I have tried to be clear that my rekar is in the long term, usually several years. Now, however, I left quite a lot of rekar and because the oldest is a few months old it may be time for a follow-up of them I wrote in the spring and summer. Not least because one of them, Catena Media has fallen since I wrote my analysis in June. I would like to take the opportunity to comment on the development of the CTM in a little more detail than the other rekarna. (All procentangivelser is counted from yesterday morning.)

Overall you can probably say that most of the rekarna gone my way so far. So, even the negative ones. I’ve only written two negative rekar and H&M and the Fingerprint Cards have done everything to confirm my warnings, especially the latter. H&M continues to stand and stomp without getting somewhere even if the share is not collapsed but is basically unchanged. The company has ominous again decreased in the amount of information to the market, and has clear negative organic growth (4 % total growth in spite of an increase of 10 % new stores), and falling margins and profits, which showed itself clearly in the Q3 report.

The nightmare FING continues to surprise the market in the wrong direction, not least with its new profit warning three weeks ago and the subsequent collapse in the share. I would not take the share with a pair of pliers and it is -33 % since my säljrek.

LVMH has developed very nicely with a very solid half-year report, with 27 % increase in profits against last year and the share has after a period of weakness then, I took the opportunity to raise once again approached the ATH. In the week com Q3:an out very nicely and the stock is +10 % since my cor and noted a new ATH, at 241 euros yesterday.

Similarly, Apple (+5 %), LeoVegas (+9 %) and the Evolution of Old-timer (+10 %) have provided some very nice Q2’s and businesses to develop apparently completely according to my expectations .

Even Netflix is going like a train with the now almost daily new ATH and has gone up 12 % since my rec. Netflix announced in a week significantly increased (10-17 %) abonnemangspriser in the united states, which indicates that it is very confident of their position in the market and the strength of the customer offer. All these five companies have a given place in my portfolio also in the future.

Cherry has gone weak (-5 %) but I think this does not feel justified. Cherry has uneven reports of the various reasons but the company is developing very nicely, which is also true for Storytel which, however, is too new as the cor for evaluation than as well as the two weeks old reken by ikea of sweden.

Of the year (-2 %) goes similarly, good operational and Q2:an showed the strength of the deal but shares are weighed down by the weak pound which in turn will of the uk government’s absurd inability to deal with the situation that Brexit vote plunged it in. I have reduced my holdings in KOBR, but this will increase if it falls. The long-term case is more than intact. Had Brexit not occurred, I think f.island. the stock had been over 300 $ today.

The black sheep is, as said, Catena Media (CTM). The shares fell after Q2, then on the news that the owner of the Optimizer Invest has decreased by two million shares (18 million) in order to finance another investment, a very negative analysis in Today’s Industry, and finally last week on news that the CEO replaced with immediate effect to be replaced by branschveteranen and legend Henrik Ekdahl, who also founded the Optimizer Invest. From having fallen from 96 at my cor, the share rose again up to this level, then, as said, fall on the report and the upcoming news.

If you are serious about their värdeinvesteringsstrategi can, however, do not stare yourself blind on how shares go from day to day. Evolution Gaming had t.ex. a weak period in the summer (when I f.island. increased my habit, which I also did with LEO), but have come back very strongly, not least by the fact that it is one of only five listed companies with the only köprekar from the analysts and their estimates have been raised time and time again.

Catena Media goes as far as it is possible to assess from the outside just fine. To storägaren sold a small portion of their jätteinnehav is nothing that affects the company and there was a perfectly reasonable reason for the sale. CEO-the change was clumsily implemented, but most likely positive as the company has grown enormously in recent two years and a change probably had to happen sooner or later to bring in an experienced stock exchange-CEO.

Catena omlistades finally to the MidCap at the end of the summer. Of course, this is positive for the company and not least the owners, but also something that has taken a lot of time, energy and money during the past year. Optimizer Invest’s goal is to take the company to the Large Cap, which Ekdahl recently told in an interview in Börspodden (strongly recommended for those who are interested in the company). Among the other good news is företagsköpen. Several acquisitions have been made in the recent past, not least the japanese purchase that is supposed to open the way towards Asia, a huge gaming market.

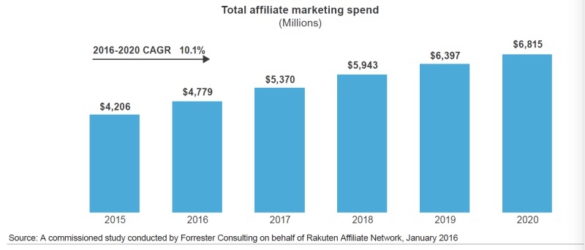

As I wrote in my original analysis is the CTM is a pretty boring company, or rather the perceived affiliatesindustrin as the right of the arcane and osexig despite the fact that today it is huge and is a big part of the reason that Amazon, Facebook and Google have become what they are today. An estimated half of Amazon’s sales.ex. today is not their own, but in fact the customers that Amazon has caught up via his site and to compensation passes on to the other vendors. The company is due to its somewhat obscure business easy to criticise, not least by those who got to affiliatesverksamhet in högmarginalsektorn casino and sports games would not be sustainable and successful.

There is, as I see absolutely nothing to indicate that this would be the case. CTM as well as several of their competitors have very good margins and are doing a vital work for the operators. That you go over to the increasingly ”revshare” meaning that instead of a lump sum payments for the client gained access operator share of revenue over time is not only reasonable but also an excellent approach. Next year, several big sporting events which will drive up revenue for the operators as well as for affiliatesbolagen and in that you’re now taken to the temporary decline in revenue as the transition towards more revshare meant so will the revenues to increase in the autumn and next year. In addition, a bit anecdotally that all the measurements of traffic to catena’s pages have shown increased and, in some cases, greatly increased the intensity of the last few months. This paves the way well for their ability to grow organically.

Like all fast-growing companies that have not yet matured finished is of course the risk is greater in the Catena than in the business as the more chugging along with proven faithful customers and established governance structure. As an exposure to an exciting part of the onlineekonomin, the company is, however, very interesting and in the same way as the risk is there, so are also good opportunities for nice development if the trend reverses. This, of course, even more today of sek 75 than when I wrote my first analysis.