Weak positive noises dominated the stock markets on Wednesday. Swedish storbolagsindexet OMXS30 index rose +0.57% to 1552 points. The turnover on the stockholm stock exchange amounted in the same period to 12.8 billion. The leading index in the US ended slightly in the plus, while the u.s. dollar continued to lose ground. Leading futures pointing to a introduction just below zero on Thursday. The question is if we get challenging of technical support at 1540, or if the continued consolidation in the 1540-1560 will dominate Thursday’s trading…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Sentiment shifted in early on Wednesday, and instead of challenging the technical support level at 1540 noted the greater part of today’s movement within 1550-1556 points.

In particular, the workshop looked köpstyrka forward, and lifted the mood, also was bank in a good mood. However, the strength is not fully sufficient on Wednesday as a whole to get a crystal clear picture.

Initially on Thursday, pointing the leading futures that we will start just below Wednesday’s closing price, around 1550-1551 points.

Short-term has 1550 emerged as a key level in the last four trading days, which means that the large part volume has been built up. This means that an early challenging of this level on Thursday morning can decide the pitch on Thursday.

A break and trade below, could mean that we get a larger part of the current movement in the lower part, towards 1540 points. Similarly, would the new köpstyrka for the second day in a row mean that we instead with high probability, trade within the 1550-1560 points.

Whether we get outbreaks from 1540-1560 depends entirely on buy alternatively of the sales force.

Sure we got something higher köpstyrka on Thursday, but at the same time, this is only a small part of the whole.

That the current week is still in a less sommardvala is clear, the turnover on the stockholm stock exchange is still relatively low, which on Wednesday was 12.8 billion.

When we are looking for sign of strength, as we do in case of an outbreak out of the clear handelsintervall and heavy support resistance levels to confirm the trend direction. Then we often look for a daily turnover of over sek 20 billion.

The united states is a great guide, similar to the German ledarhunden DAX. When it comes to the united states is an interesting observation that the u.s. dollar is now around the two year low levels, and we break below the 8 crowns of USDSEK, there is the possibility for a challenging of the 7 crowns in a relatively short time from a technical perspective. This would possibly be able to put a negative sentiment on the market.

Whether from a macro-perspective this is possible in the short term, is a completely different question, and the future may simply tell how it will be.

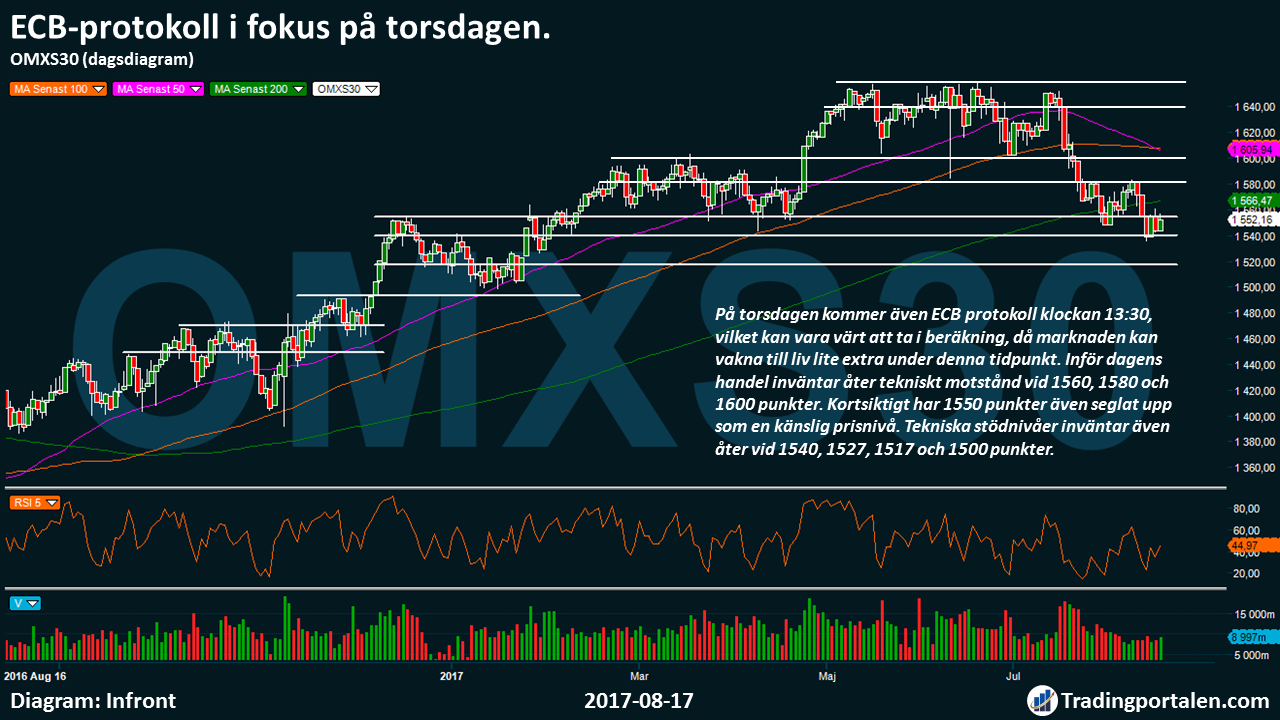

On Thursday will also be the GOVERNING protocol at 13:30, which can be worth taking into calculation, then the market can come to life, a little extra during this time.

Ahead of today’s trade await once again technical resistance at 1560, 1580 and 1600 points. Short-term has 1550 points also emerged as a sensitive price. Technical support levels await even again at 1540, 1527, 1517, and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Hålltider during the day

Company reports

- Ambea (at 7.00), New Wave (at 7.00), Oriflame (at 7.15), Mips (7.30), SSM (7.30), Volati (at 7.45), Acando (8.00), Alimak (8.00), AQ Group (8.00), Bonesupport (8.00), Eltel (8.00), Ratos (8.00), Bure (8.30), Fagerhult (approximately 12.00), Holmen (noon), Kabe, Midway (probably at 8: 30 am), Neurovive

- Wal-Mart (13.00), GAP (at 22.15)

Ex-dividend

- Genova Property (2:62 usd in preference shares)

Macro statistics

- Japan: balance of trade July at 1.50

- Australia: unemployment rate July at 3.30

- France: unemployment rate July at 7.30

- Austria: CPI July at 9.00 am

- Uk: retail sales July at 10: 30 a.m.

- EMU: trade balance June 11.00

- EMU: CPI (def) July 11.00

- USA: the new unemployed in the previous week at 14.30

- USA: Philadelphia Fed index in August at 14.30

- United states: industrial production July at 15: 15

- United states: Bloomberg consumer confidence veckoindex at 15: 45

- USA: leading indicators of July at 16.00

Other

- The ECB protocol at 13.30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was trading up on Wednesday and also on the leading european exchanges was a positive development. The market has in recent days shown a greater appetite for risk since the likelihood of armed conflict between north Korea and the US appear to have decreased. Mining companies got a boost from rising metals prices and also verkstadssektorn low in the top among large corporations.

Rapportfloden continues and there had dagligvarubolaget Ica it tough on the stock exchange while mobilspelbolaget Leo Vegas got the thumbs up.

At the time of closing had the OMXS30 index increased by 0.6 per cent to the level of 1.552. Shares for sek 12.8 billion changed hands during the day.

Ica’s adjusted results for the second quarter was slightly below what analysts had expected, according to SME Direkt prognosinsamling. For the largest sub-area of Sweden, which performed below expectations, its operations have had a development that was close to market developments during the second quarter. Ica shares were punished with a decline of 6.5 per cent.

Leo Vegas report for the second quarter of invited instead of a result of analytikerprognoserna and a comment on that July has begun, ”really strong”. Share strengthened to 13.4 per cent.

Elsewhere in the rapportfloden showed the clothing company Odd Molly increased loss in the second quarter, and its shares slumped 9.7 per cent. Troax, which sells perimeter protection for indoor use, gave greater profits, and an organic growth of 26 per cent in the second quarter, the share price rose 5.8%.

Precise Biometrics Biometrics results are melted down to just over break even in the quarter. Projections were repeated for the full year, but the increase in volume among the company’s customers reported to be difficult to assess. The shares declined 1 percent.

Several major base metals had a positive development on Wednesday, including the step price of zinc the price to its highest level since 2007. Among råvarelaterade companies on the stockholm stock exchange advanced Boliden by 3.7%, and Lundin Mining by 4.3 per cent and on the other Europabörser also joined the sector strong.

A series of workshops, belonged to kursvinnarna among large corporations in Stockholm, among them Atlas Copco, SKF, ABB and Sandvik, with kursökningar around 1,4-1,8%. In the bottom among the OMXS30 companies low Fingerprint Cards, when the shares lost more than 4 percent.

Elekta has received a height recommendation to overweight from previously neutral by JP Morgan. The stock was up 2.6 per cent.

On rekommendationsfronten has also Intrum Justitia received the council of overweight when the JP Morning initiated coverage of the company. Shares were rewarded with a rise of 2.7 per cent

Kepler Cheuvreux has initiated coverage of Mekonomen with a buy recommendation. The shares climbed 2.1 per cent.

First North-listed Arc Aroma Pure, as handelsstoppades on Tuesday afternoon, announced after tisdagsbörsens closing it is negotiating with Alfa Laval Copenhagen a kommersialiseringsavtal on olive oil production during platform Olivecept. The shares rushed for 13.7 per cent on Wednesday.

The business community recommends the purchase of the Railway, while the SCA will get the recommendation to wait. Cloetta rose 1.7 per cent while the SCA increased 0.7 per cent.

First North-listed Savo-Solar, a Finnish solfångartillverkare, vinstvarnade after the lower order intake than expected and the price plummeted 19%.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1552.16

3484.57

12263.86

7433.03

2468.11

22024.87

6345.11

19716.14

27408.66

1.18

9.5

8.07

46.93

50.51

0.57%

0.65%

0.71%

0.67%

0.14%

0.12%

0.19%

-0.07%

0.00%

0.06%

0.00%

-0.05%

0.32%

0.48%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!