The OMXS30 leveled out on Thursday after initially volatility. Storbolagsindexet rose +0.18%, while the turnover on the stockholm stock exchange was sek 12.2 billion. The united states lost ground in the evening and finished to slightly less, although this is traded Asia in positive territory after overnight trading, and this week’s last trading day points to a pending motion in limine for the OMXS30…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

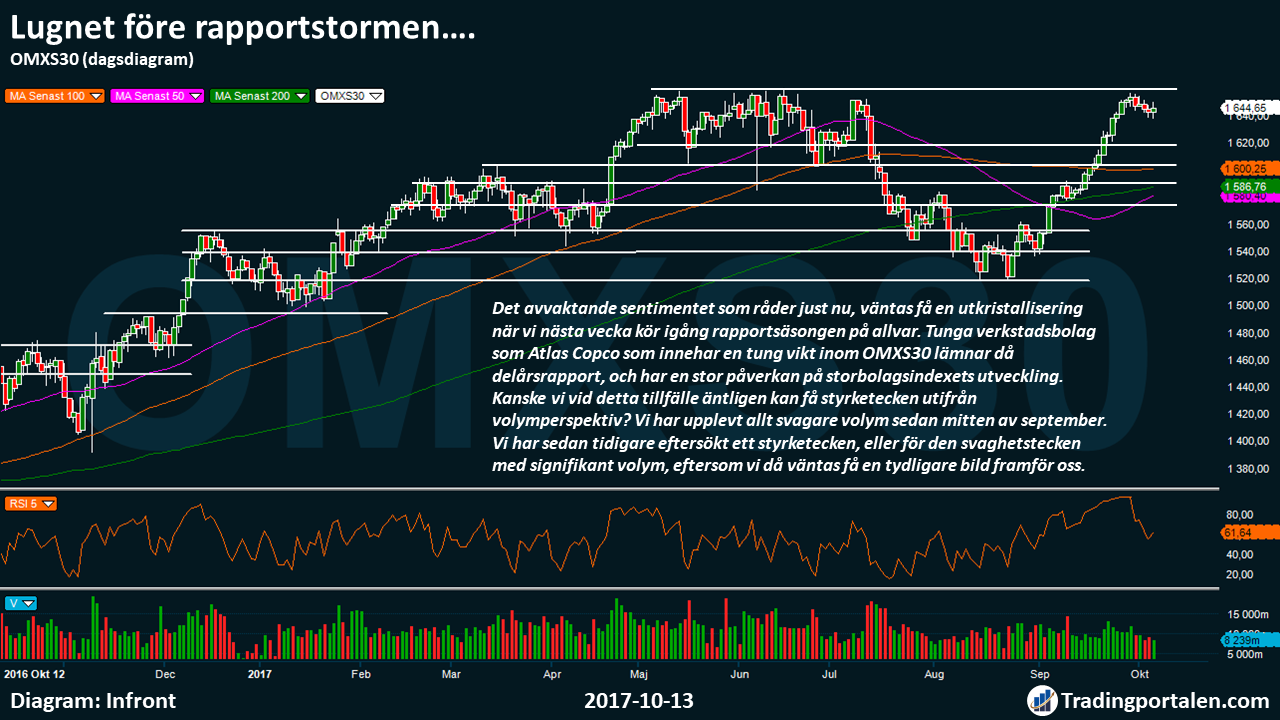

It is all the more weaker volume we are experiencing for the next week, then several indextunga corporation launches rapportsäsongen seriously.

The OMXS30 step under conditions of low köpstyrka and sales on Thursday, which clearly reinforces this point of view, with cautious movements that we previously highlighted as a scenario.

In the short term is maintained, the mark of 1640 points in the big move, and it was hardly damaged if we get a consolidation in the next few trading sessions, to gather forces before the outbreak.

OMXS30 index is not technically overbought longer, which means that the space is on the upside, at the same time as utvädring and less profit taking can still get up over the surface.

According to a leading futures it is a cautious introduction as expected, with a couple hours left until the stockholm stock exchange opens the week’s last trading day.

U.s. leading the S&P 500 trade displays just above the surface after the night’s trading in Asia, and if this strengthening increasingly closer to the börsöppning, it can be slightly positive development that dominates initially.

Already on Thursday were the OMXS30 on the way to challenge the 1650 points, but noted only a dagshögsta on 1649.50, which is very much in line with that, we are still keeping an eye toward 1650-1656 points.

The cautious sentiment that exists right now, is expected to get a utkristallisering when we next week start rapportsäsongen seriously. Heavy engineering companies such as Atlas Copco, which holds a heavy weight in the OMXS30 leave when the interim report, and has a great impact on storbolagsindexets development.

Perhaps we, on this occasion, finally get a sign of strength on the basis of volymperspektiv? We have all experienced weaker volume since the middle of september. We have previously sought after a sign of strength or sign of weakness with significant volume, since we are expected to get a clearer picture in front of us.

We are aiming at a positive outbreak, then we also raised the bar in our weekly newsletter to 1700 points in the year. However, it is a difficult to judge position when the rapportsäsongen beats out all the previous expectations over a short period of time, technically as well fundamentally.

This will also be the focus of at least a couple of weeks ahead of us, then normalize and return to a more technically driven market.

In the big move remain, therefore, we are still trading within 1640-1660 points, with the possible movements to the technical support at 1618 points.

For today’s trading are awaiting the technical key levels, with resistance at 1650, 1657, followed by 1660 points. Support await once again at 1640, 1630, 1616 and 1600 points.

No major corporate events will be at home today in addition to Clas Ohlsson which leaves the sales figures for september. In the U.S. we get reports from Bank of America and Wells Fargo in the early afternoon.

The G20 holds press conference at 18:30 on Friday, and can get a provide movements in the foreign exchange market at the unexpected statements. Otherwise, among other things, CPI, retail sales, Michiganindex in focus in Friday in the united states on makroagendan.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Kappahl soars after report!

The company’s shares rose initially +15.0% on Thursday.

On Thursday unveiled the Kappahl an operating profit of sek 139 million for the fourth quarter (June-August) in the split financial year 2016/2017.

Klädbolaget knocked sharply analysts ‘ expectations of an average of an operating income of 111 million.

Dividend per share proposed 2:00 kronor, compared with the expected 1:92 crowns.

Inventories amounted to 726 million at the fourth quarter(as at last August), compared with 820 million the same period the year before.

”During the year, several since the previous launch changes borne fruit. It applies, in particular, further adjustments of the range as well as price and promotional strategies, which impacted revenues and gross margins positively. Our control over operating expenses continued to be favorable,” wrote the company’s ceo Danny Feltmann.

In a press release, the board of directors in KappAhl an extra dividend of sek 6.50 per share via an automatic redemption procedure.

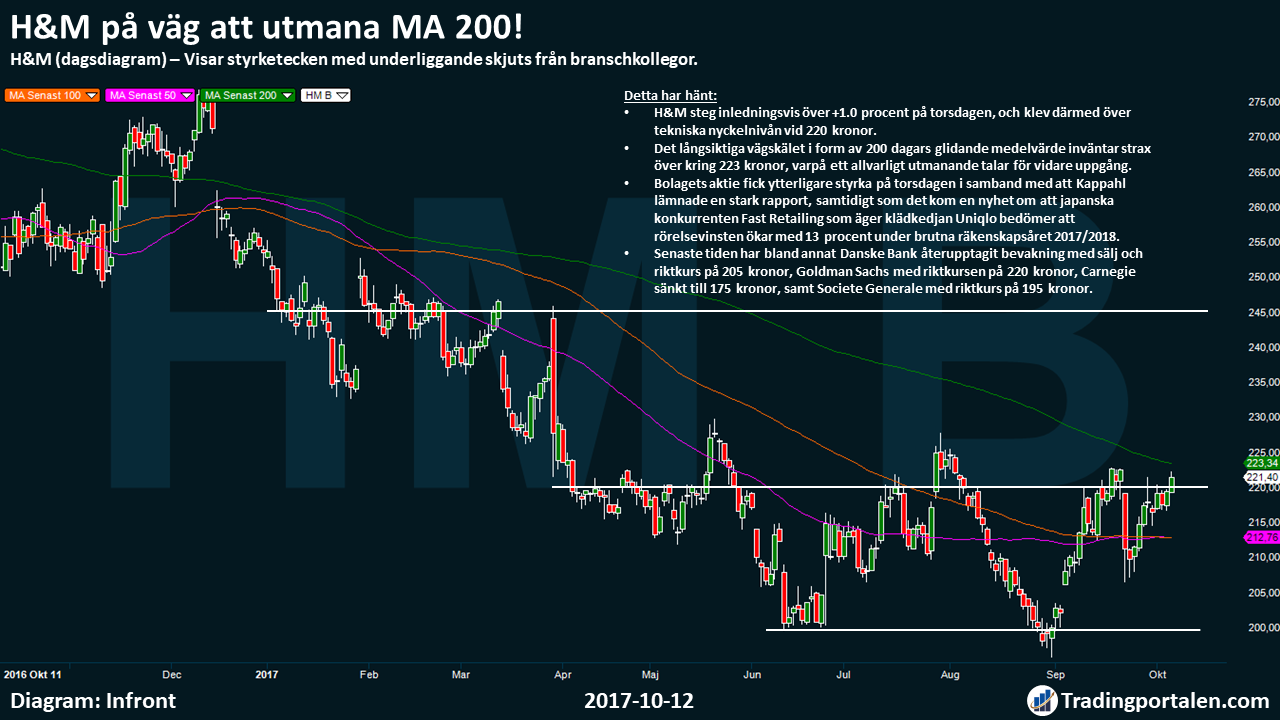

H&M on the way to challenge the MA 200!

Shows sign of strength with the underlying impetus from industry peers.

H&M rose initially above +1.0 per cent on Thursday, and stepped thus of the technical nyckelnivån at 220 sek.

The long-term partner in the form of the 200 day moving average awaits just over around 223 crowns, and a seriously challenging talk for on the rise.

The company’s share gained further strength on Thursday in connection with Kappahl left a strong report, at the same time that there came a news that japanese rival Fast Retailing, which owns clothing chain Uniqlo believes that the operating profit increases by 13 percent during the split financial year 2017/2018.

Recent times have, among other things, Danske Bank resumed coverage with a sell and price target of 205 crowns, Goldman Sachs riktkursen at sek 220, Carnegie lowered to 175 sek, and Societe Generale with a target price of 195 sek.

Catena Media joins forces for the decline.

Pareto reiterates buy, but lowers the riktkursen on Thursday.

Catena Media is showing signs of gaining strength, following the previous decline that challenged the 70 kronor in connection with the former ceo Robert Andersson resigned.

The company wrote in a press release on 3 October that they have taken the decision to ”pursue the company’s strategy, continuing growth, and creating shareholder value”.

Henrik Persson Ekdahl has been appointed acting ceo with immediate effect, which is already today a member of the board, as well as partner and co-founder at Optimizer Invest.

”We have grown from 20 to 250 persons during the Roberts 2.5 years as ceo – it means there is a much larger and more complex organization, with more countries and new verticals. Our ambitions are very high and the agenda is long-term, and then it is not unnatural to replace the ceo who we recruited for a certain type of company,” wrote the company’s chairman of the board Kathryn Moore Baker to the News agency Directly on 3 October.

Pareto lowered on Thursday riktkursen to sek 113, from the previous 118 sek.

”While we are positive to tolvmånaderscaset, pointing to management’s comments after the Q2-report on a slightly slower third quarter, and we are therefore somewhat cautious ahead of the report,” wrote Pareto, as repeated purchase.

Hålltider during the day

Company reports

- Clas Ohlson: presents sales data for september at 7.00

- Bank of America (12.45), Wells Fargo (14: 00)

Macro statistics

- Mäklarstatistik: house prices september at 6.00

- Finland: CPI september at 8.00

- Germany: CPI (def) september 8.00

- Valueguard: house prices september at 9.00 am

- KI: Lönebildningsrapporten 2017 at 9: 15

- United states: CPI september at 14.30

- U.S.: retail sales september at 14.30

- USA: Michiganindex (prelim) October 16: 00 pm

- United states: stock of unsold goods August at 16.00

- China: trade balance september

Other

- G20: press conference at 18: 30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange remained within a narrow range from unchanged levels on Thursday and closed in an irregular tendency. The spotlight was directed towards the reporting klädbolagen where Kappahl glowed while RNB ended up in snålblåsten.

Storbolagsindexet the OMXS30 was at closing up 0.2 percent to 1.645. The net sales was 12.2 billion.

On the foreign exchange market noted the crown weak after the CPI data from statistics SWEDEN, which did not reach up to expectations. The CPIF rose by 2.3 per cent in annual terms in september, compared with expectations of a rise by 2.5 per cent according to the consensus from the SME Directly. The dollar got a boost upwards, and noted at 8:10 sek.

Kappahl rose 12 percent. The operating profit of sek 139 million for the quarter June-August was higher than analysts ‘ expectation of about 111 million, according to SME direkt. Kappahl proposes an extra dividend through an automatic redemption of shares, in addition to an increase in the ordinary dividend.

An improved lagermix, favorable valutautsikter and a continued belief in the Polish turnaround makes Kappahl’s ceo Danny Feltmann optimistic about the journey towards the margin targets.

RNB did on the other hand a loss of sek 13 million during the period from June to August, compared with a profit of 10 million in the same period of the previous year. Sales in comparable stores were down 1.0 per cent in the quarter. The shares fell nearly 9 per cent.

UBS has lowered its recommendation for Nordea to neutral from buy. Riktkursen was cut from 117 to 110 sek. Nordea fell 0.5 per cent to 109:70 sek.

Among the big on the OMXS30 was SSAB best share with a rise of 2 per cent. Lundin Petroleum was reduced to 0.5% with pressure from declining oil prices.

Bergs Timber delivered an improved profit in its fourth quarter and came up with the proposal of a dividend of 0:05 per share. Sågverksbolagets share was strengthened by 1.5 per cent.

Nordax step less than 9 per cent after the announcement that Sampo has gone in as a new major shareholder with a holding of 7.6 percent.

Karolinska Development portfolio company Bioarctic made an entrance on the stockholm stock exchange. On the basis of the issue price $ 24 per share rose Bioarctic share with 21 percent.

Bolagsbyggaren and it is the company’s Forward rushed up 57 per cent to 31:30 sek subscription price, sek 20 during its first day of trading on Thursday.

Amnode has signed a customer agreement with an estimated order value of around sek 20 million in 2018, followed by approximately 30 million by 2019. The share was raised to 15 per cent.

The real estate company Corem has called an extraordinary general meeting to increase the company’s flexibility in future fund raising. Some stämmoåtgärder is made to allow for continued growth, said Corems managing director Eva Landén to the News agency Directly. The stock rose 0.7 per cent.

Fagerhult fell 4 percent. Carnegie has lowered its recommendation for the belysningsbolaget to sell.

The business community recommends in this week’s edition purchase of Balder, Itab and Duroc, but wait with Troax. Duroc lifted closer to 10 percent, while Troax dropped 3 percent.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1644.65

3605.54

12982.89

7556.24

2550.93

22841.01

6591.51

21170.06

28468.76

1.18

9.6

8.11

50.97

56.59

0.18%

-0.05%

0.09%

0.30%

-0.17%

-0.14%

-0.18%

1.03%

0.03%

0.14%

-0.08%

-0.18%

0.73%

0.60%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!