About 20 years ago, Harvard professor Clayton Christensen book ”The Innovator’s Dilemma”. The presented concept of ”disruption” and got enormous significance for our understanding of how innovation affects the market. In particular, it gave an explanation as to why some of the until recently prosperous and growing company suddenly starts to go much worse and in many cases go over in just a few years. He showed how technical development is often ”disruptar” whole segments of the market by new, inexpensive technology comes in and although it in the beginning, is much worse than the existing so is beating the time out the old technology (the digital camera is a prime example) and those companies that have not managed to adapt (Kodak, of course, but most of all the camera manufacturers).

This is, however, certainly not just within the tekniktunga industries, but other researchers have shown that it is everywhere. The internet’s emergence has t.ex. affected all industries and those who are not fleet of foot and ask about when the market and the customers change the behavior of the ports relentlessly at the garbage dump sooner or later. In principle, there is no sales take place today without, in each case, there is a possibility to buy it online also. In many cases it is only online as of today and those that do not have managed this transition has had problems. In the united states have plenty of previously very large retail store chains have gone under and lots of shopping malls have closed down as more and more is a large part online.

According to the american research starting a business, with many physical shops to go bust when the industry in which they operate to reach 20-25 % of their sales online. This occurred for natural reasons, first of all digital products which is why we no longer see any music or videoaffärer in the cities. The first of the more physical sectors to achieve these levels became the consumer electronics industry and we have in recent years gained an exclusion of the first, smaller shops in the cities followed by the chains as an Expert. The segment ”Clothing and footwear” increases the course steadily and is today at 13 % online in Sweden, far less than in the US, where butiksdöden is in full swing, but we are moving towards 20 %, which brings us to today’s säljråd.

H&M has been a fantastic company that perfected the principle of selling cheap fashion to the masses through an increasingly impressive network of stores. H&M disruptade themselves the clothing industry by offering cheaper clothes manufactured in low-wage countries, and thanks to an amazing ability to open new stores everywhere where many people moved. It increased the number steadily over many years by 10-15 % to over 4400 stores around the world, and was slowly but surely far beyond Sweden’s borders.

It needed to as usual do not buy early in order to get rich as a shareholder in H&M, even if you waited ten or t.o.m. twenty years after the ipo in 1974, so could over time collect as much in annual dividends as the original shares had cost. This did, however, that H&M had an aura of immortality and the notion that an investment in the H&M meant not only security but good return grundmurades in the Swedish investor community. I was no exception, was enthusiastic owner since 2010. The only problem is that the market is constantly changing and a new, large-scale disruption was coming – online shopping.

Industry today, march 2000

When the IT frenzy com would all businesses, including H&M, of course, bet on the ”digital commerce” as the man said at the time. H&M did not, however, these plans, see the picture above, but went after a first bet in the late 90’s which is not given dividend instead back to fully bet on what had always worked – expansion. In the clipping above says Stefan Persson, that instead of building up an online sales should ”refocus towards the core of the business”… This is a very typical attitude of the companies that are disruptas – you don’t realize what is about to happen, and want to instead focus on what you always have previously succeeded with.

Initially, however, was this a good choice as many online initiatives fail because customers had not yet moved online. Unfortunately for H&M lived obviously the show left within the company that it was the stores, and only stores it was important, and onlinesatsningarna was severely depressed. Telling example may be that it was not until 2016 that it started online sales in Canada and Korea, and it was only in the beginning of 2017 as part of an officially abandoned the goal of opening 10-15 % new stores per year… H&M was, therefore, no longer the agile company that is constantly found new ways to increase sales without the colossus in the market.

At the same time did not set the competition on his hands. Zalando and many other companies, was sold only on the internet and had far lower fixed costs than H&M. Their archrival Inditex (Zara m.fl. chains) seemed to succeed with both online and in-store sales. The customers went very clearly against the online from young. In 2010, with lower margins, but at the same time, in many cases, lower fixed costs. Even if H&M eventually made an increased effort in onlinesatsningen so dragged the said, heavily in the roll-out of the world compared with its competitors and did not free returns or the opportunity to pick up or return in store, which meant that it got tarnished reputation. While H&M opened several new store concepts, which today stands for young. 10 % of sales, but has not gained traction on the sales.

The problem became, if not earlier, so in any case, 2015 is obvious. Even if neither the analyst or H&M’s management knew it, so did the market. The share reached its ATH in the spring of 2015 on more than 360 usd and has since fallen slowly but surely, with now 40 %. What the market apparently realized was that H&M’s previous so-important competitive advantage – the ability to open many stores quickly and easily throughout the world – was not particularly important at all. It now really gave the success – to give the customer a great shopping experience online despite trying absolutely not their strength. Other problems also began to be felt in this period, H&M made their clothes far from the main markets and was very difficult to set about the production and the product range quickly. Something that Inditex with its production in Europe proximity avoided. Unusual weather for a certain season of the year led to an increase in inventory and sales that weighed on the margin.

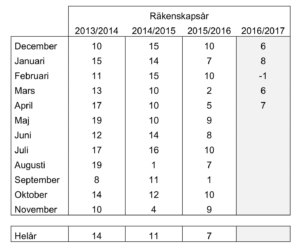

A bit simplified but still true, one can say that all key indicators have gone in the wrong direction for H&M the last few years. From having had a brilliant gross margin around and not rarely over 60 % is now at 52 %. The at least equally important, the operating margin has plummeted from 22 % when I stepped on the train in 2010 to around 14 %. Of course, this is a horrible deterioration in profitability, which is clearly reflected in the currently falling net income. Even the growth leaves much to be desired. Despite the fact that steadily, as said, has opened more than 10 % new stores per year have gone from always having the double-digit monthly growth in local currencies to rarely be in the vicinity of 10 % (see image below). Unit sales fall.

Image Source: H&M

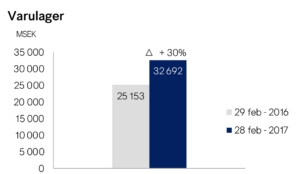

Equally worrying is the increase in inventory levels. This is far much higher than what would be justified with a ten percent increase in the number of stores. It binds the now huge amounts of money in stocks and anything that accelerates the negative trend. From 28 to 30% year on year in the last two reported quarters.

Image Source: H&M

It is very difficult to find good news to base any hopes on what comes to H&M today. A PE ratio of 19 suggests that the market as soon as is overly positive to the company given that the profits are falling and you can keep up a growth only thanks to aggressive butiksöppningstakt. A growth which is only just over half of the increase in the number of stores. It is also, as I see it impossible to believe that a steadily increasing jättelager will be able to be sold without substantial sales which will bring further pressure on margins. The dividend has been at a standstill for several years. Man shot recently in addition the payout of half of 2016-the distribution, in the fall and advertised in connection with the latest quarterly report for the first time, will borrow on the market. H&M’s previous mark of honor to the financing itself is then gone. Add to this the fact that analysts now have finally woken up and are lowering their forecasts for the company, see t.ex. Wednesday’s from Morgan Stanley.

At the same time as the results and particularly the outlook has deteriorated, it is obvious that many small investors are increasing their holdings in the belief that it is now ”cheap” to buy H&M or with reference to the chairman Stefan Persson buys huge volumes. The problem with this is just that He has purchased for many years regardless of aktieutvecklingen and H&M at PE of 19, while traded lower against the profit compared with the past, when PE has been at 22-25, but absolutely can not be seen as cheap if you compare with other companies with considerably better development and prospect.

I sold my shares over a year ago and would not buy at these levels (210 sek). The risk is, just as before, that share continues to fall, in the worst cases, far below the 200 b.c.