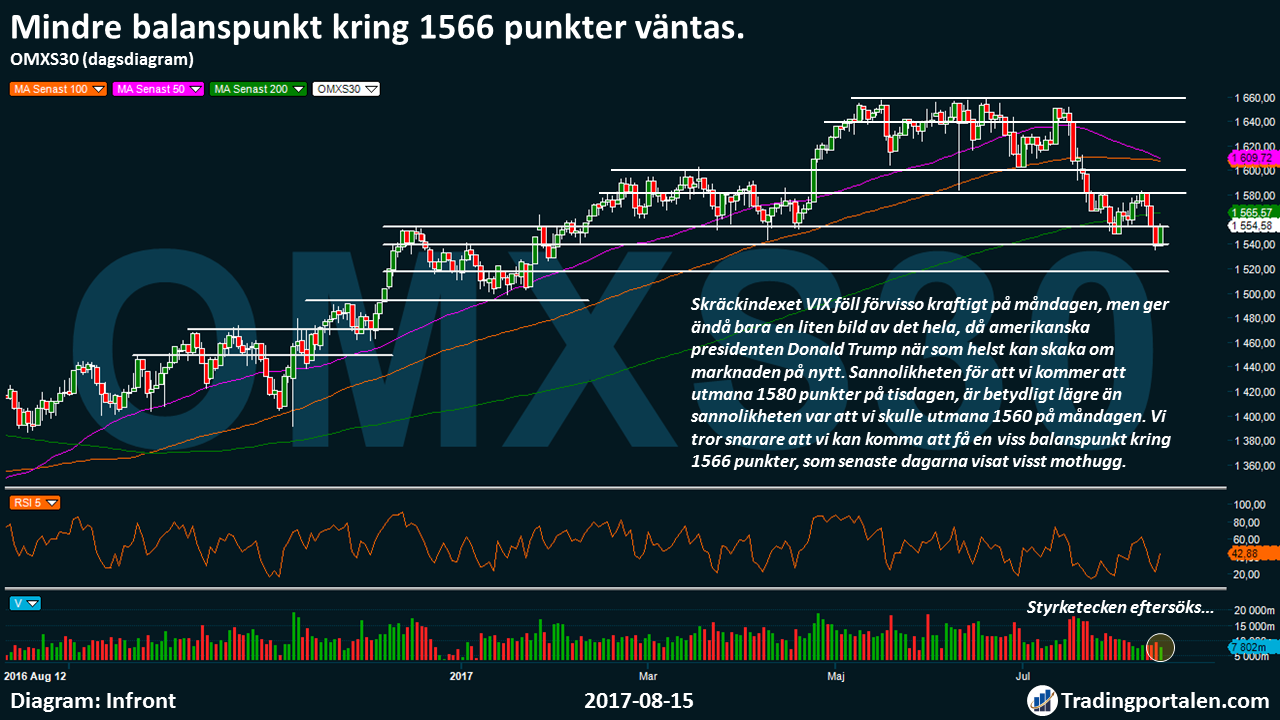

The week started in positive territory after risk appetite increased since the turmoil that previously characterized the market surrounding north Korea and the USA decreased. Around in Europe and the united states experienced broad gains, and at home step storbolagsindexet OMXS30 clearly more than expected. Storbolagsindexet closed at 1554.58, a rise of +1.01%. After overnight trading in Asia is the continued positive progressions, and we are turning the eye is already initially against technical resistance 1560 points.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Monday’s trading, the market was characterized around the world with a positive sentiment. Storbolagsindexet OMXS30 got properly pushed to the north, with the German ledarhunden the DAX in the throne, which rose +1.30%.

Even if the OMXS30 closed at 1554.58, noted storbolagsindexet a dagshögsta at just over 1556 points, just 4 points from the next technical resistance level at 1560 points.

We already wrote in Monday’s morgonrapport that if the vibes remained during this morning’s trading, was the likelihood that we would challenge the 1560 in the week high.

Much really left, we also have a short-term oversold territory on Monday, and we had a clearly stronger development than expected when concerns about north Korea and the USA decreased.

Leading futures point this morning that we can get an opening if the a couple of hours around 1560 points for the OMXS30 index.

This would mean that we already after two trading days may get turning their attention further north, towards the next stop 1580 points.

We highlighted also on Monday concerns about the weak growing of the sales force that remained in the picture at the end of the previous week. Despite the fact that we got a rise of +1.01% on Monday, was köpstyrkan in the OMXS30 not quite as dominant as we had desired.

This will be a piece of the puzzle, with the risk on Tuesday. We are seeking, therefore, a clearer domination from buyers on Tuesday, in order to reduce the risk of it is temporary breath we experience.

Skräckindexet the VIX fell indeed sharply on Monday, but still give only a small picture of it all, then us president, Donald Trump, when that time can shake up the market again.

The probability that we will challenge 1580 points on Tuesday, is significantly lower than the likelihood was that we would challenge the 1560 on Monday. We believe, rather, that we may come to have a certain balance point of around 1566 points, as recent days have shown some opposition.

In today’s makroagenda is German GDP in focus, at the same time as we get the CPI numbers both at home but also in the united kingdom. The united states will, in the afternoon, with both detaljhandelsiffror, and inventories. This week’s big focus from a macro-perspective will clearly be the u.s. central bank’s minutes from the FOMC meeting on July 26, which falls out on Wednesday night.

Large corporations have already submitted interim reports during the summer, but a few interesting stragglers on Tuesday, Tethys Oil and Storytel. On Wednesday, also the Ica and the Leo Vegas to be the focus among the reports, likewise, Oriflame on Thursday and Catena Media on Friday.

Ahead of Tuesday’s trade, we have technical resistance levels that await already at 1560 and 1580 points. Then await the sentimental heltalsnivån 1600 points as clear resistance. Nearby support is awaiting likewise, at 1540, 1527, 1517, and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

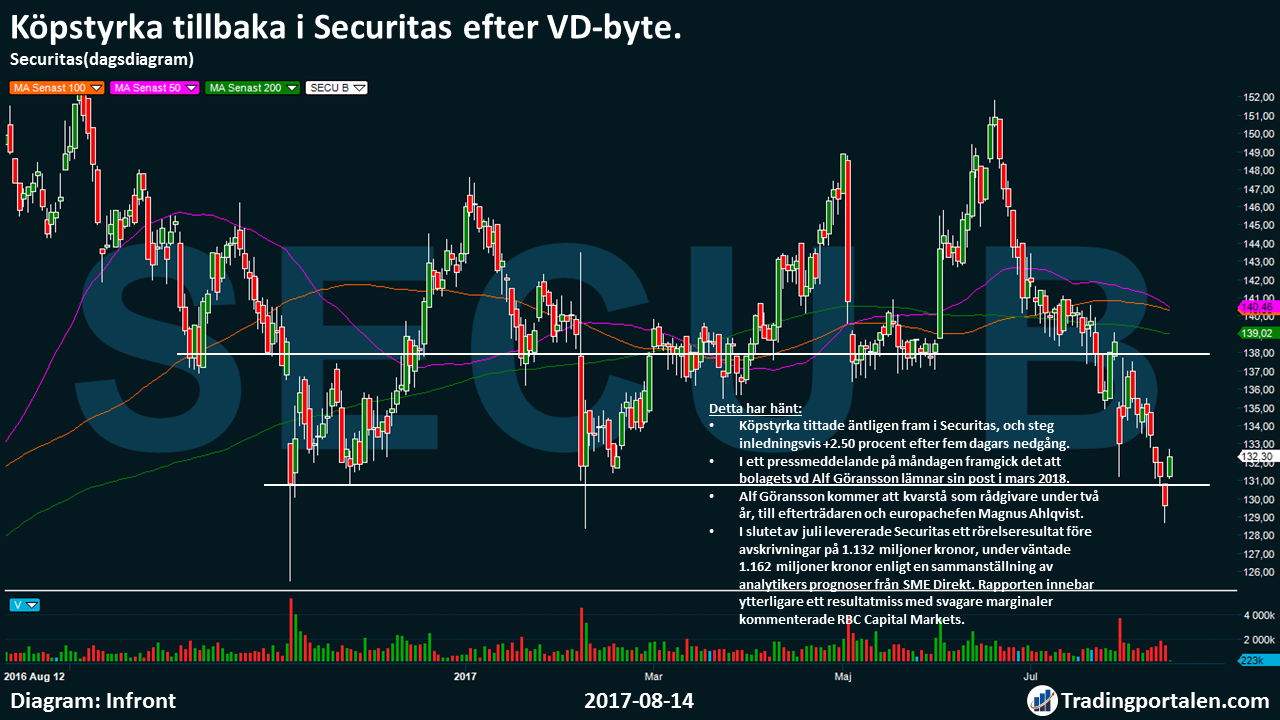

Köpstyrka back in Securitas after a change of CEO.

Köpstyrka finally looked up in the Securitas group, and step initially, +2.50% after five-day decline.

In a press release on Monday, it emerged that the company’s ceo Alf Göransson will leave his post in march 2018.

Alf Göransson will remain as adviser during the two years, to the successor and europachefen Magnus Ahlqvist.

At the end of July, Securitas ‘ operating income before depreciation and amortization of 1.132 million, during the waiting 1.162 million, according to a summary of analyst forecasts from the SME Directly. The report represented another resultatmiss with weaker margins, ” commented RBC Capital Markets.

Evolution Gaming back over 500 dollars.

Time to resume a steady upswing in the future?

Evolution is one of the shares, which topped the Large-Cap early on Monday, with a rise of +2.80%, and get thus back over 500 dollars on new.

The company got earlier in August at a new all time high at 537 crowns, then, we have received a steady decline until on Monday.

Most of the rise in riktkurser came in earlier in the end of July, with SEB at 515 sek, SHB at 590 kronor, Danske Bank on 545 sek, Nordea, 530 sek, which all repeated the recommendation buy.

The day before the river to rise riktkurser left the company interim report on 20 July, which was clearly better than expected, with 19.2 million (expected was 17.5).

The company’s CEO does not see any obstacles in the tailwind right now was very pleased with the quarter, and wrote, among other things, in the interim report that:

”In the last quarters of good momentum, with a strong and steady growth for all products, also continued in this period. Worth noting is that the gaming revenues that were generated via our platform from mobile devices for the first time exceeded 50 per cent during the quarter… We see further bets in the live casino of all of our customers, which is also increasingly promote their offers towards end-users… We expect an intense period during the rest of the year regarding the expansion of new environments”.

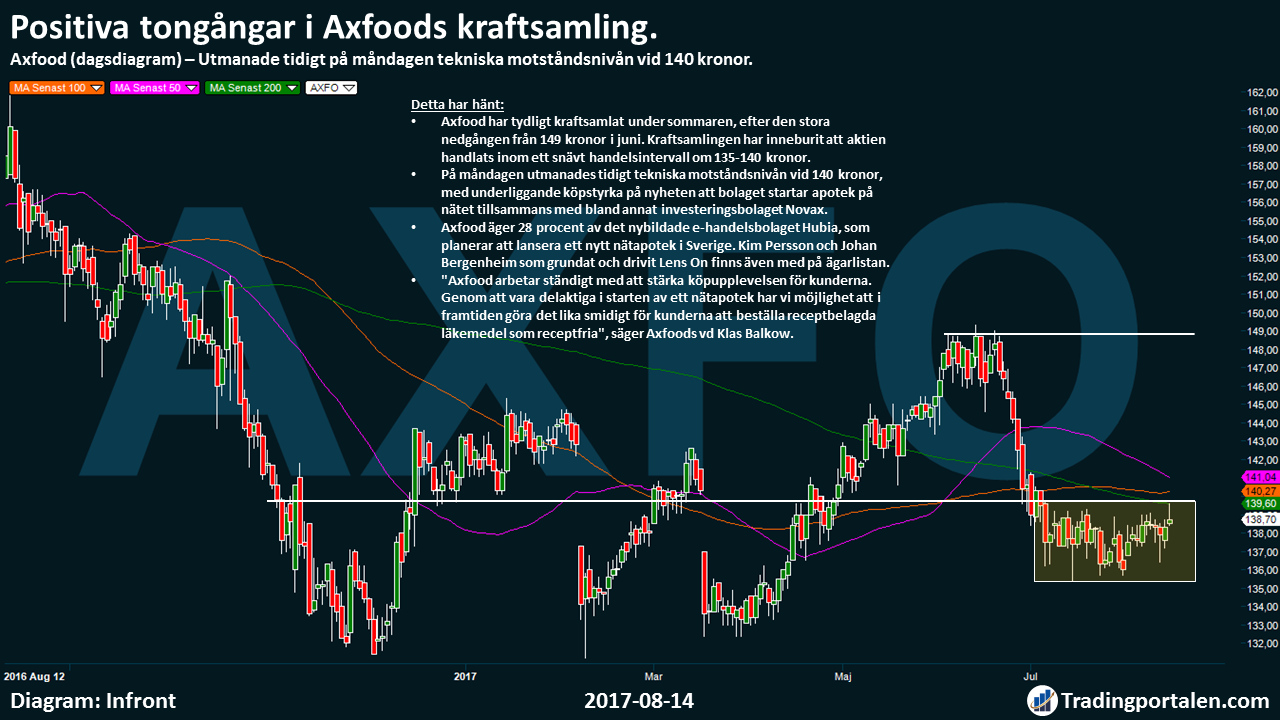

Positive attitude in Axfood’s focus.

Challenged early on Monday, the technical resistance level at sek 140.

Axfood has clearly gathered a during the summer, after the big decline from sek 149 in June. Build-up has meant that the share was traded within a narrow handelsintervall about 135 to 140 sek.

On Monday challenged early technical resistance level at 140 usd, with the underlying köpstyrka on news that the company start the online pharmacies together with, inter alia, the investment company Novax.

Axfood owns 28 per cent of the newly formed e-commerce company Hubia, which plans to launch a new online pharmacies in Sweden. Kim Persson and Johan Bergenheim, who founded and operated the Lens On is also available on the ägarlistan.

”Axfood works continuously to enhance the shopping experience for customers. By being involved in the inception of an online pharmacies, we have the opportunity in the future to make it as easy for customers to order prescription drugs over-the-counter,” says Axfood’s ceo, Klas Balkow.

Hålltider during the day

Company reports

- Tethys Oil ab (7.30), Eniro (8.00), Munters (8.00-8.15), Nordic Waterproofing (8.00), the Actic, Concordia

- Home Depot (15.00), Viavi Solutions (after the united states-the exchange closing)

Ex-dividend

- Pandora (9:00 dkk extra dividend paid quarterly)

Macro statistics

- Japan: industrial production (def) June at 6.30

- Finland: GDP and indicator June at 8.00

- Germany: GDP (prel) q2 8.00

- Statistics SWEDEN: CPI June at 9.30 am

- Uk: CPI July at 10: 30 a.m.

- Uk: PPI July at 10: 30 a.m.

- Uk: house price index (WED) June at 10: 30 a.m.

- USA: THREE veckoindex at 13.45

- USA: import prices of July at 14.30

- USA: Empire manufacturing index in August at 14.30

- U.S.: retail sales July at 14.30

- The united states: Redbook weekly statistics at 14.55

- USA: NAHB husmarknadsindex August at 16.00

- United states: stock of unsold goods in June at 16.00

- United states: oil (API), the weekly statistics at 22.30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange had, like most other leading european börsindexen a positive start to the new week. The concern that during the last week characterized the markets surrounding the north Korea/the united states put itself in part.

”The markets were concerned about a potential escalation in tensions between the united states and north Korea, something that could have a negative impact on what overall has been a good makromiljö. The VIX index lifted about 40 per cent on Thursday,” wrote Goldman Sachs in a marknadsbrev. The investment bank expects the period of low volatility, consists, so far, not the mix of growth and interest rates are moving in the negative direction.

Storbolagsindexet OMXS30 index closed down 1.0 per cent up on the level 1.554,6. Sales on Monday have been summarised to about 11 billion kronor on the stockholm stock exchange. On the continent steps the leading indices between 0.7 and 1.5 per cent, while volatilitetsindexet the VIX fell substantially.

Securitas has appointed Europachefen Magnus Ahlqvist as its new ceo for the company from march 2018. He will succeed Alf Göransson, who thus ends after eleven years as ceo of the säkerhetsbolaget. Shares climbed about 2 per cent. Than the bigger winner was Tele2 and Electrolux with the 2.1 and 2.5 percent boost at the same time that Fingerprint advanced 4.2 per cent.

SCA was the only OMXS30 company minus 1.3 per cent lower after a retreat on Monday afternoon.

Outside storbolagsindexet reported järnhandelskedjan Swedol a sales increase of 12.8 per cent in July to 172 million. Shares were up 3.5 per cent.

On Monday’s rapporthimmel was beroendevårdbolaget Kontigo Care. The second quarter showed a revenue growth of 36 per cent, but the result was still negative on the last line. The share was reduced to 6.5 per cent.

A number of the heavier reports of the store later this week. Among them are the ICA Group and Leo Vegas on Wednesday, Holmen and Oriflame on Thursday and Nibe and Peab on Friday. On Monday, the advanced, for example, Leo Vegas, just over 3 per cent.

Kambi started the week with a rise of close to 4 percent since it emerged that Brummer & Partners, through Bodenholm, increased its holding and that in addition, the Keel Capital purchased shares in the spelbolagsunderleverantören in August.

Börsveckan recommended in this week’s edition purchase of Momentum and Medicover while the wait was council for Mr. Green and Resource. Momentum and Medicover rose by over 4% and around 3 per cent, while Mr. Green dropped close to 2 percent.

Resource steps remains just over 1 percent. Than the bigger winner in the nischbanksektorn was, however, the Collector who turned up around 4 percent after four straight nedgångsdagar. The company has appointed Maria Lykken Ljungdahl from Kinnevik new cfo. In the last week, it was announced that Pia-Lena Olofsson to leave the Collector.

CTT Systems went down after Friday’s report and closed just over 4 per cent lower on Monday.

Finnish game developer Rovio, which is behind the mobile game Angry Birds, is planning an ipo. Sources of Bloomberg News report that investment banks shall have been engaged in an initial public offering for the equivalent of sek 16.2 billion. In the same sector was strengthened G5 Entertainment just over 6 percent in Stockholm.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1554.58

3450.66

12165.12

7353.89

2465.84

21993.71

6340.23

19798.99

27358.09

1.18

9.55

8.11

47.66

50.84

1.01%

1.30%

1.26%

0.60%

1.00%

0.62%

1.34%

1.34%

0.40%

0.05%

-0.06%

-0.12%

0.15%

0.22%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!