After a sharp decline to a new low for the year and 10 månaderslägsta, it looks like oil bottomed out, seriously. Despite the fact that OPEC has neither made any positive statement, or the lifting up indications of no additional lost output recovers, oil prices all the more. China got the gold to lose ground following the declined purchase in may, but several analysts believe, on a nice upswing in the future. China even commented that you are positive to achieve the objectives of the year, and should continue with its reforms and increase the market availability, which can help with the positivet in among the other base metals in the future. In the usual way, you will find 5 technical analysis further down in this week’s råvarubrev.

Oil begins to grope everything north after the earlier decline to 10 månaderslägsta.

Not least, we have experienced pressure when oil prices continued to back away, after the previous rising u.s. inventory levels and production.

The previous week, they decreased u.s. stocks of crude oil by 2.7 million barrels, slightly more than expected 2.1 million barrels. Tonight we will see if it gets the same positive surprise, or disappointment. Also on Wednesday we get the american weekly statistics of oil inventories from the DOE at 16:30.

That the oil now leave what can be called a low at the low for the year, highlighting a short-term positive image. Brent semester now runs a fight with the 47 dollars seriously, and a establishment of would be both good for the short-term development.

Despite the fact that we have previously highlighted the question of how OPEC will act when the oil been under clear pressure, a delegate stated to Reuters that there are no ideas to act with an enhanced output decline.

In China, commented on the prime minister Li Keqiang that the economy continued to experience a good momentum of steady improvement in the second quarter, with the prospect to meet the financial objectives in the years, although many challenges still remain.

China should continue with its reforms and increase the market availability, which means that we very well may get pushed to among the other base metals.

Gold continues to pursue a fight in our medeltalstrio MA 50, 100, 200. Some pressure arose when China reported decreased guldköp during the month of may, compared with the previous month, which set a temporary negative tongång.

However, it has flourished in the news that several are positive to gold on the basis of a longer-term perspective. Commerzbank has, as we had highlighted earlier, an assessment that we can see 1300 dollars before year end. A principal analyst at U. S. Global Investors believe that we can get a further rally in gold, with a rise to as high as 1500 dollars in the future.

The uk has also continued to be in focus, with both Brexit negotiations and the Bank of England. Central bank governor Mark Carney stated that it was not the right time to start raising interest rates, and want to wait for, inter alia, a weaker consumption in the country. The statement got the pound to drop against their currency pairs, but managed to recover shortly thereafter to be strengthened after the support of relatively positive signals in the Bank of England’s regional konjunkturrapport. Recovery took then real momentum when the central bank’s chief economist, Andy Haldane, flagged that he is positive to take away a part of stimulus measures during the second half of the year.

On Monday, the steps, the German IFO index to a record high of 115.1 in June from 114.6 the previous month, as expected, was 114.5. The IFO noted that private consumption continues to be the central driving force and see a GDP increase of 0.7 percent in the second quarter. The prospects for the eurozone look better which could give a further boost to exports.

Later on Tuesday evening at 19:00, the focus closest to Janet Yellen, who is participating at an event in London, where the subject is global economic issues. The governor is also expected to respond to publikfrågor.

”The market continues to call the Fed’s bluff about their intentions to change interest rates. I don’t think that something that Janet Yellen said this week could change this. We recommended to buy in dippar in the pound and euro last week, making it this week, too”, commented Stephen Gallo at Bank of Montreal told Reuters.

The upcoming FOMC meeting is not until about a month, and a decision to initiate the downsizing of the balance sheet can come in the relatively near future, while the market puts a probability of under 50 percent that the Fed has raised again before the end of the year.

Despite the fact that central banks have shown more hawkish tongång as reported in the previous week, there is some questioning on the market. Not least confirmed this from the Bank of England after cautious comments about future interest rate hikes.

Something that also left a major footprint in social channels is that the u.s. congressional budget office, CBO, estimates that the republican sjukvårdsförslag, to replace ”Obamacare”, would lead to 22 million more americans would be without health insurance about a decade, but also reduce the budget deficit by 321 billion dollars.

We lifted briefly until the orange juice already in the previous week, and the week råvarubrev we take a closer look at this raw material in our technical analysis below.

Get Råvarubrevet to your e-mail every Tuesday!

Analysis

Oil rebounds on 10 månaderslägsta.

After a sharp decline and lost land, it looks like Brent oil bottomed out.

From the to have noted a new low for the year at 10 månaderslägsta about 44.50 dollars, we have not only stepped back over 45 dollars, but also managed to find the land just over 47 dollars on Tuesday.

Thus we had a brief decline during the 46 dollars, which was highlighted as a potential scenario during the previous week.

Technically, the markets, oil prices are still in a short-term stressful situation, but the turning point which resulted in a four-day rise, which also received a huge boost after the listing of 46 dollars, highlighting a positive image.

The probability that we are about to challenge the 49 dollars in the future is increased, at the same time as a risk factor this week lands on oljelagersiffror. We have previously highlighted, the high inventory levels and high production risk factors, and it remains to see if we can get positive surprises this week.

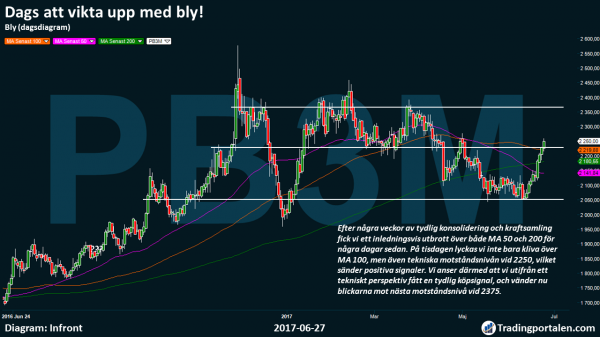

Time to weight up with lead!

It’s been a while since we provided an analysis on the lead. This metal has, since the end of the first quarter experienced an extremely dull development. Clear sideways movement with a slow gradual decline.

After a few weeks of clear consolidation and concentration we got a initially outbreak of both the MA 50 and 200 a few days ago. On Tuesday, we manage to not only step over the MA 100, but also a technical resistance level at 2250, which sends positive signals.

We therefore believe that, from a technical perspective got a clear buy signal, and are now turning their attention towards the next resistance level at 2375.

Time for gold to rekylera…?

Gold has continued to lose ground with the pressure from China after the reduction guldköp in may. Despite the fact that we assessed a higher probability that the expected interest rate hike from the u.s. central bank could have been discounted, this resulted initially decline.

From a technical perspective driven a struggle within our medeltalstrio, MA 50, 100 and 200. At the same time, it also appears that we may be about to challenge the underlying trend line, which is clearly modelled on the three previous bottoms.

The three previous bottoms has nevertheless meant higher and higher peaks, except the last utmanandet of the year high just under 1300 dollars, and a new challenged of 1300 dollars may very well become a launching pad for a rise to 1400 dollars, or even $ 1500 if you can believe some investors.

Maybe we will get to a turning point before, if not more likely to recoil at the underlying trend line.

Given that several storbolagsindex are at or near all-time high, and we believe that a possible turning point ahead later in the year, it could very well mean that investors will flock to gold before year end. Perhaps it is worthwhile to take an initial position today?

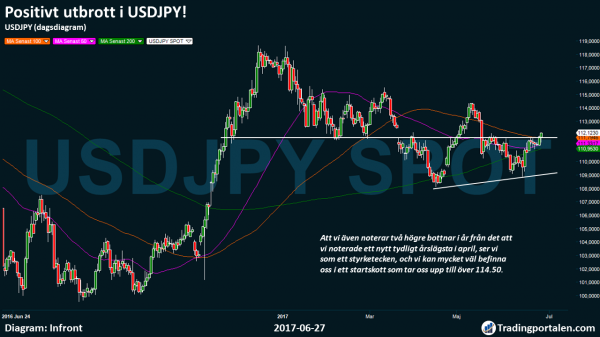

Positive outbreak in USDJPY!

This week we are highlighting the USDJPY which after a steady rise meant that once again, we see an establishment of the 200-day moving average, also received an additional positivity after the eruption on Tuesday.

In addition to that we are after the previous establishment of MA 200, now also climbed above the MA 50 and 100, we can manage on Tuesday to find the land over the technical resistance level at 111.80.

This means in addition to from a technical perspective, experiencing positive progressions, we also leave unchanged all the more behind us.

We also note two higher bottoms in the year we noted a new clear year low in april, we see as a sign of strength, and we may well find ourselves in a launching pad that takes us up to 114.50.

Mobilization before the outbreak in the orange juice…?

Sometimes it goes good and less good of a forecast, the most important thing is however, that statistically is profitable over the long term. When it comes to orange Juice, we managed to pinpoint the top extremely well, and even if we thought it might be time to get off the train already in the first quarter of this year, was it properly with fruit to harvest in spite of a further decline.

Now we have after a sharp decline of over 40 per cent since its peak at the end of 2016, started to experience a clear kraftsamlingsfas, which indicates that we may get an outbreak to the north shortly.

We believe that the positive underlying momentum that exists, is strengthened by an image where we do not observe a clearly lower bottom, at the same time as we note the increasingly more volume within the upper part of the build-up and handelsintervallet.

An outbreak of 142 would also mean that we challenge the short-term 50 day moving average then, and would yet be able to mean here also a starting point on a nice turning point and a further upswing in the future.