As a co-opted rug has concerns about north Korea occurred again. Once again, it is Trump that cranks with their Twitteruttalanden. A lot of talk and little action in the usual way so clear, but the clear imprint is felt on the market which exhibit slightly more bearish sentiment, which is reflected in gold’s development. Increasingly, the focus has begun to shift towards OPEC, and whether the current produktionsfrysning up to march 2018 will be extended or not, in order to give strength to the price of oil…

With renewed concern about north Korea, which is clearly reflected in the commodities market, it is first and foremost the developments in the oil market we take up.

The focus has clearly shifted against the OPEC, and whether the current produktionsfrysning prevailing up to the march will be extended or not.

Concerns about a hurricane this past weekend, which was expected to hit the u.s. gulf coast was not so mean as expected, and the refineries fared well in relation to feared.

Brent crude has maintained the land over the past utbrottsnivå at 55 dollars, despite earlier brief rise to over 59 dollars.

That the price of oil maintains the mark of just 55 dollars, supported by both saudi Arabia and Russia, is for a continued cooperation in respect of accounts.

”We hear that saudi Arabia and Russia, are singing from the same songbook, both countries celebrates the producentutbudsbegränsningarna,” said BNP Paribas råvaruhandelschef Harry Tchilingurian to Bloomberg News.

When the Saudi king Salman bin Abdulaziz visited Russia for the first time, for a meeting with president Vladimir Putin, was it that he wished to see an extension of the oljeutbudsbegränsningssamarbetet. The Russian president ruled out the possibility, then, is not an extension.

This has given back to the price of oil, which continues to be up a little more than half a per cent since the previous week.

Swedish Torbjörn Törnqvist from the Gunvor Group, commented at the Reuters Global Commodities Summit, ”OPEC in our point of view cannot afford to give up, more oil is coming and the big question is whether the market can absorb this,” and further said that oil companies ‘ shares are ”still trading at high levels”.

Concerns about north Korea has once again emerged on the wallpaper, and again, it is Trump who is on the go.

Twitter posts that that years of diplomacy with north Korea has failed, and that ”only one thing works”, and that the answer to the question of what this means, ”well, you will be able to figure it out pretty soon” are some of the statements that ended up in focus.

Iran has also spoken out about the american president, that the iranian forces will teach US the ”new homework”.

We are thus in a situation with slightly elevated anxiety, which can contribute to volatility in the future unless something changes.

Gold has, in line with this started to shine again, and even managed to bounce around the heavy technical support level at 1270 dollars, and looking rather to continue further north, as the us dollar is now weakening.

Technically, we thought that the dollar had more space on the top, especially now, when everything is pointing towards a rate hike in december, but geopolitical concerns gave the market a rebuff, and is now trading even during the 8.10 against the Swedish krona on Tuesday.

After that China had been closed during the previous week, risk appetite initially good this week.

Aluminum, copper, nickel, and zinc are some of the base metals which continued to show strength since the past, and may very well experience continued strength now that China is back in the picture.

As previously reported, we think cocoa looks really interesting. Build-up has continued, with underlying positive momentum since we brought up the raw material with the faith on the rise week 38. We remain with our position that the kakaofrossa is on time.

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

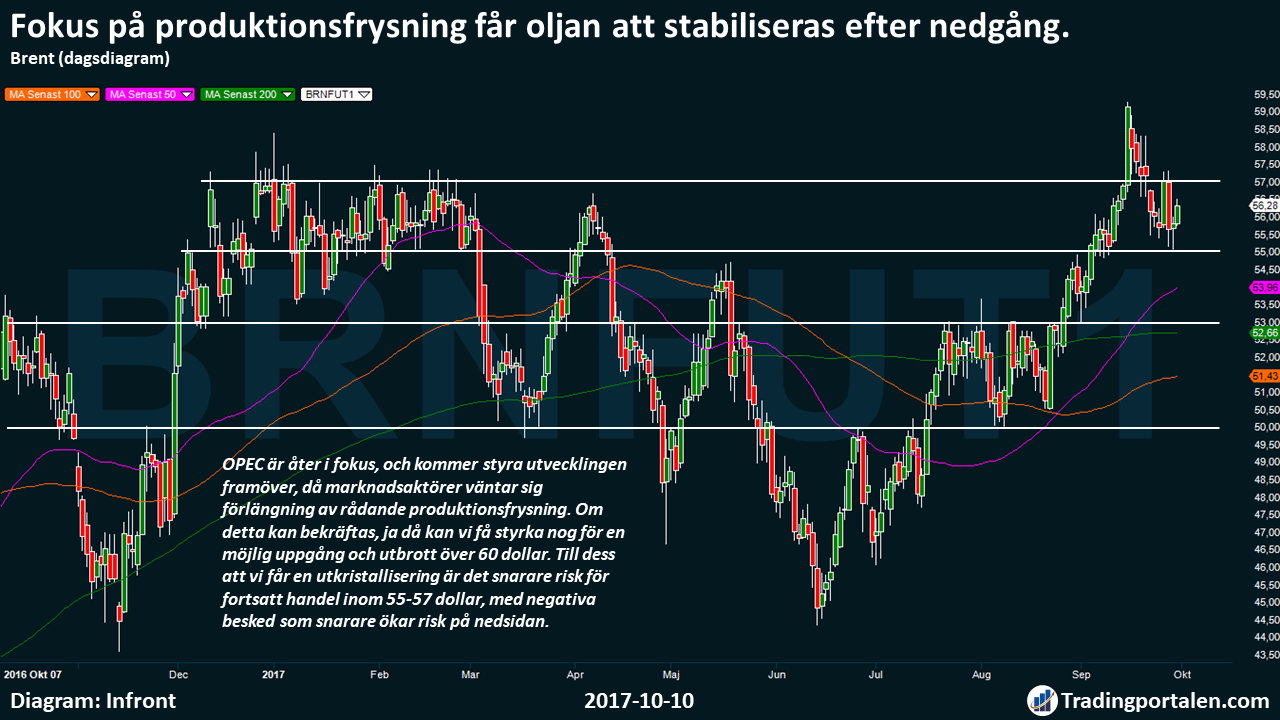

Focus on produktionsfrysning get the oil to stabilize after the decline.

The price of oil has after previous decline in the face of the past weekend’s anxiety about the hurricane in the us gulf coast has stabilized. The hurricane was not so mean as expected, and gave strength to the brent crude to reverse at the serious attempt to the challenging of 55 dollars.

We find the heavy volume on this price level, which was one of the reasons for the difficulty of the outbreak earlier in the year, and nedställ in the first quarter.

OPEC is back in focus, and will guide the development in the future, when market participants expect the extension of the current produktionsfrysning. If this can be confirmed, yes, we can have strength enough for a possible upturn, and the outbreak of 60 dollars.

Until we get a utkristallisering it is rather a risk of continued trading within 55-57 dollars, with the negative reply, which rather increases the risk on the downside.

Nickel on the way for the challenging of the majority of the technical key levels.

In tune with the us dollar increasingly weakened, we are now seeing a recovery also in the nickel.

Several base metals were a bit on hiatus the previous week, when China was closed. On Monday came the chinese with risk appetite back, which caused the nickel to rise sharply.

Past recoil on the heavy intensities of 10 to 400, opened in already up for a potential turning point, and after several days of gradual recovery, now is the MA 50 which are challenged on Tuesday.

As long as the dollar is weakening, and China is still in the picture, there is scope for a challenging technical resistance at 11 200, then the risk increases for a brief stop with the consolidation before we can make a more accurate assessment.

Gold shines again!

By both concerns about north Korea, and an increasingly weakened us dollar in the symbiosis, has the gold started to shine again.

By investors exhibit slightly more bearish mood, flock to the market participants to the ”safe haven”-the gold, who got back köpstyrka at the technical support level at 1270 dollars.

After three-day rise, now even the 100 day moving average been left behind, and technically, it is a clearly increased probability that we may now be on the path to a challenging of 1300 dollars.

Despite the fact that the market is expecting a rate hike in december, puts the geopolitical turmoil of their tracks, at the same time that the u.s. dollar is largely if much can be inprisat this through renewed commerce of 8.00 against the Swedish krona, after the previous brief dip below.

Kakaofrossa at the time…

Then a few weeks back, we have been clearly bullish cocoa.

A clear focus has been going on since just before the summer, where the third quarter was characterized by a clear underlying positive sentiment.

We now have the following four significant challenging of 2.10 dollars level, a situation where we assess the likelihood that clearly elevated that we can get to get a significant motion in case of an outbreak.

Cocoa is now trading even over the 200-day moving average, and we remain with the initially assessment of a rise to 2.20 dollars shortly, as soon as an outbreak occurs.

If the momentum is growing properly, we can come to, we continued to rise, in which additional fuel in addition to the technical situation which is mirrored can be an ever-weaker us dollar in the coming months.

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about Ingredients:

- Oljebjörnen

- Kakaokaos and chockladchock

- Unsustainable cheap cup of coffee, thank you

- Cotton is cheap

- Glencore exemplifies råvarusektorns crushing spiral downwards

- The gold glitters are not

- Fish for return of salmon

- Dawn for Solar energy

- Sweeten your portfolio

- Bitcoin – digital gold, fixed köpvärt

- Tighten the woods!