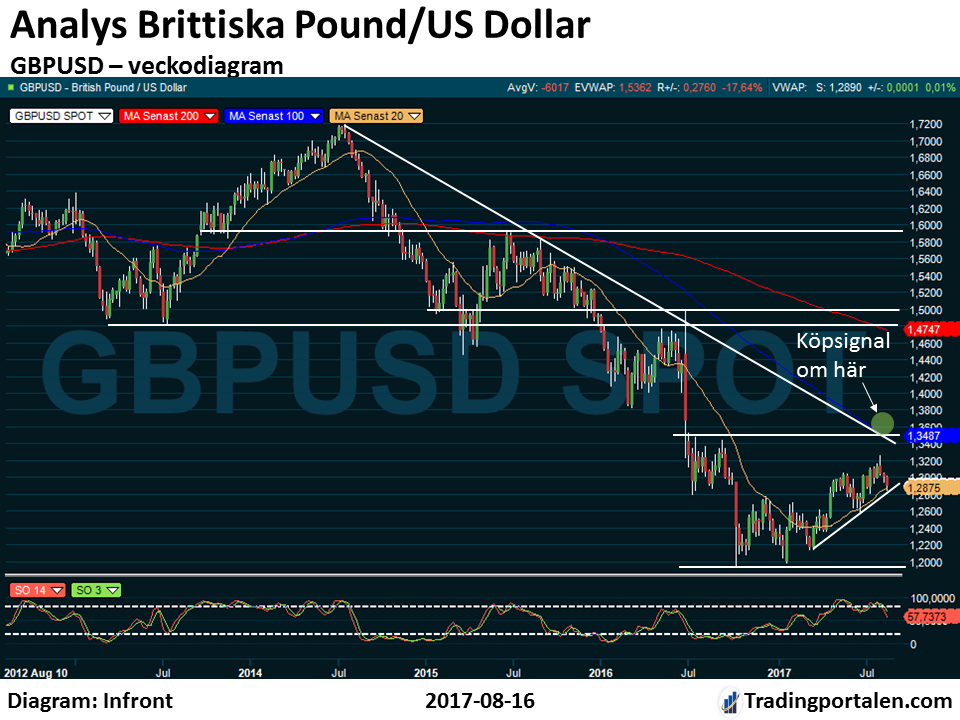

The old classic of the currency pair british pound and the u.s. dollar shows up an exciting diagrambild. The long trend is down for the pound. But it has in recent months started to build up a bottenformation.

Very interesting buy signals are obtained on the pound, which at the time of writing is at 1,29 dollars, manage to break above resistance and the downward trend line which is at about 1,35 dollars. Would instead the pound facing down, there are strong support levels at about 1,19 dollars.