After initially slightly positive start on Thursday, it was a day with a subdued börshumör we experienced. It was broad downs, and storbolagsindexet OMXS30 index fell -0.4% to 1621 points. Turnover amounted to just over sek 13 billion on the stockholm stock exchange. Leading futures pointing to a continuation of the journey to the south, and the question is whether the support at 1616 points will keep today. American jobs are the focus in the afternoon, and is expected to contribute to volatility in the event of abnormal figures.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Thursday’s trading meant that we got a trade largely in the negative territory. OMXS30 index fell -0.4% to 1621 points.

The decline occurred, however, during the low volume, which means that we regard this as a temporary pressure on the downside.

Asia traded to the minus this morning, and even the oil has backed down over -1% in overnight trading.

Even if we see inledningsvisa movements to the south, traded despite the fact that the leading stock indexes in the U.S. closed negative on Thursday evening, the u.s. leading the S&P 500 semester on the weak plus this morning.

Finally, this week is expected to usher in the day in negative territory, and the focus in the afternoon lands on american employment.

Until we can get somewhat cautious movements at home as well, similarly, if we receive adverse figures in the afternoon that the volatility can increase.

After previous may-the outcome was a disappointment, as is now expected, the number of employed have increased by 177.000 people in June, and the unemployment rate remained at 4.3 percent.

Possibly can we also get a continued trading with lower trading activity in the coming trading days, not just because we now find ourselves now in the middle of summer, but also to rapportsäsongen starts in earnest, the second the next week.

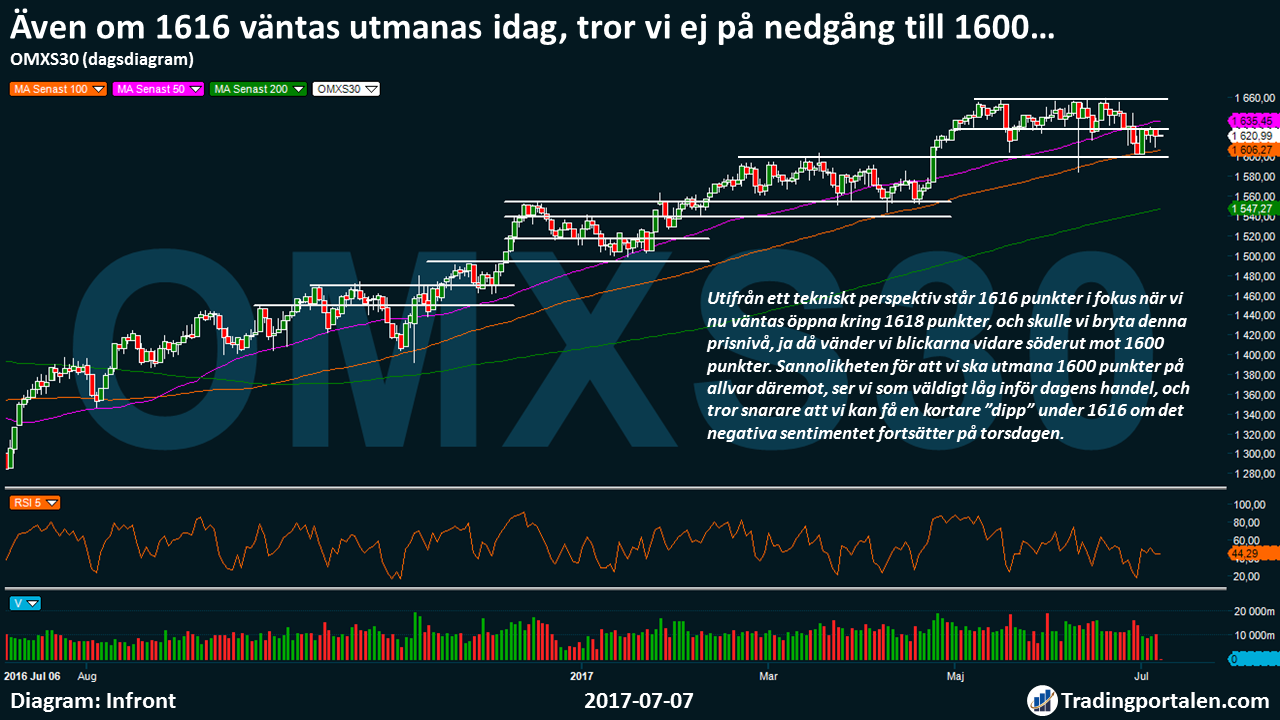

From a technical perspective, 1616 points of focus when we are now expected to open around 1618 points, and if we break this level, then we turn our eyes southwards towards 1600 points.

The probability that we shall challenge the 1600 points seriously, however, we see that very low ahead of today’s trading, and believe, rather, that we can get a shorter ”dip” in 1616, if the negative sentiment continues on Thursday.

Finally, we maintain our assessment that it may be time to step back to 1630-1650 points within the card, and think that this is a temporary phase of the breath, and profit taking before the quarterly reports.

Ahead of today’s trade await once again technical resistance levels for OMXS30 at 1630, 1640, 1650, 1658, and 1670 points. Underlying support levels, we find that around 1616 and 1600, then 1594, 1588 1580 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

The Volvo up and sniffs at the peaks…!

Forces before new heights?!?

Volvo rises above +1 per cent on Thursday, which means that the company’s share continues to be up and sniff at the previous peak levels.

A clear kraftsamlingsfas has been going on since the end of april, but continued underlying positive momentum since the middle of may, points to the ”waffles” may be about to get an outbreak to new heights.

For just a couple of weeks ago challenged 150 sek seriously, but was unable to find momentum enough for a trip further north, in tune with the subdued börshumöret.

Among Volvo’s latest riktkurser from analyshusen we find, among other things, Swedbank of sek 175, Handelsbanken of sek 180. Jefferies 165 sek, and Goldman Sachs at sek 146.

Positive attitude in the Boliden…!

Get the fuel to Thursday’s rise in Boliden replaces Sampo Nordea’s nordic model portfolio.

Boliden began initially clearly negative during the Thursday, with pressure from, among others, a weak trend in copper and zinc.

After it emerged that Boliden replaces Sampo Nordea’s nordic model portfolio, then turned the vibes on Thursday and Nordea steps initially +0.86%.

”We assess that the market is underestimating future growth, and we look positively on the company’s strong balance sheet and good cash flows that provide space for the transfer of capital to the company’s shareholders,” wrote Nordea, in its morgonbrev of Boliden.

Boliden is in a rising kraftsamlingsfas, with higher bottoms and tops since the middle of June, and may very well be on the way to get an outbreak for a return visit at 246 crowns, and kanaltak in the kraftsamlingsfas was going on earlier in the year.

Among the latest adjusted riktkurser for the company, we find that ABG Sundal Collier of 240 sek, JP Morgan at 230 kronor, Danske Bank Markets at sek 240.

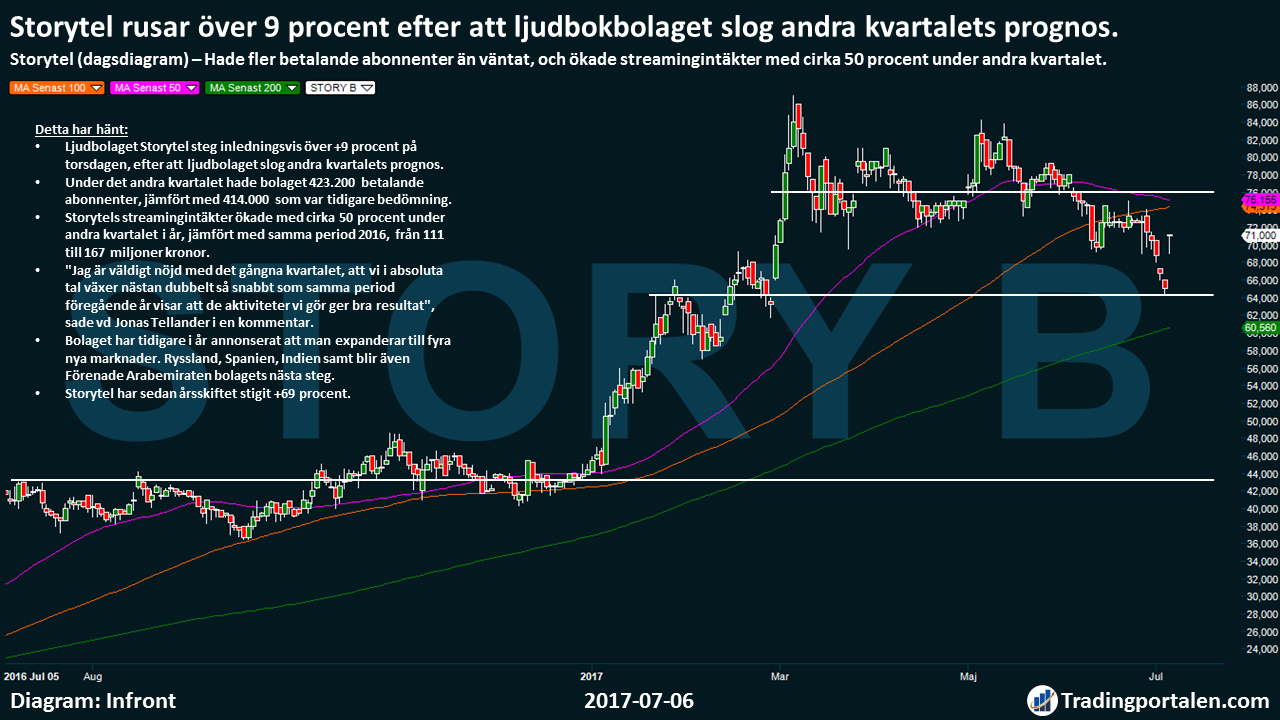

Storytel rushes over 9 per cent after ljudbokbolaget beat second-quarter forecast.

Had more paying subscribers than expected, and increased streamingintäkter by approximately 50 percent during the second quarter.

Ljudbolaget Storytel step initially over +9% on Thursday, after ljudbolaget beat second-quarter forecast.

During the second quarter, the company had 423.200 paying subscribers, compared with 414.000 which was the previous assessment.

Storytels streamingintäkter increased by approximately 50 percent during the second quarter of this year, compared with the same period in 2016, from 111 to 167 million.

”I am very pleased with the past quarter, that we, in absolute terms, is growing almost twice as fast as the same period of the previous year shows that the activities we do will give good results,” said ceo Jonas Tellander in a comment.

The company earlier this year announced that it is expanding into four new markets. Russia, Spain, India and even the United arab Emirates the company’s next step.

Storytel has since the turn of the year has risen to +69 per cent.

Hålltider during the day

Company reports

- Diös (at 7.00), Fabege (8.00), Platzer (8.00)

Ex-dividend

- Amasten (5:00 kr in the preference share quarterly), Balder (5:00 kr kv.the vis pref.share), Footway (2:00 kr-kv.the vis in the preferred stock), Hemfosa (1:10 sek on a quarterly basis in common stock), Hemfosa (2:50 kr kv.the vis in the preference shares ), Prime Living (2:13 £ preference share B quarterly), Urb-it (estimated first day of trading on First North)

Macro statistics

- Germany: industrial production may at 8.00

- France: industrial production may at 8.45

- SCB: hushållskonsumtion may at 9.30 am

- SCB: production business may at 9.30 am

- Uk: industrial production may at 10: 30 a.m.

- Uk: NIESR GDP estimate June at 14: 00

- United states: employment June at 14.30

- China: foreign exchange reserves June

Other

- Policy: The Institute Of Contemporary

- The G20 summit in Hamburg

- SAS: trafiksiffror for June at 11.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange fell gentle splashing on the Thursday. The oil market recovered slightly from Wednesday’s collapse of the market. Förlagsägaren Storytel was awarded for more revenue and more subscribers.

At the time of closing was storbolagsindexet OMXS30 index down 0.4 per cent to the level of 1.621. The stockholm stock exchange, had traded just over sek 13 billion. Major markets in Europe lost a little more, about 0.6% for the French CAC 40 and German DAX.

Ericsson fell 2.2 per cent. The Media points out a number of candidates for the new chairman of the board after Wednesday’s announcement that Leif Johansson will not stand for re-election in 2018. Ericsson’s not yet a year old, the president Börje Ekholm, the former Sony Ericsson-head and Vestas chairman Bert Nordberg, and Johan Molin, ceo of Assa Abloy and president of Sandvik, is mentioned – as well as the arguments for a non-american with a global network of contacts for potential sales.

Health care had the overall weak development in the US and Europe, and in Stockholm, dropped the Astra Zeneca and Getinge 1.7 and 1.3 per cent.

Fingerprint Cards was 1.4 percent higher. The trial against the former ceo Johan Carlström will not occur until 2018.

Volvo rose 1.2 per cent and the SSAB noted 0.4 per cent up, while most other companies lay on the minus.

Billerud Korsnäs assigned a buy recommendation when Goldman Sachs initiates coverage of the stock. Riktkursen was set to 170 crowns. The shares rose 1.3 percent to 137 kroner.

Deutsche Bank adjusted down the outlook for the Brent oil price to 60 dollars per barrel from 65 dollars for the year 2021.

As a result, lowered the bank also riktkursen for Africa Oil to 13:70 crowns from the previous 16 crowns and Lundin Petroleum to 170 from 182 dollars – and repeated the recommendation keep for both. and Africa Oil rose 0.1 per cent to the 12:80 sek, Lundin Petroleum dropped 0.6 percent to 162 kronor.

Xvivo advanced 1.6 per cent after announcement that the u.s. pivotal Novel study färdigrekryterats.

Storytel surpassed its forecast of the number of subscribers in the second quarter, while streamingintäkterna are reported to have risen by 50 per cent. Shares were rewarded with a rise of approximately 10%.

Endomines advanced 9 percent after having reported a gold production of 107 kg for the second quarter, an increase from 73,7 kg in the corresponding period in 2016. Mining and exploration company reiterates helårsprognosen about 300-350 pounds with the supplement it can be more if the second half of the year will be as good as the first, however, in new areas, ”with some degree of uncertainty with regard to the gold content”.

Promore Pharma became the latest in a line of kursdevalveringar immediately upon listing. The subscription price low at 23:30 Swedish kronor and its shares closed the first trading session at 13:sek 85, 41 per cent lower.

Djurhälsovårdbolaget Panion did on Thursday, its debut on the Market. The subscription price low on the 2 crowns. Also here was the listing of a disappointment for investors. The share was characterised by great volatility and closed for 1:16 sek, 42 per cent lower.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1620.99

3462.06

12381.25

7337.28

2409.75

21320.04

6089.46

19901.42

25373.8

1.14

9.64

8.45

44.93

47.53

-0.38%

-0.47%

-0.58%

-0.41%

-0.94%

-0.74%

-1.00%

-0.46%

-0.36%

-0.03%

0.05%

0.10%

-1.30%

-1.21%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!