If I had said ”audiobook” to you for a couple of years ago, you had probably thought either on the CD-books which were then still common, or the audiobooks, you can buy piecemeal from t.ex. Amazon or the iBookStore. If I say audiobook, or the ”listen to a book” today is probably the likelihood is much greater that the thoughts go to Storytel – the company who is ”disruptar” the publishing business in our part of the world.

From nowhere has Storytels CEO created a company that today is valued at roughly three billion and has made to listen to books via the mobile phone to a steadily growing phenomenon. The service, for those who don’t already know, works just like Spotify and Netflix (which I own), i.e. for a fixed monthly fee of 169 usd to get listen free, incl. download, on thousands of books and now also some longer articles, read books in the e-boksformat and a range of smaller services such.ex. pods. Buying either of the books färdiginlästa (”Storytel Originals”) or produce them with your own readers. In addition to this if you own a ”classic” in the publishing business (t.ex. Connecticut and a number of smaller publishers).

I will, as usual, not to go through the company in detail, but recommend the weekly presentation of the semiannual report that even if the course is a degree of self-government is a sufficient factual review of virtually the whole of the business:

The company, which this week reported H1 is interesting from a värdeperspektiv through that it is the undisputed leader in its markets – mainly Sweden, Denmark, Norway, Holland and now also Russia. Thus, one can soon have built up a moat (see previous post) against its competitors in a market which is not unlikely given how it usually goes when a sector becomes digital/online is going to be a dominant player per country. Because the service is very scalable, and the become a customer generally stays becomes the economy of the arrangement is obvious if you manage to become big enough. The potential can t.ex. be seen in the simple fact that in Sweden, which is their biggest market, is 3 % of the adult population is now a customer of them, while Spotify and Netflixs proportion of the population is up ten times higher. Storytels future called, of course, streaming and in the long term the rest of the world rather than Sweden, as it is crucial, just as has been the case for many Swedish companies. If everything goes the way it is still possible to buy a future Swedish large companies in an early stage.

Storytel, as well as several of my other holdings.ex. LEO and Netflix, sacrificing current profitability in order to instead build out the business and bring in new customers. This is pretty typical for owner-managed growth companies and something like Amazon as the familiar taken to an extreme level. As long as you know that you can recoup this money many times over in the long run and as long as one does not draw on any extreme debt, this is very common and something that the market absolutely correctly puts a premium on. It is the exact opposite of kvartalskapitalismen.

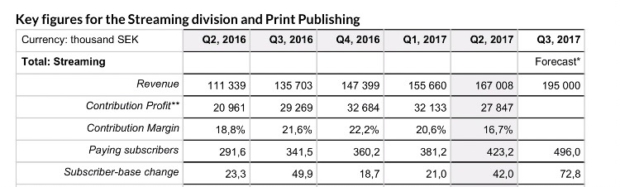

Then Storytel, as said, owns a fairly significant printmediadivision while the video stream is the potential beyond reporting a little confusing at first glance. The total income varies with a very strong julkvartal each year, after which a decline occurs. This of course depends on the print media that earn their money on christmas shopping. However, if we peel away these as we see with all clarity how the number of subscriptions of streamingtjänsten is passed through to the revenue:

All businesses have as I see it, a measure that is more important than any other, which means you should put very much greater emphasis on when studying communication from the company. In Storytels case it is thus the number of paying (they offer a free two-week trial) subscribers. It is, of course, the number of subscribers in a new market that determines how soon it begins to bear the economic (historical, it has fluctuated between three and five years) and it is equally self-evident such that in the long term, is meant to generate nice profits.

Storytels growth in subscribers is now at 45 % (y/y), it was 61 % between Q2 -15 to Q2-16. Growth is therefore continued to be good, but there are also large variations between the individual quarters of the year with the strongest growth, not surprisingly, before the holiday season. The profits have varied even more due to the man who said that greatly prioritizes the growth. Thus, it is difficult to look at the PE then the recent loss to the up a lot of the latest quarters profit. P/S is, however, in the 3.2 which I think is challenging at all.

The risks are mainly to the competition from the ones who Bookbeat and foreign options who want to bet on Swedish, Dutch, Danish and Russian release. Another risk is without a doubt CEO’s of large importance, not that I see any risk in that he, who so clearly is passionate about the audiobook would jump on something else instead, but if something would happen to him so want it to be just as passionate and talented employees can take at and this we know nothing about today.

”Case study” in the Storytel is thus that if the company continues to attract subscribers in Sweden, as well as, above all, on its new markets and continues to move into new countries, so can the number of subscribers becomes his major with the time. The probability for this must be judged as good given how big the market is, that listening via mobile phone without a doubt is here to stay, and that you slowly but surely build up a good ”brand recognition” as the company that is synonymous with this service. If you manage to grow about that today in a number of years, I tiodubblas, of course, the number of subscribers in the long term, and then is certainly a very good earnings, a fact.

An argument for believing in the Storytels growth was f.island. yesterday when it announced that it had reached 500 000 subscribers, an increase of 18 % in just six weeks. A landmark you thought you would reach the first in Q3. Share did not respond to this message…

May feel the potential greater for us as customers, and realize that we ”read” far more books since we became subscribers, how much more bearable it will be to commute, or drive a car alone when you have something you are really interested to listen to and not just want to continue to subscribe, but understands that it would continue even if the cost is raised in the same way that you stayed when Netflix raised from 79 $ to 99 ce, But who really believe in the audiobook and the Storytel may very well still have the chance to come in fairly early in a new american success story.

My own holdings are just under 5 % of the portfolio.