After an initially trading was on track to challenge the high for the year, there was a rebound a few hours before closing. Storbolagsindexet OMXS30 index closed Monday at -0.11 percent at 1643.5. Sales amounted again to 15 billion kronor on the stockholm stock exchange. Leading futures point to a slightly more cautious börsöppning this Tuesday, despite the fact that we are experiencing a weak positive sentiment after overnight trading in Asia.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

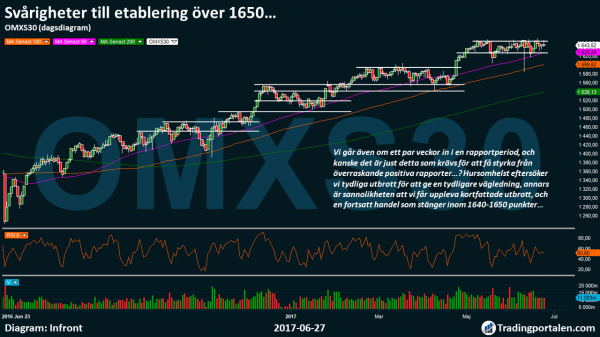

Already initially during Monday’s trading, we managed to step over the technical resistance level 1650 points.

The positive momentum that was experienced meant that we took note of a dagshögsta at 1655 points on Monday, just under the heavy technical resistance level 1657 points, and the high for the year 1658 points.

When we then experienced a rebound a couple of hours before the trade closed, we note the greatest volume around 1651 points, which gives a confirmation that we are not only of great interest at 1650 points, but also to the underlying köpstyrka is left in the image.

Leading futures point this morning at a slightly more cautious movement, this despite the fact that we are experiencing a weak positive noises around the Asia.

Us senior semester, the S&P 500 also traded at zero after the night’s trade, and thus provides a guidance that strengthens our position on a pending motion.

In today’s makroagenda we hold, inter alia, trade balance and PPI in may at home. During the afternoon we also have the american statistics regarding the Redbook, and oil stocks.

The oil which clearly lost ground in recent times has re-gained the focus, however, we are experiencing not any clear correlation so far.

As we finished Monday at 1643.5, does this mean that we are faced with today’s trading is again expected to open within its prior range 1640-1650 points.

Brief outbreak similar to what we experienced on Monday occurs continuously, however, are seeking we previously pointed out, the strength of the brief momentum that occurs, otherwise the risk is that we get to temporary establishments above and below resistance and support.

In Monday’s weekly OMXS30 analysis, we highlighted that we now find ourselves in a period which historically can give strength, and perhaps it is now approaching an outbreak as early as this week over 1658 points, in order to succeed take us up to the all time high of 1720 in the cards?

We also go on a couple of weeks into a reporting period, and perhaps it is precisely this that is required to get strength from the surprisingly positive reports…?

Either way are seeking, we clear the outbreak in order to give a clearer guidance, otherwise it is the probability that we get to experience brief outbursts, and the continued trade that closes in the 1640-1650 points. Possibly we can even go down and test the kanalbotten in the wide handelsintervallet 1630-1650.

However, we are continuing to experience a clear focus, and the underlying köpstyrka behind-the-scenes, and believes that there is a high probability that a distinct outbreak with strength can give a nice jolt to the north.

Technical resistance levels await once again at 1650, 1658, followed by 1670 points. Support levels await hence also in 1640, 1630, and 1600 points.

What hålltider and the company reports the next weeks you can read here.

Hålltider during the day

Macro statistics

- China: gains in manufacturing may at 3.30

- SCB: PPI may at 9.30 am

- Statistics SWEDEN: the trade balance may at 9.30 am

- USA: THREE weekly statistics at 13.45

- The united states: Redbook weekly statistics at 14.55

- US: the S&P Case/Schiller husprisdata of april at 15.00

- United states: household confidence indicator June at 16: 00

- United states: oil (API), the weekly statistics at 22.30

Other

- The riksbank: the executive board meets at 9: 00 am

- Riksbank: reparesultat at 10.15

- The Fed: Janet Yellen attends event in London on the global economic issues at 19.00

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The Stockholm stock exchange traded initially with a positive tendency, but closed since Monday in the negative territory.

Storbolagsindexet the OMXS30 was at the closing down 0.1 per cent. Turnover on the nasdaq omx stockholm was just over sek 15 billion.

The OMXS30 was led by the oil company Lundin Petroleum, which recorded a 1.2 per cent higher. Worst in storbolagsindexet went there for Boliden, which lost about 2 percent.

Overall, the european stock markets rose slightly on Monday, with the Italian stock exchange about 0.8% higher, which was the best in Europe. The banking sector has gone well in Italy after it reached a solution for the troubled banks of Veneto Banca and Banca Popolare di Vicenza.

Among smaller oil companies advanced Enquest 4 percent after news that flaggskeppsfältet the Kraken have begun to produce oil. Enquest has said that production at the field would be up and running by mid-year, which thus become the case. Enquest controls 70.5 per cent of the Kraken, a field with estimated maxproduktion of approximately 50,000 barrels per day.

Kappahl lifted just over 7 per cent on the stockholm stock exchange ahead of Thursday’s quarterly report. Kappahl took place in Nordea’s Swedish model portfolio for the benefit of Telia, which has made their. The bank justifies the adjustment of the market for the negative to Kappahl. During the Monday received disclosure from the Swedish financial supervisory authority to File Limited increased its holding in Kappahl to 5,02% of the share capital and votes.

Georgi ” strengthening freedom, security, managing director at it-the dealer Dustin since 2012, has been appointed the new ceo of Kinnevik effective 1 January 2018. Kinnevik’s prospective president intends to build up a ”considerable long-term shareholding” in Kinnevik.

Among Georgi Ganevs benefits lifted the company’s chairman until telekombranscherfarenheterna from five years in Tele2 and the next president-a job in the sector, as well as the trip with Dustin from the relatively small to the listed company. Kinnevik rose 0.3 per cent while Dustin was down 1.4 per cent.

Two brazilian subsidiaries of Getinge is being investigated for suspected cartel, according to a press release from the company on Saturday. Getinge has 1 per cent of its concern sales figure in Brazil, its share price dropped 0.7 per cent.

On makrofronten showed the IFO index of the climate in the business world in Germany, an unexpected rise 115.1 in June, from eur 114.6 in may. Juniutfallet was the highest since 1991. From the other side of the Atlantic, it was announced that orders for durable goods in the U.S. fell 1.1 per cent in may compared with april, which was more than analyst’s expectation of a drop of 0.6 per cent, according to Bloomberg News.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1643.52

3561.76

12770.83

7446.8

2439.07

21409.55

6247.15

20223

25894.55

1.12

9.75

8.72

43.48

46.18

-0.11%

0.51%

0.29%

0.31%

0.03%

0.07%

-0.29%

0.35%

0.09%

0.05%

0.10%

0.00%

0.23%

0.30%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com