The concept of ”dividend shares” are used extensively and these shares will come in many different varieties. With utdelningsaktie referred generally to a share with a decent utdelningshistorik and there are mainly two different types of dividend shares, one can usually distinguish between; Högavkastare and those with good dividend growth.

Högavkastare. These shares provide a relatively high yield, but often, growth is scarce or almost non-existent. It is often mature companies in an industry that’s been around a long time, the strong tillväxtperioden in the company is over, but it often has good profitability and reliable cash flows. Even if the technology is developed, it can be argued that e.g. the telecom companies belong to this type of company. A mature company with reliable cash flow and they often pay generous dividends.

Dividend growth rate. The companies that manages to deliver a good dividend growth over time usually have a different character than the ”högavkastarna”. These companies grow earnings at a higher rate and also raise its dividend in the wake of this. In most cases, these shares are somewhat lower yield than would normally be classed as högavkastare. Generally, many companies are classified into this type of utdelningsaktie, even if the yield is very low, you can call it utdelningsaktie if there is a clear history of rising dividends. It may sound crazy for some, to call a share with a 1% dividend yield for a utdelningsaktie but where is the difference between these two types.

Should you choose one or the other? On the question, there may be many answers, but generally this is a mix of both types might be a good idea. It can be högavkastare, which provides a better total return than a tillväxtaktie while those that give the highest return is likely to is a tillväxtcase. Högavkastarna is already mature and has already reached a certain market capitalization and a limited potential. Among utdelningsaktierna with growth, there can be some real rockets, the companies that grow incredibly powerful for a long time in addition. It can be easier said than done to find just those shares that goes very best, but with a keen eye, you can hit the right.To spread the risk over different industries, etc. you often hear and it can be considered as a kind of spreading of risk also spread the holdings of both the högavkastare and growth.

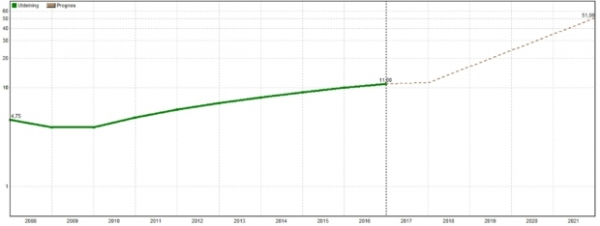

Dividend growth can become extremely powerful with time. On the really long term, and the payout quickly, like a snowball as it rolls bigger and bigger. If a company is able to raise its dividend by 15% per year is sustainable, it means that the payout is doubled every five years. After five years it is nice but after 30 years it is incredible. A dividend of sek 1000 today gets 2000 crowns after five years, but in 30 years it will be fantastic 64000 sek. Certain it is, of course, not all companies succeed in performing this high level of growth over such a long period of time but there are plenty of companies that actually made it so of course it’s possible.

Another aspect is what to do with their dividends. For those who reinvest it is neither the one or the other form utdelningsaktie to advocate solely for that reason. For the other hand consume up its dividend rate of growth a huge difference in the long term. For every year that goes by costs of goods and services more money, inflation as a familiar. In order not to lose purchasing power over time is, therefore, dividend growth, very important for those who consume its dividends. There are many who have a dream to be able to live on their dividends and this is important to be able to live on them long-term. If you bet only on högavkastare which barely raises its dividend, it indirectly poorer every year due to inflation.

An investment alternative worth mentioning in this context is the preference shares that the past 10 years, has become oh so popular. These can categorize the check as högavkastare because they generally have a very high yield, and in most cases a fixed dividend that is neither higher or lower. However, it is important to know that this kind of shares are valued in a completely different way than common shares. Preference shares are valued primarily based on general interest rates and the level of risk in the company. The interest rate goes up and down over time, and with it goes the share price of the preference shares in the same lines. The level of risk in a company varies, usually not as much, generally speaking, is the similar over time, with the exception of some of the smaller companies that can go from high to even higher or less high. This means that the preferred stock is moving up and down over time within a fairly narrow range. For example, a preference share swap between 230-350 dollars on a 20-year period. It will never take off to 700 or 1400 sek. The preferred stock is valued similar to bonds and are more like a ränteplacering. Like a bond falls the value of a preference share when the interest rate rises, and vice versa goes the preference shares issued when the interest rate goes down. Right now we have historically low interest rate that actually hardly can be lower, whereupon the preferred stock for the moment is up around its kurstak.

One thing to keep a watchful eye on when it comes to högavkastare is that the dividend is sustainable. You can find companies with eye-catching, high-yield, or might happen to you out to you own a stock that drops in the course resulting in that the yield is getting higher. You must regularly read and see, so that the company’s business generates enough money to cover the dividend. During occasional years, companies with strong finances ready to pay bigger dividends than the cash flow the business generates, but in the long term, it is unsustainable. A general rule of thumb is to be extra vigilant the higher the yield is, often there is a reason that it seems to be high. A declining share price may be the market’s way to show that you are waiting for a reduction of the dividend.

Dividends don’t lie. It is not possible to share out the money that is not available. Why have a company cut the dividend if it is not good enough. Be vigilant around the utdelningssänkningar, in general, one can say that the good companies will never lower its dividend.