A somewhat weak trading, lifted the OMXS30 index on Wednesday. Storbolagsindexet rose +0.34% to 1627 points, when the turnover on the stockholm stock exchange amounted to sek 13 billion. Leading futures point to a positive introduction this morning, despite the fact that Asia notes less losses after the night’s trading. Already initially expected to open around the technical resistance level of 1630 points…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

On Wednesday managed OMXS30 lift mood, and just before closing, we also succeeded in noting a dagshögsta just below the 1630 points.

Already on Wednesday, we highlighted the question of whether we are now on our way to challenge 1630, the seriously. Leading futures is pointing at the time of writing that we may come to have a slightly positive opening on a couple of hours, which would mean that we then challenge the technical resistance level as 1630 points.

If momentum manages to keep itself on Thursday, would this help with clear positivity, if we can close above this technical key level.

On Wednesday, we got instead a negative initial movement, which, however, was taken over by köpstyrka directly, as soon as we challenged the technical support level 1616 points.

This means that the 1616 points increasingly gained importance, now that we are short-term received a consolidation phase within this range as the 1616-1630 points.

Within this range we have a movement that is broadly observes a large part of the trading volume in the upper part of this handelsintervall, which is positive.

This indicates, as we have previously highlighted that the underlying köpstyrka is left in the image.

However, it is still alarming that we have such significant movements to the south on a couple of occasions, in addition, in the high trading activity.

It is also negative that we have not received any significant advantage from buyer, once we have taken back the land after the last pressure on the downside, which was about to challenge the 1600 points seriously.

Us senior semester is traded, however, after the night’s trading just below zero, but gave at the same time not any greater guidance on the Wednesday morning, and need to thus not do so during this summer morning.

We also get some makrobesked today that can give a certain impact. Already at 08:00 we get industrial orders from Germany, afterwards at 14:15 we get ADP private employment in June from the united states.

At 13:30 we get the minutes from the monetary policy meeting in June from the ECB, here we see a bit more opportunities to see the movements in, inter alia, the euro.

We often talk about the sektorrotationer, and real estate is a sector which looks all the more interesting. It will also be extremely interesting, if the interim reports will give strength to a trip to the north with several positive sektorrotationer, and create the sommarrally we highlighted in the OMXS30 analysis on Monday.

If the majority of indextunga companies would come up with the reports, below expectations, well then instead, the risk increased that it will be a wet summer to come back from after the holidays.

We wrote on Wednesday that the dollar has a correlation with the mood of the stock market, and the USDSEK has now been strengthened during the night and is now at 8.50.

Finally, it means that we now believe that the probability of the fact that we will now get a movement back above the 1630 points, which we highlighted already in Wednesday’s morgonrapport. Moreover, we believe that at a further slightly positive momentum, we can get a motion back to the handelsintervallet 1630-1650, in order to challenge kanaltaket 1650 points seriously.

Ahead of today’s trading awaiting like yesterday technical resistance levels for OMXS30 at 1630, 1640, 1650, 1658, and 1670 points. Underlying support levels, we find that around 1616 and 1600, then 1594, 1588 1580 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

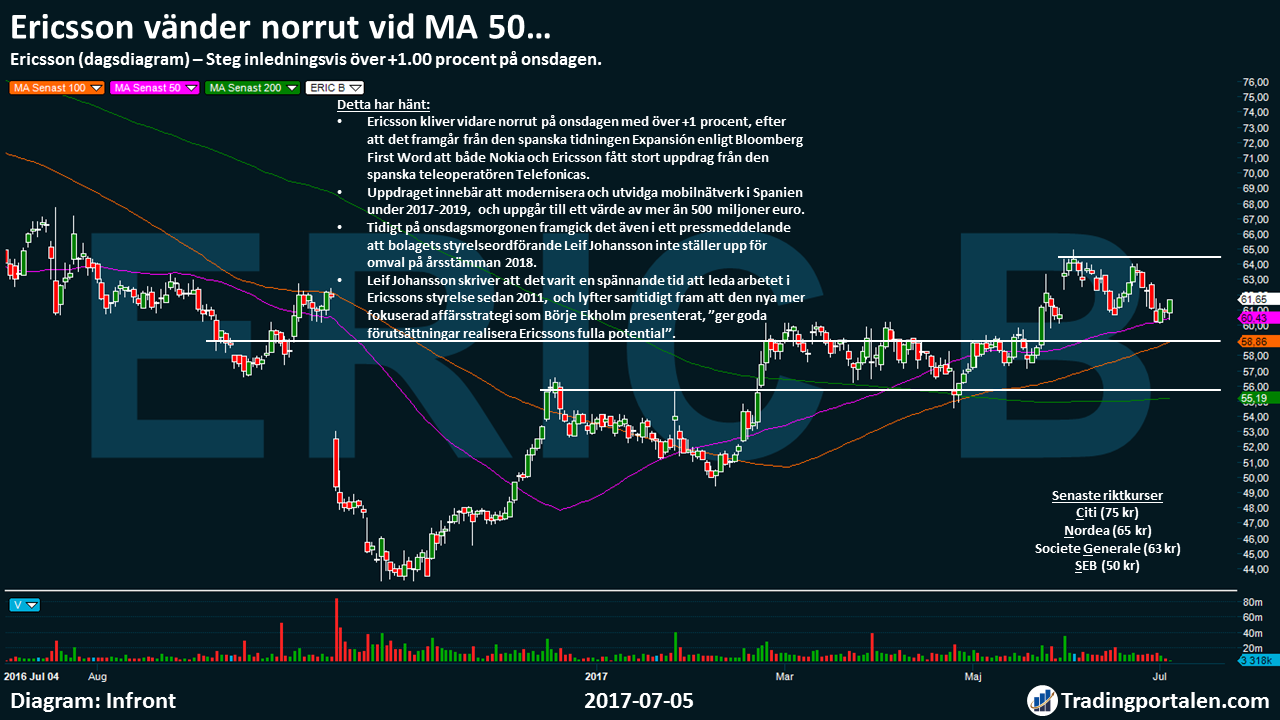

Ericsson turns to the north, at the MA 50…

Step initially over +1.00% on Wednesday.

Ericsson step further to the north on Wednesday with over +1%, after that it is clear from the Spanish newspaper Expansión, according to Bloomberg First Word to both Nokia and Ericsson had a large mission from the Spanish telecommunications operator, Telefonica.

The mission is to modernise and expand the mobile phone networks in Spain, during 2017-2019, and amounts to a value of more than eur 500 million.

Early on Wednesday morning stated in a press release that the company’s chairman of the board Leif Johansson will not stand for re-election at the annual general meeting in 2018.

Leif Johansson writes that it has been an exciting time to lead the work of Ericsson’s board of directors since 2011, and lift at the same time forward to the new, more focused business strategy that Börje Ekholm presented, ”providing good conditions to realize Ericsson’s full potential.”

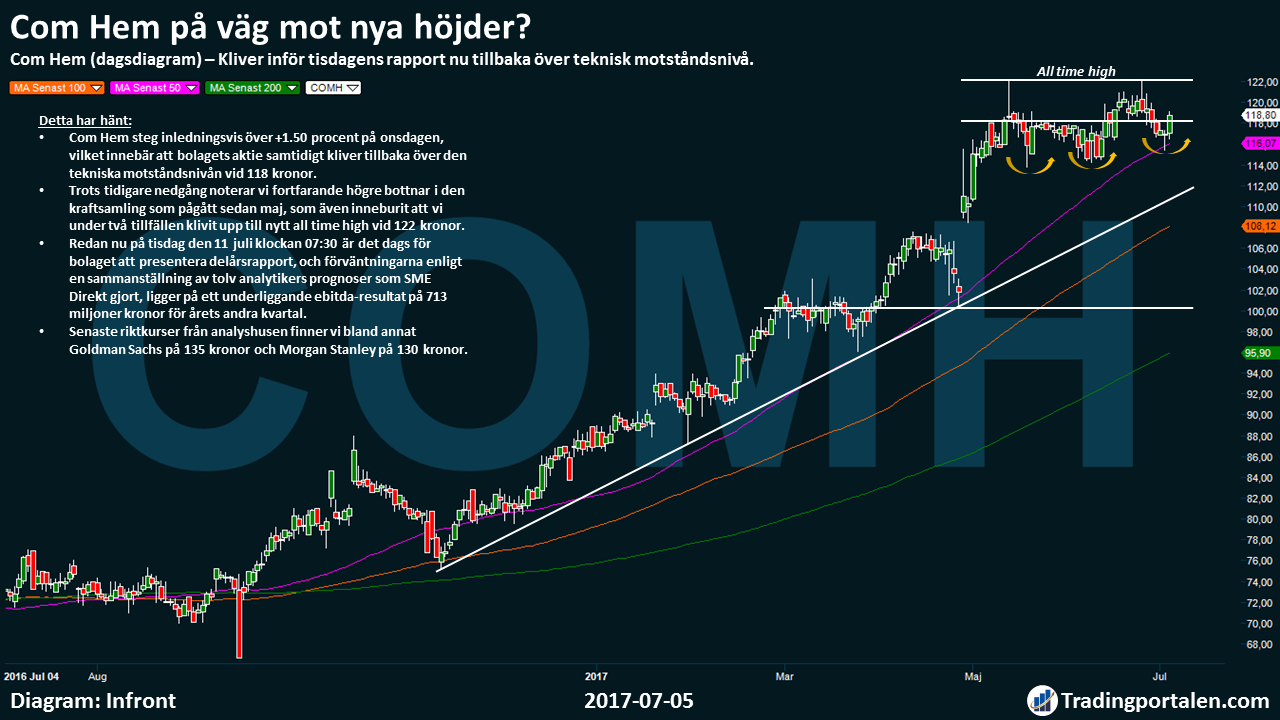

Com Home on the way to new heights?

Step ahead of the Tuesday report is now back above technical resistance level.

Com Home of the step initially over +1.50% on Wednesday, which means that the company’s share at the same time, step back above the technical resistance level at 118 kronor.

Despite previous decline, we note the still higher bottoms in the major efforts that have been going on since may, which also meant that we during the two occasions stepped up to a new all time high at sek 122.

Already on Tuesday, 11 July at 07:30 it is time for the company to present interim report, and the expectations according to a compilation of twelve analysts are forecasting that the SME made, located on an underlying ebitda of eur 713 million for the second quarter of the year.

Latest riktkurser from analyshusen we find, among other things, Goldman Sachs for 135 sek and Morgan Stanley in the 130 sek.

The gaming company Cherry moving towards the MA 200…?

The company’s share slopes for a second day in a row after hedgefondfirma flagged for a short position on Monday.

For the second day in a row falls gaming company Cherry, after on Tuesday to become pressed when hedgefondfirman Hutchin Hill on Monday flagged a short position in the gaming company.

The company’s share has now declined around -11 per cent since then, and now takes everything closer to the step the long-term partner in the form of MA 200.

The sales force has also come to life properly on Wednesday, but have not managed to find the strength enough to step below the support level at 52.50 crowns.

”A short sale can trigger people to take profits. But it is noticeable no news indicate that the value in the Cherry has changed. Investors should focus on underlying fundamentals and not the daily aktiekursfluktuationer”, commented Kristoffer Lindstrom, an analyst at Redeye, the News agency Directly.

Even if rapportsäsongen will started, slowly but surely, so that leaves not Cherry interim report until 24 August.

Hålltider during the day

Macro statistics

- The netherlands: CPI June at 6.30

- Germany: industrial orders may at 8.00

- SCB: småhusbarometern June at 9.30 am

- United states: Challenger varselstatistik June at 13.30

- US: ADP private employment June at 14.15

- USA: new unemployed from weekly data at 14.30

- United states: trade balance may at 14.30

- United states: Markit services PMI (def) June at 15: 45

- United states: Bloomberg consumer confidence from weekly data at 15: 45

- The US: ISM service PMI June at 16: 00

- USA: oil stocks (DOE), weekly statistics 17.00

Other

- Norwegian: trafiksiffror of June at 8.00

- ECB: the minutes from the monetary policy meeting in June at 13.30

- Panion: the first day of trading on Aktietorget

- Policy: The Institute Of Contemporary

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was up slightly on Wednesday, with a decline in the price of oil.

After eight days of gains, oil prices by more than 3 percent on Wednesday afternoon, without the immediate causes although Russia previously expressed negative feelings about the continuation of the agreements with the oil cartel Opec.

In Europe, dropped the oil companies, just over one per cent, while the major stock markets were slightly up slightly less than in Stockholm. Lundin Petroleum fell 2.5 per cent.

In Stockholm was storbolagsindexet OMXS30 index 0.3% higher to the level of 1.627 at the time of closing. The entire stock market had traded 13 billion.

Ericsson chairman Leif Johansson is not up for re-election at the annual general meeting in 2018 and the nomination committee has initiated work to find a replacement. Shares rose 1.9 per cent.

Nokia and Xiaomi has signed a cooperation agreement and a multi-year patentavtal with cross-licensing of the companies ‘ mobile patents. Xiaomi also buys patenttillgångar from Nokia as part of the transaction. Nokia rose 0.7 per cent.

Autoliv got the height recommendation to buy from the keep of the Carnegie with a new price target of 1,100 kronor, up from sek 900. The result is likely to rise by double-digit percentages for several years, according to an analysis. Shares closed 2.7 per cent up.

The district court overturns two previous members of the Fingerprint Cards to the board for roughly the insider dealing offence. The news did not give the impression in the course and the stock closed 1.4 per cent up after the downs on Tuesday.

Search and annonsbolaget Eniro extends the acceptance period for a utbyteserbjudande of preferred stock and convertible debentures to 26 July, only 68% accepted. The plan for the recapitalization is subject to the owner equivalent to at least 95 percent approve of the settlement. The stock was down about 1.6 per cent.

Polygiene climbed 8% after having raised the financial targets for the next five years. The company was preparing to change its listing from First North to First North Premier in 2017 or 2018.

IT-the dealer Dustin reported profit after tax of 47.5 million, compared with a 49.4 for the same period last year. The shares closed 0.7 per cent down.

The holding company Industrivärden, reported that the total return was 22 per cent in the first half of 2017. Share three 0.7 per cent.

Data in Today’s Industry claiming that the government is ready to drop the requirement on the gains in welfare and, instead, to seek a compromise with the Moderates and the Liberals is not true, says finance minister Magdalena Andersson. In the sector was listed Academedia and Attendo for gains of around 2 per cent.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1627.21

3478.41

12453.68

7367.6

2432.54

21478.17

6150.86

19969.45

25440.35

1.13

9.63

8.5

45.49

48.17

0.34%

-0.03%

0.13%

0.14%

0.15%

-0.01%

0.67%

-0.56%

-0.32%

-0.11%

0.08%

0.20%

0.80%

0.80%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!