To be gammmal player, in my case at soccer and tennis matches, is a pretty good start, when the Swedish ”gamblingbolagen” has entered a renaissance.

When I was twelve to 15 years ago played on the football and tennis (especially live) was the big news that put the games on the computer. This was the big shift in technology, which then was just about to be implemented. What I noticed was how much easier it seemed to be for the company which had started as just internet-based gaming company compared to them.ex. Swedish Games that are at the side of their main customer interface, physical submission in the store, would build up a web-based interface. Today, slowly but surely, a new technology in the gambling sector. Here, as in many other places, is now the transition to mobile gaming. One of the Swedish listed bookmakers really was born as onlinespelsbolag.

Leo Vegas was established six years ago as a gaming company whose main attraction is the was easy casino game that is reminiscent of mobile games. Simply put, this is thus, games that combine fun with the chance to win. Slowly but also very surely, it has in recent years broadened its range and its geographical spread. From appliknande games to the live casino and now the latest sports games. See here for a review of the gaming experience.

In the spring I searched among the Swedish listed online gaming operators for a suitable investment and thought that LeoVegas stack out from the crowd. This man had a, in my opinion, pressed score, despite several good reports and the stock had mostly been at a standstill over between 30 and 40 sek, since a year earlier had börsintroducerats. But then, around four billion in market capitalization and a fantastic growth strategy seemed to be just the ”disruptiva” companies would be able to several-fold in value, perhaps partly at the expense of the ”old” giants Kindred and Betsson.

Shortly after I had bought the share rose nice enough very quickly with over 50 % and now trades around 60 b.c. I think, however, that said, this company has much left to give in the next few years. This for several reasons. One reason, of course, is difficult to measure is the impression I got from the management at the very well attended annual general meeting in may. From absolutely nothing the founders built a company that today is valued at six billion, and as an unexpected bonus, introduced a dividend on a dime in the spring. This is extremely impressive in a market which is full of actors and a clear sign that you not only know what you’re doing but additionally has an offer that stands out from the crowd and appeal to the customers.

Today is reportedly around 20 % of gambling mobile the rest of the PC, and physically in the store. This percentage increases, of course, quickly and with time, it is reasonable to believe that more or less everything will be mobile. At the same time, improve the technology all the time and in casino, which has yet to completely clear their most important part, goes the trend is clearly against the live casino. It feels like I said in any way reasonable to believe that the trend toward more mobile games will continue for many years and who is born as a mobile operator is, of course, well prepared to hijack market share.

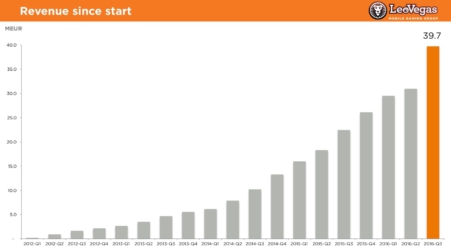

One thing that I mentioned in the previous post is my preference for companies that are happy to ”sacrifice” a quarter or two sometimes to make the investment worthwhile in the long term. In LEO’s case, this is exemplary, when you fit on to do big marketing campaigns when this is particularly favorable, as t.ex. during the second quarter of 2016, which caused the market to worry about and act on the stock. The dividend wouldn’t wait, and during the third quarter had the most new customers have started to play and the statistics show the result:

Marketing costs are extremely severe for the operators and that these provide so obvious and rapid delivery of new revenue is extremely important. LEO has, in addition, as the management like to point out, a name that works everywhere in the world. In principle, it is their only brand which enables an effective marketing unlike the bigger operators, which have dozens of different brands. Few swedes have probably missed

No analysis of the Swedish gaming operators, can be done without taking the new Spelutredningen. In the spring it presented its proposal, which will probably become law from 2019. This provides a further reason to take Leo Vegas as I see it. All the concerns about the high rate of taxation or restrictions on casino games was wrong and the investigation was characterised by the idea that adults should be able to do as they wish with their money and should only be protected against fiffel and exploitation of people with gambling problems.

A basic advantage of regulated games is that LEO, whose main market is still Sweden, and the listing of course is in Sweden, will be less of the discount on the stock exchange completion of that legislation actually banned their main business. Another advantage of the new rules and licensplikt is that it comes the closest to guaranteed to be a consolidation in the Swedish market. Because there will be expenses associated with to live up to the Swedish legislation, smaller companies are not likely to cope with this, and can be sold, possibly to Leo Vegas. At the same time, foreign companies buy access to the Swedish market by buying companies that LeoVegas. This is of course speculative but needs to be included in the assessment as well.

LEO has as the management like to point out a name that works everywhere in the world. In addition, it is basically their only brand which enables an effective marketing unlike the bigger operators, which have dozens of different brands. Few swedes have probably missed the commercials with Frank Andersson or their lejonlogga that adorn billboards everywhere.

LEO is to build up a larger customer base and a wider business. Their latest reports are very good reading for us as owners – it goes, not unlike the Architect (another favourite), slowly but steadily without taking on any significant debt, that said t.o.m. share out, and I can’t see any major obstacles for this not to be able to continue for long.

PE-wise is, of course, LEO over the cut, between 25 and 30 (four times sales, 1.6% in dividend yield) but we are talking about a company whose turnover rose by 49 % last quarter (y/y), and whose customer deposits are increasing even faster. Thus, it is an excellent example of the value through the (profitable) growth. There are risks as in any fast-growing company, but I have hard to see that these would be larger than for others in the sector. Rather, I believe that they are less thanks to LEO’s extreme focus on mobile gaming and their notoriously stable platform and the incredible growth opportunities if you manage to take customers during the continued transition to mobile gaming.

As always, this cor long-term, I have no idea how the stock will go in the short term, but I feel pretty sure that it will be within not too long a time will reach the three digit course.