If there is a marked lyxmärke that good, just all know, or at least recognize the logo, so it is probably Louis Vuitton. Whether you are interested in luxury goods or not, it is probably hard to have missed the mark if you live in a någotlunda rich country. It is a sign and a pattern which from the beginning was developed to be easy to recognize and make all the bearers of their bags m.fl. products to the pitchman for the company.

As värdeinvesterare will, of course, interested when one sees a strong brand as it is one of the most common and best moats you can have against competitors. A well-established brand is simply worth gold and is the most important exception from the rule of over time falling margins for companies which earn a lot of money. It takes a very long time and a lot of money to establish but there is the mark where in the consumer’s consciousness (or subconscious mind) so is it very difficult for competitors to take market share from them.

I started to check up LVMH, lyxkonglomeratet Louis Vuitton Moët Hennessy, for a year and a half ago and thought a lot about everything I saw. I bought a few bags to test the quality (extremely good) and went through the various subsidiaries and sectors. It has been a very good investment even if the share price was pressured during the last year due to the general konjunkturoro and I’m now convinced that I will own the company for many years to.

LVMH is simply expressed as a Berkshire Hathaway for luxury goods. It owns upwards of 80 different brands, and uses a large portion of its cash flow to buy new, very well-established companies, the oldest is a vineyard from the 1500s and the largest and most important subsidiary, the Louis Vuitton is over 150 years old. No beginner, in other words. The companies we buy seems in segments such as bags, fashion, perfume, cosmetics, wine and spirits. To the recent acquisitions, the hear Christian Dior (the portion not already owned) and the German väsktillverkaren Rimowa.

The result is very successful and if you want to which a right to levy taxes on rich people. ”Rich” is of course a truth with modifications – in countries such as Sweden, there are lots of women who are not rich but who have good jobs and a good economy that can afford to buy a LV-bag and Moëts champagne is not prohibitively expensive, but the really nice margins has, of course, on their expensive products. These want very many highly wealthy people be seen with. Or drink, if you look at their high end-champangemärken. Rich people, and as said the other with a good economy, is not so fond of paying taxes, but very interested in being able to show off their success with the ”right” products.

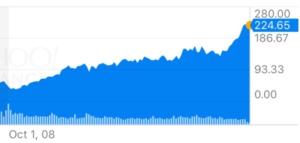

LVMH is of course never ”cheap” seen to PE or to any share which is suitable for short-term appearances. When the economy turns down or the world is again hit by ‘ kinaoro” so falls the share, but in the long term, it is difficult to see any obstacles against LVMH’s continued success. They have shown time and again that they can withstand regional problems as terrorism and the decline in tourism that followed in France and the decrease in lyxkonsumtionen in China. It is therefore the ideal long-term placement.

Where H&M has had a difficult time with the transition to the online that I wrote about in my previous chronicle, has LVMH not at all the same challenge. Secondly, their products such that people very much like to buy over the counter in their great shops, and LVMH early met onlinetrenden with stable webshops in the larger countries, and recently launched a varuhusliknande online store where you can buy all their products at one place.

Just as Berkshire is LVMH, in essence, a family business where the family Arnault owns about half the company. In other words there is no open question who the boss is, it makes France’s richest man, also the company’s CEO Bernard Arnault. However, this is not a bigger problem than in Berkshire because Arnault is incredibly skilled and aktieägarvänlig and have his successor (son) appointed and working in the company.

LVMH-share the last 10 years. Source: Yahoo Finance

The risks are not especially great in LVMH – man is over the absolute entire world with all of the product groups, and it is very difficult to see that the demand for luxuries would fall permanently, or that new competitors would be able to cause any major problems. Several brands can be understood to suffer in the short-term effects of wars and crises, but the Louis Vuitton bags will still be worn and the Moet will be drunk with pleasure on the 100 years.

LVMH’s finances are pretty much the inverse of the H&M’s. Unlike them so if organic growth, which is good (last year six per cent) and the total growth is usually at around 10 % per year, the operating margin is around 19 %, to pay off their debts and have a steadily increasing free cash flow. In addition, raising the dividend every year.

The company’s stated goal is thus extremely long-term growth, and I would absolutely not advise anyone to buy LVMH but first, the obvious own analysis (see t.ex. LVMH’s IR page) but also that said a private long-term goal with the placement. This is perhaps the ultimate long-term placement because the margins are sustainable, the demand is, in principle, unchallenged, and the company’s proven good at finding profitable acquisitions. Many people today, the well-known independent brands will eventually be bought up by LVMH. It is very likely that this may continue for a long time to come. What happens in the next few months, however, is completely impossible to predict. LVMH is listed on the paris stock exchange and can be bought in both Avanza and Nordnet, as well as the big banks.

It is interesting with France – there is much one can wish would work better but the things that you do well in France is one the world’s best. LVMH is a part of this.