Thursday’s trading was a day when leading european and american stock indexes experienced broad declines. Swedish storbolagsindexet OMXS30 fell -0.78% to the technical support level 1540 points. Turnover accelerated slightly and amounted to 14.6 billion kronor on the stockholm stock exchange. The journey is expected to continue further to the south on Friday, on continued concerns over the bombing of Barcelona as the member IS taken on. Leading futures is pointing at the time of writing on a introduction around 1533 points…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

The sales force dominated on Thursday, when storbolagsindexet OMXS30 fell to close at the technical support level 1540 points.

A weak negative sentiment hanging over the futures market early this morning, and Asia show the same as broad losses after the night’s trading.

Early on Friday morning, it has been reported that at least 13 people have died, and over 100 people injured, after a van drove into a crowd on the tourist trail of La Rambla in Barcelona. Although the market managed to shake off the attacks relatively quickly, this will help with a certain anxiety on Friday. Member ICE has taken on the deed.

Leading futures are pointing this morning to a introduction around 1533 points, which would mean that we are then starting Friday’s trading below technical support at 1540 points.

Whether this will persist is a good question, would we get a continued movement to the south, or at least close below 1540 with the growing and significant sales force, we believe this to be clearly negative in the short term.

We will at the same time to step out of a clear handelsintervall last few days, when 1533 points would mean that we have not been this low since January earlier in the year.

This means that we are looking at 1527 and 1517 points, which are the next support levels, and stop, before a possible further decline towards 1500 points.

However, if we receive a parcel that buyers fall back into the picture on Friday, is expected to 1540 points to be the focus initially, prior to any challenging of 1550 points, which sailed up to a more and more clear technical key level during the past week.

Last week we have also received a large portion of the volume around 1550-1556 points, which means that this major technological motståndsområde is expected to be hard to beat, and we would need something extremely positive in our news feed to pass unnoticed.

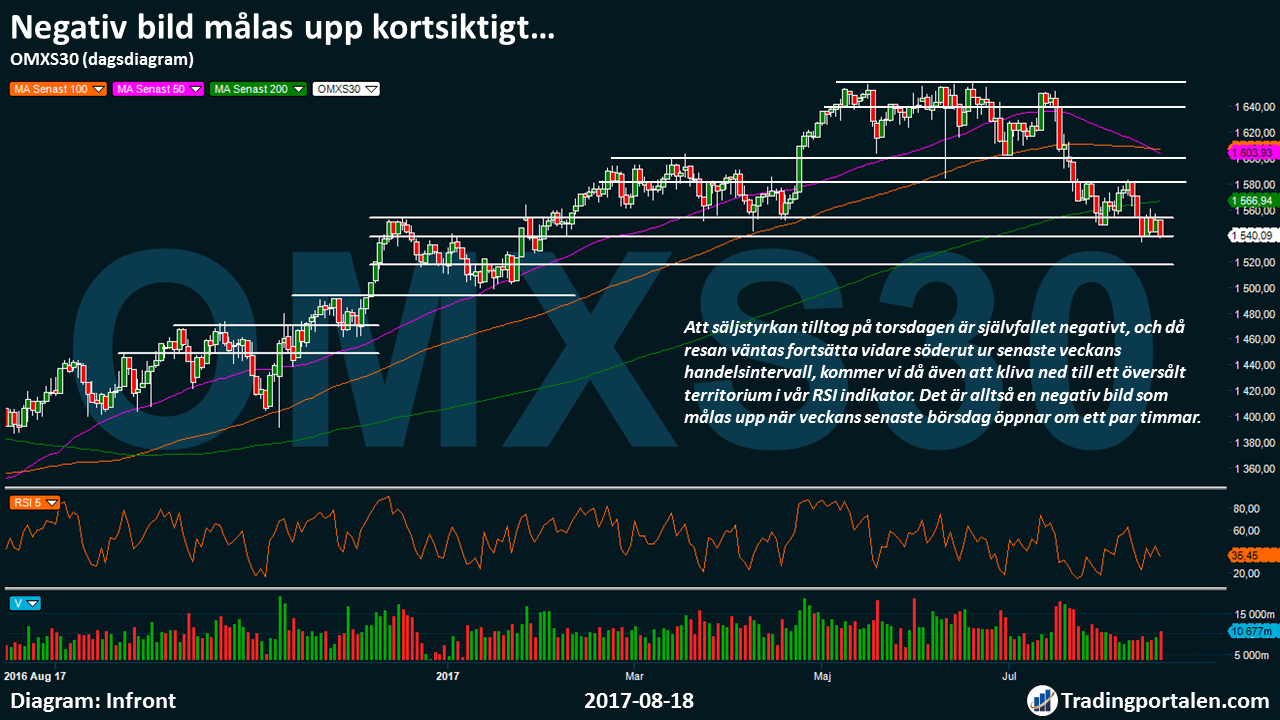

To the sales force accelerated on Thursday, of course, is negative, and when the trip is expected to continue further south from last week’s handelsintervall, will we also have to step down to an oversold territory in our RSI indicator.

It is, therefore, a negative image that is conjured up when the week’s last trading day opens up about a couple of hours.

On Friday’s makroagenda it is relatively quiet, and a few minor favorites on the stock exchange among our readers found the interim reports from both Nibe, Life Assays and a Catena Media. Popular Danish Novo Nordisk, are also traded ex-dividend on Friday.

For today’s trading are awaiting the technical resistance at 1550, 1560, 1580 and 1600 points. At an opening in the 1540 per early indications from the futures market, the 1540 also act as technical resistance. Technical support levels await hence also in 1527, 1517, and 1500 points.

What hålltider and the company reports the next weeks you can read here.

Hålltider during the day

Company reports

- Björn Borg (7.30), Biogaia (8.00), Humana (8.00), Nibe (8.00), Peab (8.00), Episurf Medical (8.30), Invisio (8.30), Opus (at 8.30), Endomines (at 8.45)

- The Life Assays (8.30), Fortnox

- Catena Media (at 7.00), F IT (kl 8.00), Nexam (8.00), Scibase (8.00), Amasten (before börsöppning), Arcoma, Avtech, Confidence, Drillcon, Fastator, Generic, Immunicum, Impact Coatings, My Taste, the Netjobs Group, Papilly, Photocat, Polyplank, Powercell (before börsöppning), Robert Friman

Ex-dividend

- Novo Nordisk (3:00 dkk)

Macro statistics

- Germany: PPI July at 8.00

- SCB: industrial capacity utilization and inventory 2 kv at 9.30 am

- EMU: current account June at 10.00 am.

- EMU: construction June at 11.00

- USA: Michiganindex (tbc) August 16: 00 pm

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was down on Thursday, with banks leading the way for the decline. Also on the leading european exchanges was a similar development. Oriflame and Alimak got fuel after their respective reports and belonged to the winners.

At the time of closing was noted storbolagsindexet OMXS30 for a decline of 0.8 per cent to the level of 1.540. The turnover on the stockholm stock exchange stood at 14.6 billion dollars.

In Europe, pulled the region’s banks down in the wake of the generally lower interest rates after Wednesday night the Fed-protocol.

In Stockholm it was noted the four major banks between 0.6 and 1.6 per cent lower. Fingerprint Cards and H&M, down 1.3% and 1.5%, noted both declines for a third trading day.

The US-dependent on construction company Skanska lost also 1.8 per cent. United states-the president, Donald Trump has chosen to phase out its Strategy – and Policyråd and Industry, which consisted of business leaders. This has traveled further doubts about his ability to push through his policies, among other things, he has talked about the heavy investment in infrastructure.

In the top among the big step Boliden by 1.4 per cent, followed by Atlas Copco, which increased 0.5%. JP Morgan has raised the recommendation of Atlas Copco to overweight from neutral.

Kosmetikabolaget Oriflame advanced 11 percent since the turnover proved to be a few percent higher than expected in the second quarter, and operating profit at eur 40.5 million, 4 percent higher than the SME Direkt konsensusprognos. The sales growth so far in the third quarter of about 10% can be set against analytikersnittförväntan of +8.5% for the entire quarter.

Holmen fell 0.6 per cent after the company reported an operating profit in line with expectation, but with a margin that was lower than expected.

Bygghissbolaget alimak’s was up 3 per cent, then the adjusted ebita-result for the second quarter was 18 per cent higher than expected in the SME Direkt analytikerenkät. The organic revenue growth was 20 per cent.

Spelkoncernen Cherry was reduced from over 7 per cent after a profit warning for the current full year due to the integration of Come On yet ”not reached its full positive effect.”

Troubled Eltel, which sells technical services to owners of infrastructure networks, retreated 16% after a disappointing report with the red numbers.

Swedish shareholders ‘ association is in the August issue to buy Bahnhof and Bilia. The shares were less than 3, respectively, 0.6 per cent higher.

Haldex was up 2.6 per cent to 109:75 sek. The egm voted in favour of Knorr-Bremses proposal. When the Haldex principal shareholder ZF abstained from voting, the field was free for the institutions to accept the proposal from Knorr-Bremse, who also chose not to use their voting rights.

Medicpen, which was handelsstoppad for a little over a hour in the afternoon, presented a upphandlingsvinst in Denmark by a value of ”a and another” million according to ceo Fredrik Westmans data to Directly. The shares responded with a rise of 31%.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1540.09

3461.97

12203.46

7387.87

2430.01

21750.73

6221.91

19468.62

27149.69

1.17

9.54

8.12

47.03

50.97

-0.78%

-0.65%

-0.49%

-0.61%

-1.54%

-1.24%

-1.94%

-1.19%

-0.71%

0.12%

-0.04%

-0.15%

-0.13%

-0.12%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!