Köpstyrka stepped clearly back into the picture on Wednesday, despite a closure of +0.16 per cent at 1640.5 points, noted a dagshögsta at 1649 points. The turnover on the stockholm stock exchange amounted to 22.7 billion, which means that we got a confirmed withdrawal of the köpstyrka in connection with the upswing. After overnight trading in Asia, there exists a weak positive attitude in the face of ”supertorsdagen”, which, in addition to Comey-the hearing include the choice in the Uk as the interest rate announcement from the ECB…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

During Wednesday’s trading was once again a dagshögsta at 1649 points, which means that we again experienced difficulties to climb over the resistance at 1650 points.

Greatly sized köpstyrka dominated yet Wednesday’s trading, and we got a turnover of over 20 billion, in line with the growth that we experienced.

We had such a significant volume of Wednesday’s trading in the upper part intraday, between 1645 and 1649 is extremely positive, and we believe that this can be a sign of strength before the outbreak, the establishment and further rise against the initially 1670 points.

Leading futures pointing to a more or less unchanged opening. The USA closed in slightly positive territory, which flowed over to Asia during the night.

The oil that got whack in the week and challenged 48 dollars on Wednesday, noted that, despite a rise during the night to low 48.41 dollars, which is the lowest since more than a month back.

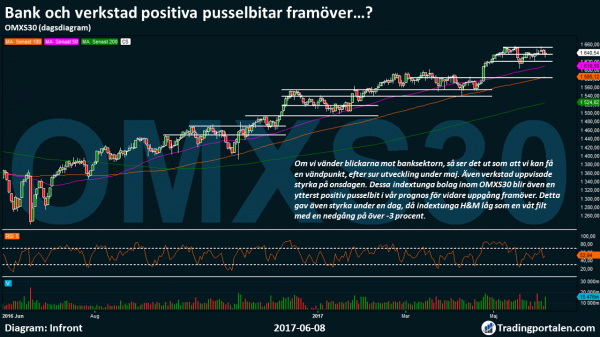

If we turn the attention to the banking sector, so it looks like we can get a turning point, after acid development during may. Also, the workshop showed strength on Wednesday.

These indextunga companies in the OMXS30 index will also be an extremely positive piece of the puzzle in our forecast for further upswing in the future. This also gave strength for a day, then indextunga H&M was a wet blanket with a decline of over -3%.

We see the recurring sign of strength that we can now be on your way to a new high for the year, to begin to establish us well above the 1650 points shortly. As late as in may, we noted in 1657 that the highest price levels in years.

However, there are always questions that need to emerge before this can happen.

We actually got a dagslägsta in 1631 on Wednesday, which in itself is negative. However, we did not have any direct volume during the 1640s during the day, which means that the decline is considered to be of minor importance.

However, if we would begin to establish ourselves in this intensity as 1630, when, for example, such a significant volume as we noted on Wednesday at the rise of more than 20 billion, yes then it may be worth to lend your ears to be more vigilant.

On Thursday, has been called both ”Supertorsdag” as a ”Triple Threat Thursday”.

In addition to Comey-hearing in the united states, where the prevailing political turmoil, inter alia, received the dollar on clear case last time, so there is a certain cautious optimism ahead of today’s trading.

Recent measurements before the british parliamentary elections today, suggests a victory for the Tories, however, the less margin than what the british prime minister, Theresa May hoped for. Even in the face of minimum bid rate of the ECB, pointing to leaks that we may get a positive statement on the economy, but to signal any exit from the expansionary monetary policy.

As we noted in yesterday’s morgonrapport as expected Brexit negotiations begin already on June 19.

For today’s trading we have technical resistance levels that await already at 1650, and in 1654 points, and the previous high for the year 1657, followed by more significant resistance at 1670 points. Technical support levels await even already at 1640 and 1630, followed by heavy sentimental heltalsnivån 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Hennes & Mauritz at new low for the year…

Morgan Stanley may indextunga the company on the case after lowered price target.

H&M continues south on Wednesday morning with over two percent, after that it appears that Morgan Stanley in a analysis from the on Monday lowered riktkursen for the company to 150, from the previous 160 sek.

Recommendation underweight is repeated, however, for the company.

The company has thus lost more than -16.6 percent since the end of the year.

Wednesday’s decline means that H&M note a new low for the year at the 211 dollars, and are thus in an increasingly stressful situation.

On the basis of a longer-term perspective also traded H&M has just under a heavy technical key level, which is negative.

The OMXS30 pushed clear of the indextunga the company on Wednesday, which has a indexvikt at over 7 per cent.

Fingerprint Cards soars over 7%!

Temporary turning point or genuine köpstyrka?!?

Fingerprint Cards soars over 7 percent on Wednesday morning, which means that the share is clearly different from the year just under 30 sek.

Since the end of the year notes share, a decline of more than -50 per cent.

The new positive sentiment has resulted in us challenging the resistance level 32), which proved to be hard to beat, since we had an establishment, under the technical nyckelnivån in may.

”As we previously stated, we expect inventories in the value chain shall be normalized at the end of this quarter,” said Christian Fredrikson in an interview with Redeye, which analysfirman laid out on its website on Friday, which gave positive reaction.

On Wednesday, it was revealed also that the company’s sensor in order that the company’s partner in the field of biometric payment solutions, Zwipe has received, from the two stakeholders in the payment card.

Evolution Gaming to new heights after the height of the price target.

Danske Bank believe that tillväxtsagan learn continue…

Evolution Gaming step initially 2 per cent on Wednesday, to new all-time high.

The company is a supplier of live casino system in Europe, and has been since the end of the year now risen over amazing 70 percent.

Fuel’s rise is Danske Bank, which raised the riktkursen for the company to 494 crowns, from the previous 431 sek.

Recommendation buy be repeated, and the bank believe that the tillväxtsagan is bound to continue.

”Despite a strong performance of the share price, we believe continued strong revenue growth thanks to the company’s well-established position in the market. At the same time, there are more to download from the four new customers before the launch. Finally, we do not rule out that the company can get the Swedish Games as a customer at a reregulation of the Swedish gaming market,” wrote the bank.

Danske Bank expects even during 2017-2019, an annual growth rate of around 22 per cent on the revenue side, while the earnings per share is expected to grow by 19 per cent, which is among the highest in the industry”.

Hålltider during the day

Company reports

- Clas Ohlson (at 7.00), Systemair (8.00), Oasmia (before börsöppning)

Ex-dividend

- K2A (5:00 kr in the preference share quarterly), SBC (1:10 kr.), the Tobin Properties (5:75 kr in the preference share semi-annually), XXL (2:00 nok)

Macro statistics

- United kingdom: RICS house price index of may at 1.00

- Japan: GDP (def) 1 kv at 1.50

- The netherlands: CPI may at 6.30

- Germany: industrial production april at 8.00

- RGK: the outcome of the state payments may at 9.30 am

- EMU: GDP (def) 1st qtr, 11.00,

- USA: new unemployed from weekly data at 14.30

- United states: Bloomberg consumer confidence veckoindex at 15: 45

- China: trade balance may

Other

- The ECB interest rate announcement at 13.45

- The ECB press conference with Mario Draghi at 14.30

- Uk: parliamentary elections

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange closed on Wednesday in positive territory, after opening at minus when the trade was started again after Tuesday’s break.

H&M was the biggest sinker in the index, while the Fingerprint Cards traded up sharply on the news from kortsegmentet. The news that the Spanish major banks have Santander buying the crisis-hit Banco Popular led to a lättnadsuppgång in the banking sector on the european exchanges and the Swedish bankaktierna was no exception.

At the time of closing had the OMXS30 has risen 0.2 per cent to the level of 1.641. Shares for sek 22.7 billion changed hands on the stockholm stock exchange.

Of today’s turnover low 2 billion on the network operator DGC in the form of internal mäklade items. EQT has submitted a mandatory offer on the DGC as recommended by the board of directors and the main shareholders. The upturn of the share, to just over budkursen 250 sek, almost 60 per cent and corresponded to the bid premium.

Most traded share was H&M, which fell 3.3 percent. On Tuesday pulled a profit warning from Macy’s down to companies in the retail sector in the united states, which is H&M’s measured in the number of stores the largest country, and on Wednesday came negative aktierekommendationer for the clothing line from both Today’s Industry and Morgan Stanley.

In the wake of the announcement that Santander is buying the ailing Spanish bank Banco Popular for € 1 in a transaction that is executed immediately, step banking shares around Europe. In Stockholm increased Swedbank and Handelsbanken most in the sector and peaks was written to 1.8 and 1.7 percent.

Sobi went against the grain and declined 1.8 per cent since the company announced that the operational head Alan Raffensperger ends.

At the other end of the storbolagsindexet advanced Fingerprint Cards more than 11 per cent after news that the company’s sensors in the smart card, which the partner Zwipe received orders from the two the producer of the card, which is a global so-called tier 1 operator.

Livekasinobolaget Evolution Gaming made the debut on the stockholm stock exchange following the move from First North and step on the day by 1.5 per cent to 440:50. Danske Bank has raised its price target for the share 431 494 sek.

Terranet, which recently debuted on First North, then turned downwards and fell 17.6 percent to 32:30 sek. Mjukvarubolagets share has otherwise risen by double-digit percentages in four of the five trading sessions since its listing, which was made to the course 13 crowns.

SCA has been lowered recommendation by Goldman Sachs to neutral from earlier buy, with the new riktkursen 305 sek (310). The stock was down 1.9 per cent to sek 299 sek at the closing.

IT-the dealer Dustin fell 2.4 per cent after a rekommendationssänkning from the purchase to the keep of SEB.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1640.54

3548.84

12672.49

7478.62

2433.14

21173.69

6297.38

19986.3

26027.44

1.13

9.78

8.69

45.99

48.41

0.16%

-0.15%

-0.14%

-0.62%

0.16%

0.18%

0.36%

0.01%

0.21%

-0.09%

-0.04%

0.04%

0.59%

0.73%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com